🚀 How Blockchain Makes Tiny Transactions Possible

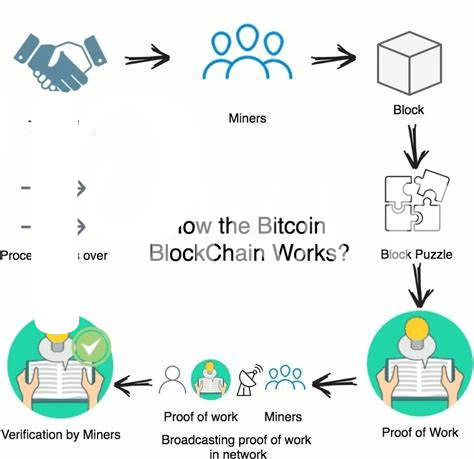

Imagine a world where paying for a sip of coffee or reading a single article online doesn’t require a second thought. This isn’t a distant dream anymore, thanks to the magic of blockchain technology. Think of blockchain as a digital ledger, but unlike traditional ledgers, it’s decentralized and spread across many computers. This setup is what makes tiny transactions, or micropayments, feasible and secure. Before blockchain, small transactions online were a big hassle due to high processing fees and slow transaction times. With blockchain, these tiny transfers can zip across the globe in seconds at a fraction of the cost, opening up a whole new realm of possibilities. From tipping your favorite blogger with a few cents to buying an article for a penny, blockchain is turning the digital world into a place where every little bit counts.

Here’s a quick peek at how blockchain compares with traditional systems when handling micropayments:

| Feature | Blockchain | Traditional Systems |

|---|---|---|

| Transaction Fees | Low | High |

| Speed | Fast | Slow |

| Accessibility | Global | Limited |

| Transparency | High | Low |

💡 the Magic Behind Micropayments: Simplifying the Complex

Imagine walking into a digital shop where you can buy bits of articles instead of the whole magazine or pay by the second for a tutorial video. This might have sounded like a fairy tale years ago, but thanks to blockchain technology, it’s becoming our new reality. Micropayments, tiny transactions often as small as a few cents, are now possible and more practical than ever. Blockchain, a kind of digital ledger, makes these small transactions smooth and cost-effective by cutting out the middlemen who usually make small transactions expensive and complicated.

For those who find the world of digital currency a maze, understanding how blockchain facilitates these micropayments can be eye-opening. It’s like having a magic wand that can divide your digital money into tiny, usable pieces that you can spend on very specific things with ultra-low fees. This capability could dramatically change how we use money online, promising a future where digital content creators can be directly supported with small amounts of money. To dive deeper into how blockchain technology is transforming traditional economic models, consider exploring an insightful article athttps://wikicrypto.news/evaluating-the-best-bitcoin-interest-accounts-of-2023. Here, the potential and evolution of blockchain in creating a more inclusive and efficient economic model are vividly discussed.

🌍 Changing the Game: Global Impact of Micropayments

Imagine a world where even the tiniest contributions can have a massive impact. That’s the magic micropayments are bringing into our global village, making it possible for people everywhere to partake in the digital economy with just a few cents at a time. This innovation is breaking down the traditional barriers of financial transactions, enabling support for creators, charities, and innovative projects with amounts that would have been dismissed as too small in the past. It’s like suddenly, everyone, everywhere, can be a part of something bigger, turning small streams of financial support into mighty rivers.

But it’s not just about the little guy getting a leg up. 🌱 On a larger scale, micropayments are poised to transform how we think about money itself. In places where access to banking is limited, micropayments offer a lifeline, connecting individuals to global economies with nothing more than a smartphone. This democratization of finance promises to lift people out of poverty by offering new ways to earn, spend, and save. 🚀 Whether it’s a farmer in a remote village investing in seeds with microloans or a young artist receiving support from around the world, micropayments are crafting a new narrative for prosperity, one tiny transaction at a time.

💳 from Pennies to Power: Stories of Micro Impact

Imagine a world where your daily cup of coffee or the time spent scrolling social media could directly support small businesses and creators across the globe. That’s precisely the kind of impact micropayments are beginning to have, thanks to blockchain technology. Every transaction, no matter how small, tells a story of empowerment and opportunity. For instance, artists can now receive direct contributions from fans worldwide for their work, one digital penny at a time, breaking down the barriers that once made it difficult for talent to be rewarded. Similar stories unfold in education, where blockchain-facilitated micropayments are revolutionizing how knowledge is consumed and compensated. This digital leap forward means a student in one corner of the world can access invaluable lessons from an expert in another, with transactions as seamless as a message exchange. For a deeper dive into how bitcoin and economic theories and the blockchain are crafting these narratives, consider the broader implications of technology that respects the value of every penny. These aren’t just transactions; they’re bridges between aspirations and achievements, illustrating how even the smallest gesture can fuel a larger movement towards a more inclusive economy.

🛠️ Overcoming Challenges: Making Micropayments Work for Everyone

Making micropayments work for everyone isn’t a walk in the park, but it’s a challenge that’s being met head-on with creativity and innovation. Imagine sending a few pennies online as easily as liking a post or sending a text; that’s the promise of micropayments. However, to truly make this a reality for everyone, a couple of hurdles need to be cleared. First, there’s the issue of accessibility – not everyone has the technology or know-how to jump onto the blockchain bandwagon. Then, there’s trust; for micropayments to really take off, people need to feel secure in their transactions, no matter how small. Thankfully, solutions are on the horizon. From user-friendly apps that simplify the process to education efforts aimed at demystifying the tech, steps are being taken to open up this world to more people. Even more exciting is the development of security measures that are robust yet not so complicated that they scare away the curious. Here’s a peek at what’s being done:

| Challenge | Solution |

|---|---|

| Accessibility | User-friendly apps |

| Trust | Enhanced security measures |

By tackling these challenges, the future of micropayments looks bright, opening up a world where even the smallest transaction can make a big impact.

🌟 the Future Is Now: Innovations Shaping Tomorrow

Imagine a world where buying a single article, or even tipping your favorite blogger a few cents, is not just possible but commonplace. That future is closer than we think, thanks to the latest wave of innovations in blockchain technology. At the heart of this transformation are micropayments, small online transactions that, until now, were too costly to process in traditional financial systems. Blockchain, with its low transaction costs and high speed, is making these tiny transactions not just possible but efficient and widespread. For those eager to dive deeper into how this technology is reshaping our financial landscape, resources like bitcoin educational courses and the blockchain offer a wealth of information. These platforms provide insights into the mechanisms allowing for such innovations, equipping individuals with the knowledge to navigate and benefit from this evolving digital economy. As we stand on the brink of this new era, it’s clear that micropayments represent more than just an advancement in technology—they symbolize a democratization of the digital space, where the value of every penny is recognized and every creator can be supported directly by their audience.