Bridging Worlds: Cash Tells Crypto Tales 🌉

Imagine a world where your money is not just a piece of paper in your wallet but a digital friend that lives in your phone, making life easier. This is the story of how, traditionally, we’ve used cash for everything – buying groceries, paying rent, and saving for a rainy day. However, in some corners of the world, banks are a far-off reality, and many people carry their life savings in their pockets. Now, enter the world of cryptocurrencies – a digital form of money. It’s like moving from handwritten letters to instant messages. Cryptocurrencies, or ‘crypto’ for short, don’t need a physical bank; they live on the internet and can be sent or received anywhere in the world with just a click.

The transition from cash to crypto is like opening a new door for millions who had no access to traditional banks. It’s a bridge between the old and the new, where every person, no matter where they live, can be part of a global economy. Imagine being able to save, invest, and even earn interest on your money without needing a physical bank. This change has the potential to transform lives, especially for those who have always been left out of the financial system. Below is a simple table illustrating the differences and conveniences between using traditional cash and embracing the new era of cryptocurrencies:

| Feature | Cash | Crypto |

|---|---|---|

| Accessibility | Limited to physical locations | Accessible anywhere with internet 🌐 |

| Bank Account Required | Yes | No 🚫 |

| Global Use | Exchange rates and fees apply | Easily used across borders 🌍 |

This table highlights the freedom and global inclusivity that cryptocurrencies offer, making the leap from cash not just an upgrade in how we deal with money, but a step towards financial inclusivity for everyone, everywhere.

The Unseen Benefits: Beyond Bank Accounts 🌱

In the world of finance, not having a traditional bank account often leads to challenges in managing and growing personal wealth. However, the rise of digital currencies is beginning to turn the tide, offering new paths for financial inclusion. Imagine a farmer in a remote village or a small street vendor in a bustling city; for them, accessing a bank may not just be difficult, it might be impossible. Enter the realm of cryptocurrencies, where all one needs is a smartphone to leap into a world of economic possibilities. This isn’t just about sending and receiving money; it’s about creating opportunities for savings, investment, and even earning interest, all of which were previously out of reach. It’s a shift that’s quietly nurturing a new financial ecosystem, ripe with possibilities for those traditionally left out.

This shift towards cryptocurrency isn’t just a technical upgrade; it’s a beacon of hope for financial empowerment. Take, for example, women in some developing countries, who may face societal barriers to owning a bank account or property. Cryptocurrency wallets offer them a safe, private way to secure their finances, opening up avenues not just for saving, but also for participating in the global digital economy. It’s a change that promises not only to transform individual lives but also to reshape the broader economic fabric of communities. If you’re curious about how these technologies are paving the way for more secure and decentralized futures, especially for small businesses looking to leverage blockchain for enhanced security, this link offers a deeper dive: https://wikicrypto.news/the-future-of-decentralization-beyond-bitcoins-blockchain. Through stories of empowerment and innovation, we’re witnessing the unfolding of a financial revolution, where digital currencies are more than just money; they’re a lifeline to a brighter, more inclusive future.

Digital Wallets: Unlocking Financial Freedom 🔓

Imagine a world where managing your money is as simple as sending a text message. For many people who don’t have access to traditional banks, that world is becoming a reality, thanks to digital wallets 📲. These wallets allow folks to store, send, and receive money right from their smartphones 📱, making financial transactions easier and more accessible than ever before. Think of it as having a bank right in your pocket, without the need for physical branches or paperwork 🌐. This revolution not only simplifies the way we handle money but also opens doors to new opportunities, empowering individuals to take control of their finances in ways they never thought possible.

Crypto Vs. Cash: a Tale of Accessibility ⚖️

Imagine walking into a store with your wallet full, not with cash but with a digital ticket to an endless marketplace. The contrast between old and new – physical money in your hand versus digital currencies at your fingertips – tells a profound story of accessibility and innovation. While cash has been king, reliable and straightforward, it requires a physical exchange. On the other side, digital currencies, spearheaded by the likes of Bitcoin, are breaking down barriers, allowing anyone with a smartphone to step into the global marketplace. This shift isn’t just convenient; it’s transformative, especially for the unbanked populations who’ve been sidelined by traditional finance systems.

The journey from cash to crypto isn’t just about swapping one form of money for another; it’s about opening doors to financial services and opportunities that were previously out of reach. For more insights into this transition and its impact, especially on small businesses and their integration into the digital economy, consider exploring bitcoin for small businesses and the blockchain. The movement towards digital wallets and cryptocurrencies represents more than just a shift in how we view money; it’s a leap towards financial inclusivity and equality, bringing us one step closer to a world where everyone has access to the economic tools they need to thrive.

Success Stories: Uplifting Real-life Transformations 🚀

Imagine a world where the lack of a physical bank near your home doesn’t limit your financial capabilities. This isn’t a dream for millions who’ve discovered the magic of cryptocurrencies. In remote villages and bustling cities alike, individuals once excluded from the traditional banking system are now embracing crypto. 🌍💼 They’re paying for groceries, sending money to family, and even saving for the future – all without setting foot in a bank. One heartening story is of Maria in Argentina, who used her digital wallet to start a small online business, overcoming the crippling inflation in her country. Then there’s Samson in Nigeria, who found financial security for his family by investing in crypto, avoiding the unsteady local currency. 🚀👨👩👧 Their lives, and countless others, are testimonies to how a blend of technology and vision can rewrite the rules of financial inclusion, paving the way for a brighter, more accessible future for everyone.

| Name | Country | Transformation |

|---|---|---|

| Maria | Argentina | Started an online business |

| Samson | Nigeria | Secured financial stability |

Overcoming Hurdles: the Road Ahead 🛣️

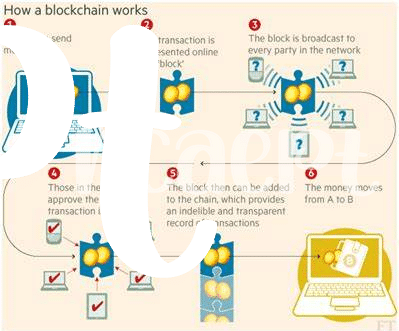

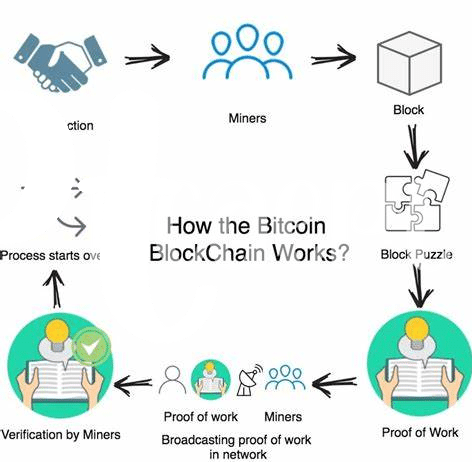

As we navigate the transition from traditional cash systems to the flourishing world of cryptocurrencies, it’s important to recognize the challenges that lie ahead. For many, the journey towards digital finance is filled with hurdles, such as understanding how these new technologies work 🤔. There’s also the matter of trust – with stories floating around about bitcoin and cybercrime, it’s understandable why some are hesitant. Yet, education and clear, accessible information can turn the tide, building confidence in the safety and benefits of cryptocurrencies.

Moreover, for this digital leap to truly make an impact, global internet access and the availability of technology need to improve. In parts of the world where access to the internet is limited, the potential of digital currencies remains just out of reach 🌐. However, initiatives aimed at expanding digital infrastructure and making technology more affordable offer a glimmer of hope. These efforts, combined with a greater understanding and trust in the system—especially with secure foundations like the blockchain—pave the way for a future where financial inclusion is a reality for everyone, regardless of where they are in the world 🌍.