🌍 How the World Sends Money: Bitcoin Vs. Banks

Sending money around the globe has transformed dramatically, with two key players at the forefront: traditional banks and the digital maverick, Bitcoin. Imagine you want to send cash to a friend across the sea. In the old days, you’d rely on banks, navigating through paper forms, waiting for days, and crossing fingers for a fair exchange rate. Now, enter Bitcoin – it’s like sending an email, but it’s money. No need for a middle man, and it works 24/7. Yet, it’s not just about convenience; it’s a battle of fees too. While banks charge you at every step, from converting currencies to transfer fees, Bitcoin whispers, “Hold my digital beer,” offering a path where the only fee you worry about is the small amount to keep the network running. Here’s a quick snapshot:

| Aspect | Banks | Bitcoin |

|---|---|---|

| Speed | Days | Minutes to hours |

| Fees | High | Low |

| Accessibility | Limited hours | 24/7 |

Choosing between them is like deciding whether to mail a handwritten letter or to shoot off a quick text. The world is leaning toward the digital tick of Bitcoin, favoring its blend of speed, cost, and the luxury of sending money without time constraints.

💡 Understanding Fees: Where Your Money Really Goes

When it comes to sending money across borders, understanding where your fees are going is crucial. Traditional banks have been the go-to for decades, but they often include a mix of transaction fees, exchange rate markups, and sometimes hidden charges that can quickly add up. On the other hand, Bitcoin transactions bypass these traditional financial intermediaries, offering a more direct route for your money to travel. This means that, generally, fees are lower, and you’re paying mostly for the network processing your transaction, not for the profit margins of big banks.

However, not all that glitters is gold. The decentralized nature of Bitcoin means that you’re also forfeiting some of the protections that banks offer, and navigating this space can be tricky if you’re not well-versed in cryptocurrency. That’s why staying informed and cautious is key, especially with the rise in scams as Bitcoin becomes more mainstream. For more insights on keeping your Bitcoin transactions safe, consider reading about the challenges and solutions here. Understanding these intricacies can empower you to make smarter choices about how you send your hard-earned money across the globe.

⏱ Speed Matters: Sending Cash in a Flash

When we talk about sending money to a friend in another country or settling an international bill, how fast that money moves is a big deal. Imagine you’re in a race, but instead of running, you’re sending money. Traditional banks are like the reliable old bicycle – they’ll get your money where it needs to go, but it might take a while, sometimes days. On the other hand, Bitcoin is like a super-fast sports car. It zooms your money across borders, often within minutes. This difference in speed can be a lifesaver in emergencies or when you’re trying to beat a payment deadline. Plus, who doesn’t like watching their money sprint to its destination instead of taking the scenic route? So, in the constant hustle and bustle of our lives, where every second counts, choosing the quicker option for money transfer isn’t just smart; it’s necessary.

🔒 Safety First: Keeping Your Transfers Secure

When we think about sending money across the globe, one thing that often worries us is how to keep our hard-earned cash safe. Traditional banks have always prided themselves on their high security, using sophisticated systems to protect your money. However, the digital age has brought about new players, like Bitcoin, which offer unique security features. By using technology called blockchain, Bitcoin creates a super-secure ledger that records every transaction. This means that tampering with your transfer is like trying to change a piece of history that’s been witnessed by thousands of people. It’s not an easy feat!

Yet, as secure as these methods are, the digital world is always evolving. New threats emerge, and with them, the need for more advanced protections. For Bitcoin enthusiasts and skeptics alike, staying informed is key. bitcoin and cybercrime in 2024 delves into the latest technologies that aim to bolster Bitcoin’s defenses even further, ensuring your money isn’t just fast and cheap to send but also as safe as it can possibly be. As we look toward the future, the battle between tradition and innovation continues, reminding us that in the world of money transfer, security is not just a choice, but a necessity.

🌱 the Eco-friendly Choice: Assessing the Impact

When we think about sending money from one place to another, we don’t often consider what impact that has on our planet. But here’s the thing: the way we move money around can really affect the environment. Traditional banks, with their physical buildings and all the paper they use, can be pretty heavy on the resources. On the flip side, Bitcoin and other digital currencies are trying to do things differently. They live online, so there’s no need for all that brick, mortar, and paper. However, there’s a catch. The technology that keeps Bitcoin safe and secure needs a lot of electricity to work. People are hard at work trying to make that technology more eco-friendly, but it’s a big challenge. It’s like a race to see who can be kinder to our planet while helping us send money to where it needs to go. Here’s a brief look at how these two stack up in terms of their environmental impact:

| Aspect | Traditional Banks | Bitcoin |

|---|---|---|

| Resource Use | High (physical branches, paper use) | Low (digital, no physical footprint) |

| Energy Consumption | Moderate | High (due to blockchain technology) |

| Efforts for Eco-Friendliness | Increasing (e.g., paperless options) | Growing (e.g., more efficient technology) |

Understanding and improving the environmental impact of both traditional and digital currency methods is crucial as we look towards a greener future.

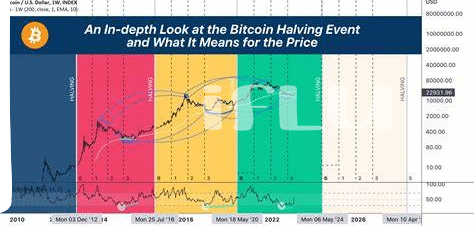

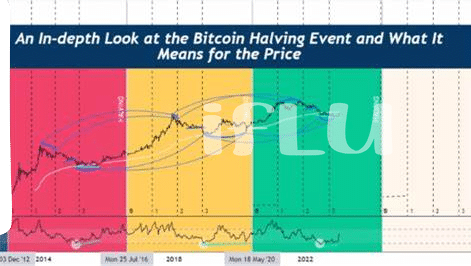

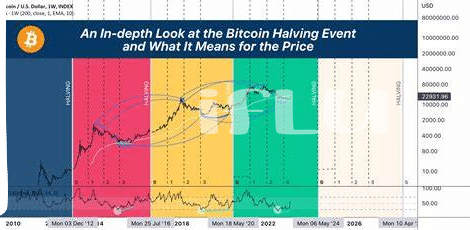

📈 Predictions for 2024: Where We’re Headed

As we gaze into the future, particularly the year 2024, the digital vs. traditional money transfer landscape is expected to evolve dramatically. With technology advancing at lightning speed, the way we send and receive money is poised for a significant transformation. Imagine dipping into your pocket, not for your wallet, but for your phone, to instantly send money across the globe. That’s where we’re headed, and it’s closer than you think. The rise of digital currencies, especially Bitcoin, is expected to redefine the essence of money transfer. These changes are not just about speed or convenience but also about expanding access to financial services to those previously excluded.

On the horizon, there’s a particularly intriguing development linked to bitcoin software updates in 2024, promising to make transactions more secure, faster, and cheaper. This could play a pivotal role in how political donations are made, suggesting a shift towards more transparency and efficiency in this domain. Experts predict that as more people become comfortable with using Bitcoin, we might see a surge in its use for a variety of transactions, pushing us towards a more inclusive and accessible financial system. The journey towards 2024 is sure to be filled with innovations that will challenge our traditional notions of money transfer, making our global village even smaller and more connected.