What Is Bitcoin Halving? 🤔

Imagine a world where your favorite video game gets twice as hard every few years, but the rewards for winning are sliced in half. That’s a bit like what happens with Bitcoin during an event called the halving. Roughly every four years, the reward that bitcoin miners receive for validating transactions and adding them to the blockchain is halved. It’s like a built-in clock, ticking down until the next big change. This isn’t just for fun, though. It’s a critical part of how Bitcoin aims to keep its value over time, acting like a digital form of gold. Initially, miners got 50 bitcoins for their efforts, but this number cuts in half after about 210,000 blocks are mined. This halving process is Bitcoin’s way of using scarcity to maintain value, almost like making sure there’s not too much of a good thing. So, with less new Bitcoin popping up, the idea is that the ones that are already out there become more sought after—and potentially more valuable. Here’s a quick glance at how the rewards have changed over time:

| Halving Event | Year | Reward Before Halving | Reward After Halving |

|---|---|---|---|

| 1st | 2012 | 50 BTC | 25 BTC |

| 2nd | 2016 | 25 BTC | 12.5 BTC |

| 3rd | 2020 | 12.5 BTC | 6.25 BTC |

In the grand scheme of things, these halvings help control the flow of new bitcoins into the market, making sure that we don’t hit the maximum cap of 21 million bitcoins too quickly. It’s a fascinating balancing act that plays a big part in Bitcoin’s world, influencing not just miners, but traders, investors, and the market as a whole.

A Glimpse into Past Halvings 🔄

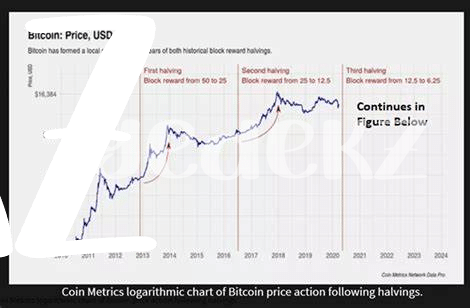

Bitcoin has a unique feature called ‘halving’ which happens approximately every four years. This is when the reward for mining a block of bitcoin is cut in half. Imagine it like a pizza party where, midway through, the size of the slices gets smaller. This is important because it affects how many new bitcoins are created. In the past, these events have been like milestones marking the journey of Bitcoin. The very first halving in 2012 reduced the reward from 50 bitcoins per block to 25. Fast forward to 2016, and it dropped to 12.5 bitcoins. In the most recent event in 2020, it went down to 6.25 bitcoins per block. Each time, this made the new slices of bitcoin more scarce, fueling conversations and excitement in the Bitcoin community.

Observers have noticed that these halvings tend to be followed by a surge in Bitcoin’s value. Think of it as a game where the rules make a rare item even rarer, making everyone more keen to get their hands on it. However, it’s not just a simple cause-and-effect; other factors play in too, but the pattern has been hard to ignore. For anyone looking to dive deeper into how this security mechanism works and what it means for potential investors, clicking on https://wikicrypto.news/the-fort-knox-of-digital-age-bitcoins-security could provide insightful details. After all, understanding the past halvings is key to preparing for what might come in the next one in 2024.

Expectations from the 2024 Halving 🚀

With the upcoming Bitcoin halving in 2024, enthusiasts and investors are buzzing with predictions. This event, which slashes the reward for mining new coins in half, is like a big, exciting countdown to potentially huge changes in Bitcoin’s value. Picture this: every four years, Bitcoin throws a curveball that can make the digital currency more scarce, possibly boosting its price due to the classic supply and demand principle 📉📈. Financial wizards and tech aficionados alike are keenly watching the crypto space, forecasting that this rarity factor could send Bitcoin’s value soaring, much like a rocket launching into a clear sky 🚀. Yet, it’s not just about the price. The anticipation builds around the broader effect on the crypto ecosystem, including how miners will adapt to receiving fewer rewards and whether this will lead to more sustainable mining practices. The community is on the edge of their seats, eagerly discussing and preparing for these potential shifts. In essence, the 2024 halving is not just another date on the calendar; it’s a pivotal moment that could shape the future trajectory of Bitcoin, making it an event of significant interest for anyone keen on the pulse of digital finance.

How Markets Might React 📈

When the big event in the Bitcoin world comes around, everyone’s eyes are on the market to see what happens next. It’s like when you’re watching a big game 🏟️, and a key player makes a move – you know it’s going to have an impact, but you’re not quite sure what it will be until it happens. In similar fashion, reactions to the Bitcoin halving can swing between excitement and anxiety. Some traders might see it as a golden opportunity 🌟, expecting prices to soar as they have in the past following halvings, and might invest more. Others, wary of the unknown, might decide to play it safe, which could lead to less movement in the market.

Understanding these market dynamics isn’t just about watching the numbers go up and down on a screen. It involves looking at the bigger picture and considering how different players, from individual investors to big institutions, might interpret and react to the halving events. Just like in a chess game ♟️, every move affects the outcome, but with knowledge and strategy, players can navigate the game more effectively. A deep dive into what is the future of bitcoin investment strategies can provide insights into how regulations and other external factors might influence the market’s response, revealing a layer of complexity and excitement that surrounds Bitcoin’s journey into the future.

Other Factors Affecting Bitcoin’s Future 🌐

Bitcoin’s journey resembles a thrilling ride through a sprawling digital landscape, constantly influenced by a host of global factors that extend beyond the anticipation of the 2024 halving. Governments around the world are waking up to the potential and challenges of cryptocurrencies, with regulation talks often sending ripples across the market. Whether these regulations come as a gentle guide or a forceful push, they play a crucial role in shaping Bitcoin’s path. Moreover, technological advancements 🌐 are not to be underestimated. As blockchain technology evolves, so does Bitcoin’s efficiency and appeal, potentially attracting more users and investors. Another key player is public perception 👀, often swayed by media, influential figures, and groundbreaking events that either bolster confidence or sow doubts. To get a clearer picture, let’s glance at some of the main factors:

| Factor | Impact on Bitcoin |

|---|---|

| Regulations | Can either stabilize or destabilize the market, depending on the approach |

| Technological Advancements | Improves efficiency and security, boosting user and investor confidence |

| Public Perception | Directly influences market demand and investment levels |

In this ever-evolving scenario, staying informed and adaptable is key 🔑 for anyone involved in the Bitcoin arena, as these factors can significantly alter Bitcoin’s trajectory, for better or for worse.

Preparing for the Halving Effect 💼

As the 2024 halving event draws near, savvy folks in the Bitcoin world are starting to gear up. Just like squirrels stash away nuts for the winter, it makes sense to start preparing early. Think of it as a big financial season changing. You might be wondering, “Okay, cool, but how do I get ready?” First off, understanding the nitty-gritty of what’s happening is key. It’s not just a random event; it’s a significant moment that could affect Bitcoin’s value. To get a solid grasp of these dynamics and why Bitcoin can be as shiny (yet sometimes as tricky!) as gold when it comes to investment, taking a deep dive into the intricacies can be really enlightening. For starters, consider looking into why do bitcoin prices fluctuate security concerns to get a clearer picture. This preparation isn’t just about beefing up your knowledge. It’s also a good time to evaluate your investment strategies. Are you playing the long game, or are you in it for quick wins? Depending on your approach, you might decide to adjust your holdings or set aside extra cash to buy more Bitcoin post-halving. Lastly, remember, the crypto world thrives on community and shared insights. Chatting with fellow enthusiasts, attending webinars, and keeping your ear to the ground can uncover valuable strategies and forecasts that could shape your pre-halving game plan. 🚀💼🔍