🌟 the Sparkle of Bitcoin: What’s the Buzz?

Bitcoin has caught the world’s attention in a way very few things have. Imagine finding a treasure chest in your backyard; that’s the kind of excitement people feel about Bitcoin. It started out as a curious piece of digital ‘magic’ and has grown into something that everyone, from your neighbor to big businesses, is talking about. Why such a buzz, you ask? Well, it’s like having money that can grow while you’re asleep, thanks to its value going up and down in ways that can make your head spin. And the best part? It operates independently, without banks or governments pulling the strings, making it a star player in the world of digital finance.

| Year | Significant Milestone |

|---|---|

| 2009 | Bitcoin’s Birth |

| 2010 | First Real-world Transaction |

| 2017 | Value Skyrockets |

| 2021 | Reaches New Heights |

This digital marvel isn’t just about making or losing money quickly; it’s about the potential to reshape how we think about and use money in the future. From buying a pizza with Bitcoin to massive companies investing millions, it shows a shift towards a world where digital currencies are as normal as asking Siri for the weather. The whole world is watching, waiting to see what Bitcoin does next. Is it a bubble about to burst, or the dawn of a new financial era? Only time will tell, but for now, the sparkle of Bitcoin continues to fascinate.

🏦 Traditional Gold: the Evergreen Wealth Preserver

For centuries, folks have turned to gold as a safe haven to park their wealth. It’s like a sturdy, reliable old tree that has weathered many storms. Unlike the newest tech gadgets that hit the market and become outdated, gold has a timeless charm. It’s not just something shiny to drape around your neck; it’s a symbol of stability in an ever-changing world. Gold doesn’t need to prove its worth; it’s valued everywhere, making it a universal currency of sorts. When the financial roller coaster takes a steep dive or when currencies wobble, gold stands firm, offering a sense of security to those holding it. This foundation of trust isn’t something that came about overnight. It’s built on centuries of history, where gold has kept its gleam, even when everything else seems dim. For anyone looking to safeguard their wealth against the ticks of time and the unpredictability of economies, gold remains an unwavering choice.

💻 Surfing the Waves: How Bitcoin Investment Works

Imagine riding the biggest wave on the surfboard of the digital age, where investing in Bitcoin sort of feels just like that. Picture this: just like you’d throw a coin into a wishing well, you put your money into a digital pot called Bitcoin, hoping its value will shoot up and you’ll get back more than what you tossed in. It’s a bit like a treasure hunt where the map is made up of complex technology instead of paper. Here’s the kicker: you don’t have to be a tech wizard to join the adventure. By setting up an account with an online platform, it’s like getting your own digital shovel to dig for this modern-day gold. The prices go up and down, kind of like a rollercoaster at the fair, which makes it exciting but also a bit nail-biting. Every so often, you’ll hear stories of folks who struck it rich, turning a few dollars into a fortune. But remember, it’s not all sparkling coins at the end of the rainbow; this digital treasure hunt comes with its share of pirate ships and stormy seas. So, while riding the Bitcoin wave, it’s wise to wear your life jacket, keeping an eye on the horizon and maybe even having a seasoned captain to guide your ship.

⚖️ Glitter or Digital: Comparing Risk and Returns

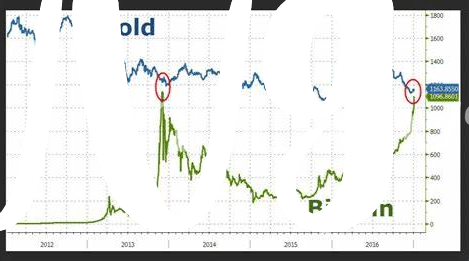

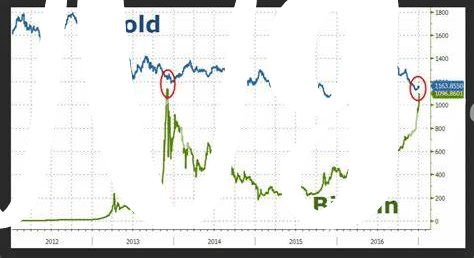

Imagine a balance scale, on one side, we have the shiny, physical gold that has been a symbol of wealth for centuries. It’s like a slow and steady tortoise, not making rapid moves but reliably growing over time. Gold is known for holding its value, especially when the economic sky seems a bit cloudy. It’s a safe harbor in the stormy sea of investment options. On the other hand, there’s Bitcoin, the flashy hare, with its price zipping up and down, creating both opportunities and risks for investors. It’s like surfing big waves; thrilling but not without the chance of wiping out. These digital waves can be tricky to navigate, and understanding why do bitcoin prices fluctuate versus ethereum can offer some insight into these movements.

So, what does this mean for you as an investor? Well, with Bitcoin, the potential returns can be eye-watering, tempting people with dreams of striking it rich fast. But remember, with great potential returns come equally great risks. It’s like the weather in these digital lands, unpredictable and sometimes extreme. In contrast, gold’s glow might not dazzle as brightly or as quickly, but it has a solid track record of weathering financial storms, protecting its owners from the worst downpours. In the end, laying your treasure in glitter or digital depends on how much adventure you want in your investment journey and how tightly you’re holding onto your financial sail.

🌍 Global Trends: the Shift Towards Cryptocurrency

Around the world, more people are welcoming cryptocurrency into their financial world with open arms. Picture it like a big, global party where everyone’s talking about this new way of handling money – digital currency. Places that once only accepted cash or cards are now starting to say “Hey, we’ll take Bitcoin too!” This isn’t just a fad in one corner of the globe; we’re seeing this shift from the bustling streets of New York to the vibrant markets of Tokyo. And it’s not just about buying a cup of coffee with crypto. Big companies and even some countries are getting in on the action, seeing it as a new, exciting way to invest and grow their money. Think of it as the modern-day gold rush, but instead of shiny metal, people are digging into their computers for digital treasures. This wide embrace of cryptocurrency is reshaping how we think about and use money all around the planet.

| Region | Embracing Cryptocurrency |

|---|---|

| North America | High |

| Europe | Medium |

| Asia | High |

| South America | Medium |

| Africa | Low |

🚀 Is Gold Losing Its Luster to Bitcoin?

In the ever-evolving world of investments and wealth storage, the comparison between Bitcoin and traditional gold has sparked much debate. Gold, known for its physical allure and historical reliability as a safe haven, now finds itself in a dazzling contest with Bitcoin, a digital contender that has captured the imagination of the tech-savvy and risk-tolerant generation. This digital cryptocurrency, with its exceptional rallies and significant pullbacks, has introduced a new dimension to asset diversification. However, one cannot overlook the complexities and risks linked with Bitcoin investments, such as understanding what are bitcoin wallets investment strategies. Yet, the shift in preference among younger investors, drawn by the potential for substantial returns and the allure of a decentralized financial system, does pose the question: is the traditional glow of gold dimming in the face of the shining promise of Bitcoin? With global trends increasingly leaning towards digital assets, and as nations and corporations start to dip their toes into the cryptocurrency pool, this debate is far from settled. The outcome could very well redefine what we consider as the true standard of wealth in the digital age.