The Dawn of Bitcoin Mining: Cpus Take the Stage 🌅

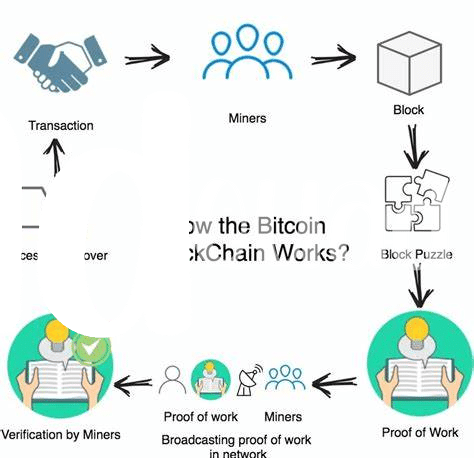

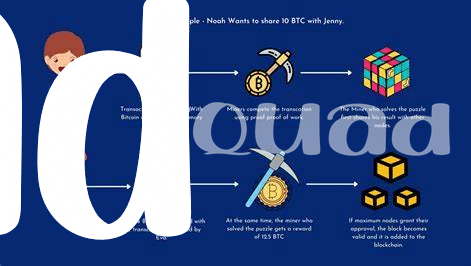

In the early days, when Bitcoin just started to flutter its wings in the digital sky, the process of mining – which is basically solving complex puzzles to earn Bitcoin – was something anyone with a computer could participate in. Miners used their CPUs, the brains of the computer, to tackle these puzzles. Imagine a world where your everyday computer could dig up digital gold from the comfort of your home! This period was like the digital gold rush where enthusiasts and hobbyists jumped in with their basic tools, hoping to strike it rich. The barrier was low, the competition was less fierce, and the whole idea of cryptocurrency was so new that the community was small, yet tightly knit. Here’s a simple breakdown showing how CPUs reigned supreme during the initial phase of Bitcoin mining:

| Year | Characteristic | Significance |

|---|---|---|

| 2009-2010 | Use of CPUs for mining | Easy entry for enthusiasts, symbolizing the humble beginnings of cryptocurrency mining. |

Back then, CPUs paving the way for the future of Bitcoin mining was akin to laying down the first stone for what would become a vast and complex edifice. This era not only marked the inception of cryptocurrency mining but also symbolized the democratization of currency; a notion that you didn’t have to be a big player to be a part of this exciting new world.

Gpus Enter the Scene: a Game Changer for Miners 🕹

Imagine a world where the quest for digital gold leads to a revolution in technology, much like the gold rushes of the past. This is exactly what happened when graphics processing units, or GPUs for short, made their entry into the world of Bitcoin mining. Unlike the early days where anyone with a computer could dig for Bitcoin using the CPU, the introduction of GPUs turned mining into a more competitive sport. These powerhouse devices, originally designed to make video games look amazing, proved to be incredibly efficient at solving the complex puzzles required to mine Bitcoin, transforming the landscape of mining overnight.

With GPUs, miners could solve puzzles faster and earn Bitcoin more efficiently. This innovation led to the creation of mining pools, where miners could work together and share the rewards. However, this leap in technology also raised the stakes, making it harder for individuals to compete without significant investment. Amidst these changes, managing and understanding cryptocurrencies became crucial, leading to resources like https://wikicrypto.news/selling-bitcoin-vs-ethereum-a-beginners-comprehensive-guide becoming invaluable for both seasoned and novice miners. The GPU era marked a significant shift in the mining world, setting the stage for further advancements and challenges.

The Rise of Fpgas: Bridging Two Worlds 🌉

Imagine a world where two vastly different landscapes – the early, simple days of bitcoin mining and the sophisticated, high-speed era that was to come – were connected by a technological marvel. That marvel was FPGA, or Field-Programmable Gate Array. Unlike its predecessors, FPGAs offered a sweet spot between flexibility and power. They were like customizable warriors, able to be reprogrammed to tackle different challenges, a feature that GPUs and CPUs lacked. This adaptability meant that miners could update their FPGAs with new instructions to keep up with Bitcoin’s evolving mining difficulty, a game-changer in the mining landscape.

As FPGAs started to light up the mining scene, they brought along a flicker of excitement. 🌉 Miners found in them a powerful ally, offering better efficiency than GPUs but without the hefty price tag and rigidity of the later ASICs. However, FPGAs were more like a bridge 🌉 than a final destination in the mining technology evolution. They represented a period of transition, experimentation, and learning for miners around the globe, setting the stage for the ASIC revolution that was to follow. Their legacy is a testament to human ingenuity in the relentless pursuit of efficiency and power in the digital gold rush.

Asics Emerge: Revolutionizing Bitcoin Mining Forever 🚀

In the world of Bitcoin mining, a significant shift occurred with the introduction of Application-Specific Integrated Circuits (ASICs). Picture a world where dedicated machines are built solely for the purpose of solving complex puzzles faster than ever before. This wasn’t just an improvement; it was a revolution. Unlike their predecessors, ASICs are specialized pieces of hardware designed to do one thing and one thing only – mine Bitcoin. This shift not only sped up the mining process but also increased the difficulty level, making it less feasible for casual miners with basic equipment to compete.

As miners around the globe raced to get their hands on these powerful machines, a new era of Bitcoin mining began. This leap in technology highlighted the importance of securing digital assets and understanding the nuances of different cryptocurrencies. For those looking into how to store bitcoin safely versus ethereum, the emergence of ASICs underscored the evolving landscape of crypto security. The arrival of ASICs redefined what it meant to be a miner, setting the stage for a future where efficiency and specialized equipment would become key to staying ahead in the race for Bitcoin.

The Global Race: Miners Vs. Electricity Costs ⚡

In the fascinating world of bitcoin mining, a silent yet intense competition brews, not only between the miners themselves but against a very practical opponent – electricity costs. Early on, when mining could be done with simpler, everyday computers, the electricity bill wasn’t much of a concern. However, as bitcoin’s puzzle difficulty skyrocketed, so did the need for more powerful, electricity-hungry machines. This pushed miners to scout for locations with the cheapest electricity rates globally, turning mining into a sort of global race. Countries with lower energy costs saw an influx of miners, creating hotspots of mining operations.

| Location | Appeal |

|---|---|

| China (before crackdown) | Cheap electricity, bulk hardware access |

| Iceland | Renewable energy sources, cool climate |

| Kazakhstan | Low energy prices, mining friendly regulations |

This scramble for low-cost power raises important questions about energy consumption and sustainability. With the increasing scrutiny on the environmental 👣impact of various industries, the bitcoin community finds itself at a crossroads. Must the pursuit of digital gold come at the cost of the planet? This ongoing debate pits innovation against conservation, urging the community to find a balance that ensures the future of bitcoin mining is not only profitable but environmentally conscious as well.

Environmental Concerns: the Ongoing Debate 🌍

As bitcoin mining evolved, it’s not just the technology that has sparked discussions but also the impact it has on our planet. Initially, mining was something anyone could do from their home computer. As it grew, so did the amount of electricity needed to power more advanced equipment. This shift has planted a seed of concern among people, considering how much energy is being consumed to keep the mining machines running. As miners compete globally, the race for cheaper electricity has led them to set up shop in places where power costs less, which sometimes means using energy sources that aren’t friendly to our environment.

The debate on the environmental impact of bitcoin mining is ongoing. On one hand, there are efforts to make mining greener by using renewable energy sources. On the other, the sheer scale of energy consumed continues to grow. It’s a challenge that the community is wrestling with. Finding a sustainable path forward is crucial, not just for the future of bitcoin mining but for the health of our planet too. Amidst these conversations, it’s essential for anyone involved in the cryptocurrency space to stay informed about these issues. For those looking into the selling points and future predictions of cryptocurrencies, this discussion about the environmental impact is especially poignant. You can explore more about this and how it contrasts with other cryptocurrencies by checking out what is the future of bitcoin versus ethereum.