Decoding Bitcoin and Ethereum: What’s the Difference? 🔍

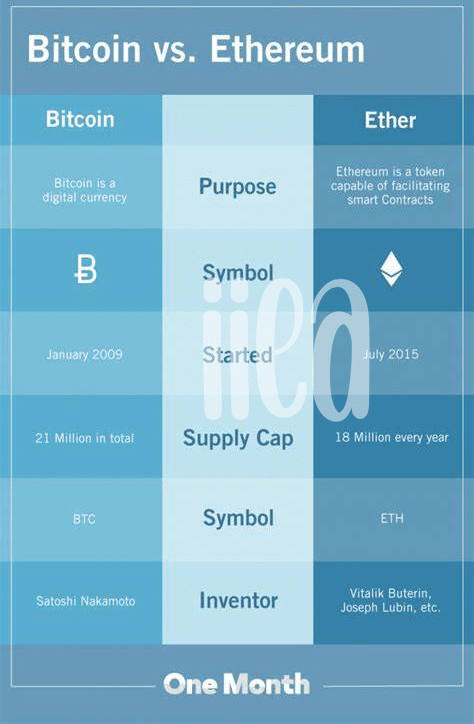

Picture a bustling marketplace where everyone is talking about two main currencies, likened to gold and silver in the digital world: Bitcoin and Ethereum. While both shine brightly in the eyes of investors, they hold unique values and purposes. Bitcoin, the first of its kind, is often celebrated as digital gold, a treasure chest that promises wealth over time, mainly used as a store of value. Imagine saving a portion of your pocket money, only it has the potential to grow significantly as years pass. Ethereum, on the other hand, is like a giant amusement park offering endless possibilities; it not only acts as money but also powers applications that can execute contracts automatically, without any middleman. This makes it incredibly versatile and akin to silver, useful and widely applied in various industries. The key difference lies in their foundational purpose and utility: Bitcoin being the pioneering digital currency aiming for stability and growth over time, while Ethereum thrives on its platform’s flexibility, supporting a vast ecosystem of applications. Choosing which to sell depends on what you value more: the solid growth and established presence of digital gold or the wide-ranging utility and innovative potential of digital silver.

| Feature | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| Main Use | Store of value, Digital Gold | Platform for Decentralized Applications |

| Launched | 2009 | 2015 |

| Supply Limit | 21 million | No hard limit (Ethereum 2.0 introduces deflationary mechanism) |

| Key Feature | First cryptocurrency, Limited Supply | Smart Contracts, Supports dApps |

First-time Seller? Setting up Your Crypto Wallet 🎒

Getting started with selling Bitcoin or Ethereum can feel like setting up camp in a whole new world. Imagine you’re an explorer, and your crypto wallet is your backpack. You wouldn’t go on an adventure without packing your essentials, right? Similarly, before you dive into the world of digital currency, setting up a secure wallet is crucial. A crypto wallet doesn’t just hold your Bitcoin or Ethereum; it’s the key to your digital treasure chest. It’s where you’ll receive, store, and send your coins. There are different types of wallets, including online, hardware, and paper–each with its own set of doors to open and precautions to consider.

Now, navigating through these options and picking the right wallet may seem daunting at first. Yet, it’s a lot like choosing the best traveling gear; it all comes down to where you plan to go and what you need for your journey. Online wallets are convenient, offering quick access to your assets, perfect for those looking to trade or sell frequently. On the flip side, hardware wallets, which store your crypto offline, are like a safe within a fortress, offering top-notch security for those who have a significant amount of crypto and wish to keep it secure for the long term. Amidst this exploration, it’s vital to be aware of the various risks and know how to shield your digital wealth from unwanted attention. For deeper dives into understanding these risks, checking out resources like https://wikicrypto.news/regulatory-risks-impacting-bitcoin-and-ethereum-investments can be incredibly insightful.

Timing the Market: When to Sell? ⏰

Imagine you’re at a funfair, trying to decide the best time to hop on the roller coaster for the shortest queue. Just like that, selling your crypto – be it Bitcoin or Ethereum – is about picking the right moment. This isn’t about finding a magical time but watching the market’s ups and downs. It’s like the weather; you can’t predict it perfectly, but you can certainly dress for rain if clouds are gathering.

Selling when the price is high seems like a no-brainer, right? 🚀 But how do you know when it’s “high enough”? There’s no crystal ball, but keeping an eye on market trends, news, and a bit of historical data can give you clues. Think of it as trying to catch a wave 🌊; you watch, you wait, and when it feels right, you ride it. Just remember, the goal is not to get the timing perfectly but to make a decision you’re comfortable with, minimizing regrets and maximizing gains.

Understanding Fees: Keeping More in Your Pocket 💸

When diving into the world of cryptocurrencies like Bitcoin and Ethereum, it’s crucial to wrap your head around the fees involved in selling them. Just like when you’re selling a toy at a garage sale, there are costs associated with finding the right buyer and making the transaction happen. These fees can nibble away at your profits, leaving you with less in your pocket than you anticipated. Imagine you’ve set up a lemonade stand; you have to pay for the lemons, sugar, and water. In the same way, various platforms charge you for the digital “ingredients” needed to sell your crypto. There are transaction fees, which are like paying for the lemonade ingredients, and withdrawal fees, which are a bit like paying for the gas to drive your lemonade to the market.

Staying informed about these fees is like knowing the recipe for your best-selling lemonade. Different platforms offer different rates, and knowing where you can get the most bang for your buck is key. It’s like choosing between selling your lemonade on a busy street corner or a quiet back alley. You would want to choose the spot that promises the most foot traffic at the lowest cost, right? The world of crypto isn’t much different. And amidst your financial journey, you might ponder about what is the future of bitcoin versus ethereum. Making savvy choices about where and when to sell can help ensure that when you decide to convert your digital coins back into traditional money, you’re not left wondering where all your hard-earned cash went. Remember, the goal is to keep as much money as you can in your pocket, turning digital dreams into real-world treasure. 🌍💰✨

Safety First: Avoiding Scams and Secure Trading 🛡️

In the exciting world of cryptocurrency, keeping your digital money safe is as crucial as earning it. Imagine you’ve got a digital wallet bursting with Bitcoin or Ethereum; you wouldn’t want someone sneaky to get their hands on it, right? That’s why you’ve got to be a step ahead, recognizing the signs of scams, which often promise big returns with no risk, or ask for your private keys (think of these as the ultra-secret passwords to your crypto). Always remember, if something sounds too good to be true, it probably isn’t true.

When you’re ready to trade, choosing where to do it safely is a big deal. Here’s a little guide to help you decide where to trade your precious digital coins:

| **Platform Type** | **Pros** | **Cons** |

|——————-|——————–|———————————–|

| Centralized Exchanges (CEX) | Often user-friendly and provide a variety of tools for trading. | May be more susceptible to hacking attempts. |

| Decentralized Exchanges (DEX) | Provide more control over your funds and offer privacy. | Can be complex for beginners and may have fewer trading options. |

| Peer-to-Peer (P2P) Platforms | Allow direct trades with other individuals which can give you better prices. | You need to be careful of scammers and do your homework on the buyer/seller. |

By staying alert and wisely choosing where you trade, you can enjoy the crypto journey while keeping your funds secure, ensuring the only surprises you encounter are pleasant ones.

Exploring Platforms: Where to Sell Your Crypto 🌐

In the colorful and ever-expanding universe of cryptocurrency, finding the right platform to sell your digital treasures like Bitcoin and Ethereum can feel like searching for a needle in a haystack 🌐🔍. Each platform has its own set of features, fees, and vibes. Some are like bustling bazaars, great for those wanting to dive deep into the crypto culture. Others are more like sleek, high-tech showrooms, perfect for first-timers eager for a smooth ride. It’s akin to choosing between a lively farmers market or a serene, high-end grocery store 🏪. The trick is to pick a place where you feel comfortable, where the fees don’t nibble too much into your profits, and most importantly, where you trust the environment to be secure. In a world brimming with possibilities, remember it’s your hard-earned crypto on the line. Doing a bit of homework on where to sell your crypto can pay off – quite literally. And, while you’re navigating this vibrant crypto cosmos, pondering on why is bitcoin valuable versus ethereum can offer insights into which digital currency might best fit your future ventures. Remember, the platform you choose should align not just with your current needs but also with your aspirations in the bustling crypto market.