🌍 Global Regulations Shifting the Crypto Landscape

Around the world, different countries are looking at cryptocurrencies like Bitcoin and Ethereum and deciding how they fit into our financial systems. Some are welcoming, seeing them as a chance to grow their economies, while others are cautious, worried about risks like fraud and market instability. This creates a patchwork of rules that affect everyone who uses or invests in these digital currencies. It’s a bit like traveling: in one place, you might need a visa, while in another, you’re welcomed with open arms. This ever-changing landscape can make it challenging to keep up with what’s allowed and what’s not.

| Country | Bitcoin Status | Ethereum Status |

|---|---|---|

| USA | Allowed with regulation | Allowed with regulation |

| China | Banned | Banned |

| Germany | Regulated as private money | Regulated as private money |

| Japan | Regulated, recognized as legal payment method | Regulated, recognized as legal payment method |

Navigating through these regulations can be tricky, but it’s essential for protecting your investments. Each country’s approach to crypto can significantly impact its value and how it’s used. For investors and users, understanding these global shifts is crucial for making informed decisions, whether you’re trading, holding, or using these currencies. It’s all about staying informed and prepared for changes as they come.

🚨 the Ripple Effect of Bans and Restrictions

When countries decide to either put heavy rules on or completely ban Bitcoin, Ethereum, or other digital currencies, it’s like a big wave that can rock the boat for investors everywhere. Imagine you’re happily sailing along with your investments growing, and suddenly, there’s a storm warning. This is what happens when a country announces new restrictions. Prices can drop, people might start selling their digital coins in a rush, and the whole market feels the shake. It’s important to understand that these changes don’t just affect the place where they’re announced; their impact spreads far and wide, affecting markets around the world. It’s a bit like when a big rock is thrown into a pond, causing ripples that reach the farthest edges. For anyone holding onto Bitcoin or Ethereum, staying informed and ready to adapt is key to weathering these storms. To dig a bit deeper into how Bitcoin and Ethereum stand in this ever-changing world, check this out: https://wikicrypto.news/the-future-of-cryptocurrency-evaluating-bitcoin-and-ethereum-wallets.

🛡️ Protecting Your Investments from Regulatory Storms

When it comes to safeguarding your hard-earned money invested in Bitcoin and Ethereum, think of it like preparing for a big storm. Imagine your crypto investments as a boat in the ocean. Now, storms, or in our case, sudden changes in rules and laws about crypto, can hit hard. To keep your boat safe, you need to know the weather forecast, right? Similarly, staying updated with the latest news on crypto rules is key. But that’s not all. Just like a boat needs a strong anchor, think of diversifying your investments as your anchor. Don’t put all your eggs in one basket; spread them across different types of investments. And finally, consider getting professional advice. Imagine having a seasoned captain guiding your boat through rough waters. By keeping these tips in mind, you can help protect your investments from the unpredictable waves of crypto rules.🚤💼🌧️

💡 Navigating through the Fog of Compliance

Navigating the complex world of cryptocurrency rules can feel like trying to find your way through a thick fog. 🕵️♂️ Just when you think you’ve figured it out, a new regulation pops up, and it’s back to square one. But there’s no need to feel lost! Staying informed and agile is the key. Keeping a close eye on the news and understanding the impact of laws in different countries can make a massive difference. It’s like having a map in a maze; knowing the legal landscape can help you avoid unexpected obstacles.

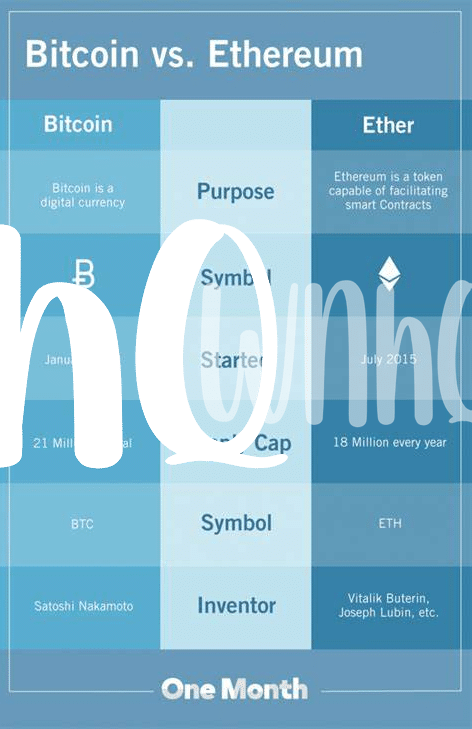

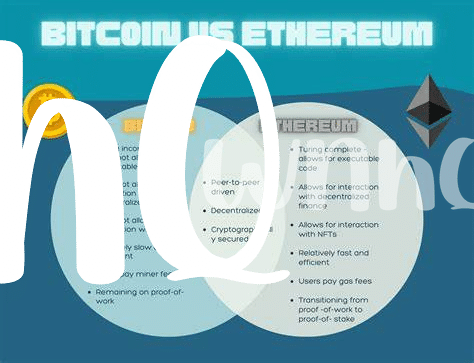

Understanding the nuances of compliance can also reveal opportunities. For example, why is bitcoin valuable versus ethereum not just hinges on their market position but also on how they navigate regulatory challenges and adapt to legal expectations. It’s all about playing smart and staying ahead of the game. 🎮 By aligning your investment strategy with the evolving rules, you’re not just protecting your assets but also setting yourself up for success in the ever-changing world of cryptocurrencies. 🚀

📈 the Future of Bitcoin and Ethereum Regulation

Trying to guess what the rules around Bitcoin and Ethereum might look like in the future is sort of like trying to predict the weather in a month. You know there will be sunny days and probably some storms, but the details can get fuzzy. What’s clear, though, is that as more people start using these digital coins and they become a bigger part of our daily buying and selling, the folks who make the rules are going to want to make sure everything is fair and safe. This could mean new guidelines on how these digital currencies are used, aimed at protecting both the people holding them and the wider financial system. Imagine a world where there’s a perfect balance between letting innovation fly and keeping things secure – that’s what many are hoping the future holds. As we move forward, the key will be finding ways for Bitcoin and Ethereum to grow while making sure that everyone plays by the rules that keep the game fair.

| Key Component | Future Projection |

|---|---|

| Innovation and Regulation Balance | Finding equilibrium between growth and safety |

| Public and Regulatory Involvement | Increased influence in shaping the rules |

🗣️ How Public Opinion Influences Crypto Rules

In the ever-evolving world of digital currencies, the voice of the people plays a surprising but significant role. Imagine a crowded market where everyone’s shouting about what they like and don’t like about Bitcoin and Ethereum. This noise isn’t just background chatter; it’s powerful enough to shape the rules of the game. Governments and regulators listen closely to these collective opinions, sometimes tweaking their stances on bans, restrictions, or support for cryptocurrencies based on what they hear. It’s a dance of opinions, where positive buzz can lead to more open-minded regulations, while widespread concerns might tighten the reins. As investors, staying tuned into public sentiment can give us hints about future policy shifts. So, keeping an ear to the ground isn’t just about understanding what is bitcoin mining versus ethereum; it’s also about foreseeing how waves of public opinion could steer the regulatory ship, potentially impacting your digital treasure chest.