The Emotional Rollercoaster of Investing in Bitcoin 🎢

Imagine going on a rollercoaster ride, but instead of a theme park, it’s the world of investing in Bitcoin. One minute, you’re high on excitement as the value of Bitcoin skyrockets, making you feel on top of the world. The next minute, the value drops, and that stomach-churning drop makes you wonder why you got on the ride in the first place. This is the reality for those daring to dip their toes into the Bitcoin market. This digital currency can bring big smiles or cause nail-biting nerves, all within a short time.

The reasons behind these rapid shifts can be as complex as the technology behind Bitcoin itself or as simple as human nature. People hear a bit of news or catch a rumor, and suddenly, everyone’s buying or selling, which pushes the value up or down like a seesaw. Understanding this emotional journey is key to navigating the Bitcoin market. Below is a peek into some major swings over recent years, showcasing just how much of a rollercoaster it has been.

| Year | High | Low | Reason for Ride |

|---|---|---|---|

| 2017 | $19,783.06 | $789.62 | Initial Boom & Bust |

| 2020 | $28,990.90 | $5,165.70 | Pandemic Effect |

| 2023 | TBD | TBD | Continued Volatility |

How News & Rumors Spark Bitcoin’s Wild Ride 📰

Imagine you’re riding a roller coaster, but instead of being in an amusement park, you’re peering at your phone or computer screen, tracking the price of Bitcoin. This thrill ride often begins with a snippet of news or a juicy rumor, suddenly sending the digital currency on a wild sprint up or down. It’s not uncommon for Bitcoin investors to wake up to a significant rise or tumble in price overnight, all thanks to a headline or tweet. In this age, information travels faster than the speed of light, and the Bitcoin market, sensitive and agile, reacts just as swiftly. This hair-trigger response to news highlights the blend of excitement and uncertainty that defines the arena of cryptocurrency investing.

Now, to navigate these stormy seas with a bit more savvy, it’s crucial to understand the role of big players and the buzz on social media. A tweet from a tech mogul or a move by a major investment firm can act like a gust of wind, stirring the waters of the Bitcoin market. This is where the mix of fear and opportunity creates a fertile ground for the FOMO (fear of missing out) to flourish, urging many to jump into the fray without a second thought. For those looking to dive deeper into making informed choices in this volatile landscape, enhancing your understanding of security measures in cryptocurrency transactions becomes paramount. Learning more about this can help investors navigate the highs and lows with greater confidence. An excellent starting point is exploring the intricacies of anonymity and pseudonymity in transactions, which you can do here: https://wikicrypto.news/security-first-safeguarding-your-bitcoin-sale-from-fraud. This resource sheds light on safeguarding your investments in the precarious world of Bitcoin trading.

Fomo: the Fear of Missing Out on Bitcoin 💸

Imagine watching everyone at a party having a blast, and you’re the only one standing in the corner. That’s how missing out on Bitcoin feels for many. As its value goes up and down like a rollercoaster, people hear stories of friends or strangers making fortunes overnight. This sparks a little voice inside saying, “What if?” Suddenly, everyone’s rushing to get their slice of the digital pie, afraid they’ll miss their chance. This fear doesn’t just nudge people; it pushes them into decisions, sometimes without thinking it through. It’s like buying a ticket to the most talked-about show in town, not because you love the band, but because everyone else is going. 🎟️💼 This rush feeds into Bitcoin’s unpredictability, making its prices swing even more. It’s a cycle fueled by the fear of standing alone while others dive into an ocean of digital coins. 🌊📈

The Impact of Big Players Shaking the Bitcoin Tree 🌳

Imagine a playground where the biggest kids can decide how high the swings go. In the Bitcoin market, these ‘big kids’ are wealthy investors and companies with heaps of money to ride the Bitcoin waves. Their financial moves are powerful enough to cause ripples, making the market swing up and down. When they buy a lot of Bitcoin, the price can soar, making the whole playground cheer. But if they decide to sell, the playground feels a bit like a storm hit, with prices tumbling down. This game of push and pull isn’t just about making or losing money; it plays a huge role in how everyone else feels about jumping on the swing. These big players have such an impact that even rumors of their moves can cause a stir. It’s a bit like knowing the weather forecast before deciding to play outside. Speaking of being informed, learning about are bitcoin transactions anonymous and the blockchain can provide a deeper understanding of what’s happening behind the scenes in the world of Bitcoin. So, next time you hear about Bitcoin’s price swings, remember the playground and the big kids who can make all the difference.

Social Media’s Megaphone on Bitcoin Volatility 📢

Picture the scene: every time a celebrity tweets about Bitcoin, or a new post goes viral claiming Bitcoin is either going to the moon or plummeting, waves are made. These digital bits of chatter can stir emotions, leading folks to make snap decisions about their investments. It’s like a high-energy party where everyone’s talking about Bitcoin, and this buzz can really sway people’s choices. 📱💬🎉

Let’s break it down with some hard facts. Imagine there’s a trending hashtag about Bitcoin on a major platform. Suddenly, everyone’s attention is laser-focused on what’s happening with Bitcoin. Whether true or just rumors, these posts have the power to push people towards buying or selling in a flurry. The table below shows just how social media conversations can swing Bitcoin’s value around like a giant pendulum.

| Social Media Impact | Result on Bitcoin Value |

|———————|————————-|

| Viral Positive Post | 📈 Spike in Buying |

| Fear-Inducing Rumor | 📉 Rush to Sell |

| Celebrity Endorsement | 🚀 Potential Value Surge |

| Negative News Trend | 🏚️ Quick Value Drop |

Through the lens of social media, Bitcoin’s journey becomes a wild ride, driven by a mix of facts, fears, and excitement. 🚀🔍💔

Learning from History: Bitcoin’s Past Investor Behavior 🕰️

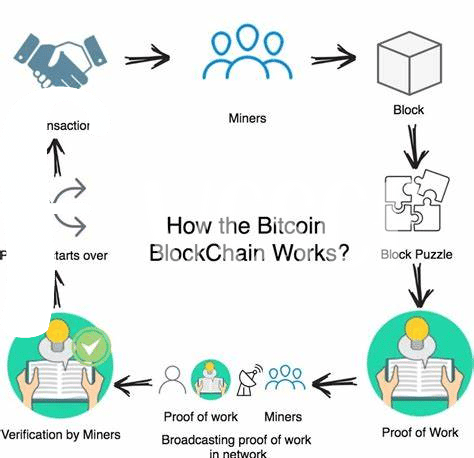

Diving into Bitcoin’s history is a bit like going through a treasure chest 🕰️🗝️. From its humble beginnings to today’s rollercoaster rides, Bitcoin has taught its investors a few important lessons. Remember the spikes and falls, and how each one left a mark on the investors’ approach? These patterns highlight not just the allure of big gains, but the real risk of sudden drops. Many learned the hard way that what goes up can come crashing down. But with each cycle, wisdom grew. Investors began to see beyond the immediate ups and downs, understanding the bigger picture of Bitcoin’s potential. This maturing perspective has been crucial, not just for individual strategies, but for the community’s approach to navigating Bitcoin’s waters. And for those looking to deepen their engagement, understanding the technical side, like how to mine bitcoin and the blockchain, becomes invaluable. This blend of history, emotion, and knowledge paints a complex but captivating picture of Bitcoin investment, guiding newcomers and veterans alike as they plot their next move in the ever-evolving cryptocurrency landscape.