Current Usage 📊

– In this digital era, Bitcoin has gradually found its way into the Cuban economy, albeit with cautious steps towards adoption. Citizens are exploring the use of this decentralized currency for various transactions, ranging from remittances to online purchases. Despite facing connectivity challenges and limited access to technology infrastructure, individuals are turning to Bitcoin as a promising alternative in a traditionally cash-based society. The current usage of Bitcoin in Cuba reflects an emerging trend towards embracing innovative financial solutions, paving the way for potential growth and integration within the country’s economic landscape.

Challenges and Obstacles 🧗♂️

In the path towards Bitcoin adoption in the Cuban economy, navigating through a maze of Challenges and Obstacles is imperative. From regulatory uncertainties to lack of access to reliable internet infrastructure, there are hurdles that must be addressed to facilitate widespread acceptance. The volatility of cryptocurrencies, coupled with the need for increased financial literacy among the populace, presents a significant challenge. Additionally, the ingrained skepticism towards digital currencies and the resistance from traditional financial institutions pose formidable obstacles to overcome. Nevertheless, by fostering education, strengthening regulatory frameworks, and building trust, these challenges can be transformed into opportunities for sustainable growth and development.

Potential Benefits 💰

Bitcoin presents a promising avenue for bolstering financial inclusion in Cuba, offering accessible and borderless transactions that can transcend traditional banking limitations. By embracing this digital currency, individuals can gain greater control over their financial assets, especially given the fluctuating nature of the Cuban economy. Additionally, Bitcoin’s decentralized nature provides a sense of security and privacy, which resonates with users seeking autonomy over their funds. These benefits have the potential to revolutionize financial practices and empower individuals seeking alternative banking solutions.

Government Policies 🏛️

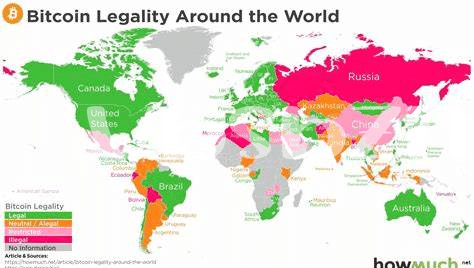

In the realm of Bitcoin adoption within the Cuban economy, government policies play a paramount role in shaping the landscape. The regulatory frameworks established by the Cuban government can significantly impact the utilization and acceptance of cryptocurrencies like Bitcoin. These policies guide how individuals, businesses, and financial institutions can engage with digital assets, influencing the overall ecosystem of virtual currencies within the country. Understanding the current and potential future government regulations is essential for forecasting the trajectory of Bitcoin adoption in Cuba.

is bitcoin recognized as legal tender in comoros?

Role of Technology 🤖

The integration of technology in the adoption of Bitcoin within the Cuban economy plays a critical role in facilitating transactions and ensuring security. With the use of secure blockchain technology, Bitcoin transactions can be processed quickly and with increased transparency, reducing the risk of fraud and manipulation. Moreover, the development of user-friendly mobile wallets and digital payment platforms makes it easier for individuals in Cuba to access and utilize Bitcoin in their daily transactions, ultimately contributing to the growth of the digital economy in the region.

Community Adoption and Impact 🌎

Community adoption of Bitcoin in Cuba has ushered in a new era of financial empowerment, shaping the way individuals engage with the global economy. Through grassroots initiatives and peer-to-peer transactions, everyday Cubans are embracing the potential of digital currency to transcend traditional barriers. The impact of this movement extends beyond monetary transactions, fostering a sense of independence and inclusion within the community. By actively participating in the Bitcoin ecosystem, individuals in Cuba are not only navigating economic challenges but also redefining the future of financial interaction on a local and global scale. [is bitcoin recognized as legal tender in colombia?]()