Overview 🌍

Turkey’s embarkment on developing a Digital Lira marks a significant step towards digitizing its national currency and embracing the potentials of blockchain technology. By delving into the realm of digital finance, the country aims to modernize its monetary system, fostering greater financial inclusion and efficiency in transactions. This endeavor also signifies Turkey’s proactive stance in adapting to the evolving landscape of digital currencies, potentially positioning itself as a trailblazer in the realm of central bank digital currencies (CBDCs). The move towards a Digital Lira underscores Turkey’s strategic vision to harness the benefits of technological innovation while navigating the complex interplay between traditional financial frameworks and emergent digital ecosystems. As the global financial landscape continues to evolve, Turkey’s foray into a digital currency realm sets a precedent for other nations to evaluate the transformative possibilities of integrating blockchain technology into their monetary policies.

Turkey’s Initiatives 🇹🇷

Turkey is making significant strides in the realm of digital currency with innovative initiatives aimed at reshaping the financial landscape. Through strategic partnerships and forward-thinking policies, Turkey has set in motion a series of measures to embrace the potential of digital currencies. These initiatives are not only positioning Turkey at the forefront of digital innovation but also fostering financial inclusion and technological advancement within the country.

By leveraging blockchain technology and fostering a conducive regulatory environment, Turkey’s initiatives are paving the way for a more efficient and secure financial ecosystem. These efforts are not only reshaping traditional banking systems but also opening up new avenues for economic growth and development. With a proactive approach towards digital currencies, Turkey is poised to chart new territories in the evolving landscape of financial technology.

Digital Lira’s Impact 💸

The introduction of Turkey’s Digital Lira has the potential to revolutionize the country’s financial landscape, offering a more efficient and secure means of transactions. The shift towards digital currency not only caters to the increasing demand for cashless transactions but also presents opportunities for financial inclusion and innovation. By embracing this new form of currency, Turkey aims to streamline payment processes, reduce costs associated with traditional banking, and combat issues such as counterfeit currency. Additionally, the Digital Lira could potentially enhance financial transparency and provide the government with better tools for economic management. However, as with any major financial change, there are challenges to overcome, including ensuring cybersecurity, addressing regulatory concerns, and fostering public trust in the new system. Nonetheless, the impact of the Digital Lira on Turkey’s economy and its position in the global financial market is anticipated to be significant.

Challenges Ahead ⚠️

Turkey’s push towards a digital lira poses a range of challenges that must be navigated attentively. From ensuring regulatory compliance to addressing potential cybersecurity risks, the transition to a digital currency ecosystem calls for careful planning and execution. Additionally, the adoption of a digital lira may spark debates regarding privacy concerns and central bank control over monetary policy. The need to educate and involve the public in this transformation process is paramount to foster trust and acceptance. Overcoming these obstacles will be crucial in establishing the digital lira as a viable and widely accepted form of currency in Turkey and beyond. For more insights on government stances on the future of cryptocurrencies in Timor-Leste, check out this article on government stance of the future of cryptocurrencies in Timor-Leste.

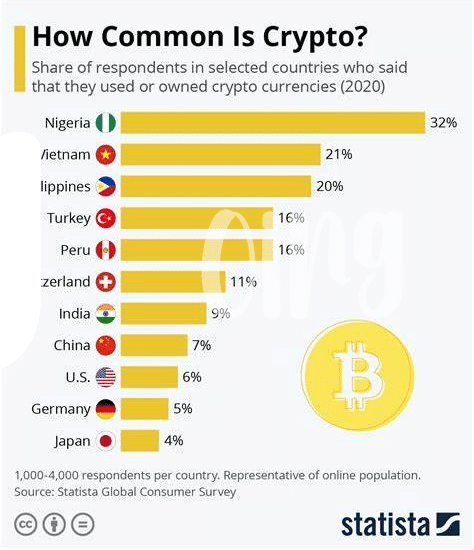

Global Reactions 🌐

Global reactions to Turkey’s push for a digital Lira have been met with a mix of curiosity and caution from the international community. Some see it as a bold move that could potentially revolutionize the way we think about traditional currencies and digital assets. Others are skeptical about the implications it might have on the stability of the global financial system. Countries and financial institutions around the world are closely monitoring Turkey’s initiatives, eager to learn from its experience and determine how it could shape the future of digital currencies on a larger scale. Discussions and debates on the topic are ongoing, with experts offering varying perspectives on the potential opportunities and risks associated with the digital Lira. The global community is divided on whether this move by Turkey will pave the way for a new era in monetary policy or if it will face significant challenges and resistance from established financial systems.

Future Outlook 🔮

In the fast-evolving landscape of digital currencies, the future outlook for Turkey’s digital Lira is met with a mix of curiosity and cautious optimism. As Turkey pushes towards adopting a digital currency, it stands poised to potentially reshape the country’s economic landscape and payment systems. The successful implementation of the digital Lira could pave the way for increased financial inclusion, streamlined transactions, and enhanced security measures in the digital realm, aligning with global trends towards digitalization and innovation in financial services.

Amidst this digital currency fervor, global reactions vary, with some nations closely monitoring Turkey’s moves while others ramp up their own explorations into centralized digital currencies. As governments worldwide navigate the complexities of regulating and embracing cryptocurrencies, each new development adds a layer of nuance to the overarching narrative of financial innovation and digital transformation. Only time will tell how these diverse approaches will intersect and shape the future landscape of digital currencies on a global scale.

government stance on the future of cryptocurrencies in trinidad and tobago