Recent Bitcoin Regulations 📜

In recent times, there has been a growing focus on establishing clear and comprehensive regulations surrounding the use of Bitcoin. These regulations aim to address various concerns such as security, taxation, and consumer protection in the realm of cryptocurrency. The evolving landscape of Bitcoin regulations reflects a concerted effort by governments and regulatory bodies to adapt to the increasing popularity and adoption of digital currencies. This shift towards formalized guidelines underscores the need for a structured framework to govern the use and exchange of Bitcoin within legal boundaries.

Luxembourg’s Stance on Cryptocurrency 💼

Luxembourg, a reputable financial hub, actively evaluates the role of cryptocurrencies within its jurisdiction. With a progressive approach, Luxembourg has shown openness to blockchain technology and digital assets. The government recognizes the potential benefits that cryptocurrencies can offer in terms of innovation and economic growth. By fostering a supportive environment for blockchain projects and startups, Luxembourg aims to position itself as a forward-thinking player in the digital asset space. As the cryptocurrency landscape continues to evolve, Luxembourg’s stance reflects a balance between embracing innovation and ensuring consumer protection.

While some concerns exist regarding potential risks associated with cryptocurrencies, Luxembourg is keen on addressing regulatory challenges to provide clarity and stability for market participants. The country’s proactive engagement with stakeholders and policymakers demonstrates a commitment to shaping a sustainable framework for the use of cryptocurrencies within its borders. Luxemburg’s approach sets a positive tone for the future of digital assets in the region.

Potential Benefits of Legal Recognition 💰

The recognition of Bitcoin within Luxembourg’s legal framework brings forth a myriad of potential benefits to both the country and its citizens. By granting legal status to Bitcoin, the government can foster innovation and attract investments in the burgeoning cryptocurrency sector. This move could also enhance financial inclusion by providing access to digital assets for a wider segment of the population. Furthermore, legal recognition of Bitcoin may lead to increased transparency and accountability in transactions, mitigating concerns related to illicit activities often associated with unregulated cryptocurrencies. Ultimately, embracing Bitcoin within the legal framework could position Luxembourg at the forefront of the digital economy and pave the way for future advancements in financial technology.

Concerns about Bitcoin’s Unregulated Status ❗

Bitcoin’s unregulated status raises significant concerns for both investors and regulators alike. The lack of clear guidelines and oversight leaves room for potential misuse, such as money laundering or illegal transactions. This uncertainty can deter mainstream adoption and institutional investment, hindering the overall growth and stability of the cryptocurrency market. As countries grapple with the challenges of regulating this evolving space, addressing these concerns surrounding Bitcoin’s unregulated status becomes crucial for ensuring its long-term viability and integration into the global financial system.

Additionally, to dive deeper into the legal recognition of cryptocurrencies in different regions, you can explore an in-depth analysis of whether Bitcoin is recognized as legal tender in Libya. This comprehensive examination sheds light on the regulatory landscape and implications of cryptocurrency adoption in various countries.

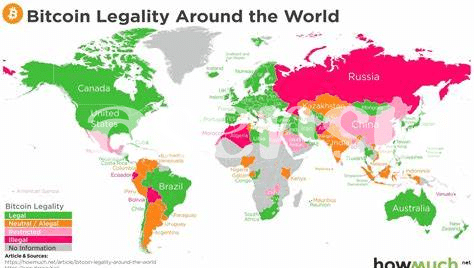

Global Trends in Cryptocurrency Legislation 🌍

Cryptocurrency legislation globally is experiencing a dynamic shift, with countries adapting their regulatory frameworks to accommodate the burgeoning crypto industry. Various nations are exploring ways to integrate cryptocurrencies into their financial systems while ensuring consumer protection and combating illicit activities. The evolving nature of cryptocurrency regulations reflects the growing recognition of digital assets as a legitimate form of value, prompting discussions on standardizing international approaches to ensure a cohesive global ecosystem. As countries navigate the complexities of regulating cryptocurrencies, the collective efforts to establish clear guidelines will shape the future landscape of digital finance on a worldwide scale.

Future Outlook for Bitcoin in Luxembourg 🔮

The outlook for Bitcoin in Luxembourg is promising, with growing interest from investors and regulatory authorities. As the country continues to embrace financial innovation, there is a possibility of legal recognition for Bitcoin in the near future. This would provide clarity for businesses and individuals looking to engage in cryptocurrency transactions within Luxembourg’s jurisdiction. With a proactive approach to digital assets, Luxembourg aims to position itself as a blockchain-friendly hub in Europe.

For further insights into the legal recognition of Bitcoin, read about Bitcoin’s status as legal tender in Liberia and how it compares to other countries like Lebanon. is bitcoin recognized as legal tender in lebanon?