Current State of Bitcoin Regulations 📜

In Sao Tome, the landscape of Bitcoin regulations is a dynamic tapestry of shifting policies and evolving perspectives. The legal framework surrounding cryptocurrencies is a work in progress, with regulators grappling to keep pace with the rapid innovations in the digital asset space. Uncertainties loom regarding the classification of Bitcoin, its taxation, and its implications for consumer protection. As the regulatory environment continues to take shape, stakeholders are faced with a maze of compliance requirements and a lack of standardized guidelines. The future of Bitcoin regulations in Sao Tome hinges on a delicate balance between fostering innovation and safeguarding against potential risks, setting the stage for a nuanced interplay between technology and law in the realm of digital currencies.

Key Challenges in Navigating Regulations 🚧

Navigating the ever-evolving landscape of Bitcoin regulations can feel like traversing a complex maze filled with uncertainties and ambiguities. The varying interpretations and enforcement practices across different jurisdictions pose significant hurdles for individuals and businesses alike. From ambiguous definitions of virtual assets to challenges in implementing effective regulatory frameworks, staying compliant in the realm of cryptocurrency can be a daunting task. Moreover, the lack of harmonization among regulatory bodies globally adds another layer of complexity, making it essential for stakeholders to constantly monitor and adapt to changing regulatory requirements. Additionally, the rapid pace of technological advancements in the blockchain space often outpaces regulatory developments, creating further challenges for regulators and market participants. These key challenges underscore the need for proactive engagement, continuous education, and robust compliance strategies to navigate the intricate web of Bitcoin regulations effectively.

Exploring Legal Implications for Businesses 🏢

Navigating the realm of Bitcoin regulations poses a unique set of challenges for businesses in Sao Tome. The legal implications are multifaceted, requiring careful consideration to ensure compliance with evolving guidelines. For businesses engaging in cryptocurrency transactions, understanding the regulatory landscape is crucial to mitigating risks and maintaining ethical practices. From tax implications to anti-money laundering laws, the legal framework surrounding Bitcoin can significantly impact operational strategies and financial outcomes. Businesses must stay informed and adapt swiftly to regulatory changes to safeguard their interests and uphold legal integrity.

In the dynamic landscape of crypto regulations, businesses face the constant task of navigating legal complexities while seizing opportunities in the burgeoning market. As authorities continue to refine their approach to Bitcoin oversight, proactive engagement with legal considerations becomes paramount for sustainable growth and risk management. By fostering a culture of compliance and integrating legal insights into decision-making processes, businesses can establish a robust foundation for navigating the intricate web of Bitcoin regulations. Embracing a forward-thinking mindset is essential for businesses seeking to thrive amidst regulatory uncertainties and drive responsible innovation in the cryptocurrency space.

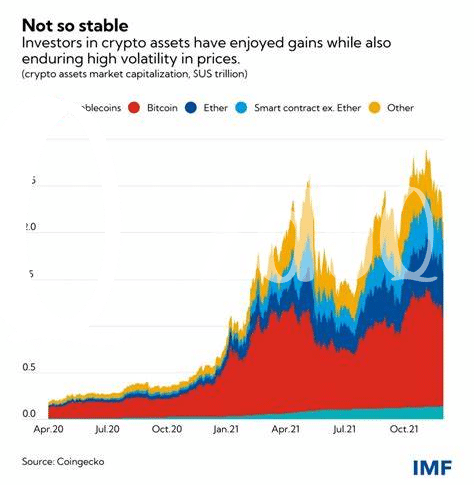

Potential Impact on Cryptocurrency Market 💰

The increasing adoption of Bitcoin and other cryptocurrencies can have a profound impact on the overall cryptocurrency market. As more countries, including Sao Tome, begin to regulate the use of digital assets, it is expected that the market will experience shifts in investor sentiment and trading volumes. This regulatory clarity can provide a sense of security for investors and businesses alike, leading to potential growth in the cryptocurrency market. However, any stringent regulations imposed on Bitcoin could also create barriers to entry for new participants and hinder innovation within the industry. Understanding these dynamics is crucial for businesses operating within the cryptocurrency space to navigate potential challenges and capitalize on emerging opportunities. For further insights on upcoming regulatory changes for Bitcoin in Senegal, refer to [this resource](https://wikicrypto.news/preparing-for-compliance-key-steps-for-bitcoin-holders-in-serbia).

Strategies for Compliance and Risk Management 🛡️

Strategies for Compliance and Risk Management in navigating Bitcoin regulations in Sao Tome require a proactive and adaptive approach. Businesses operating in this space need to stay ahead of regulatory developments by closely monitoring updates and engaging with relevant authorities to ensure compliance. Implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures is essential to mitigate risks associated with cryptocurrency transactions. Additionally, establishing internal controls and conducting regular audits can help identify and address any potential gaps in compliance measures. By staying informed, proactive, and diligent, businesses can navigate the evolving regulatory landscape in a manner that minimizes risks and ensures long-term sustainability in the market.

Looking Ahead: Future Trends and Developments 🔮

When considering the future trends and developments in Bitcoin regulations, it is essential to anticipate a continued focus on regulatory clarity and oversight. As the cryptocurrency landscape evolves, regulatory bodies are expected to enhance their monitoring and enforcement measures to address potential risks associated with digital assets. This could lead to more standardized frameworks and increased collaboration between governments and industry stakeholders to foster innovation while safeguarding against illicit activities. Stay informed about upcoming regulatory changes for Bitcoin in Sao Tome and prepare to adapt your compliance strategies accordingly. Additionally, keep an eye on emerging trends in regulatory approaches worldwide, such as upcoming regulatory changes for bitcoin in San Marino, to stay ahead of the curve in this dynamic environment.