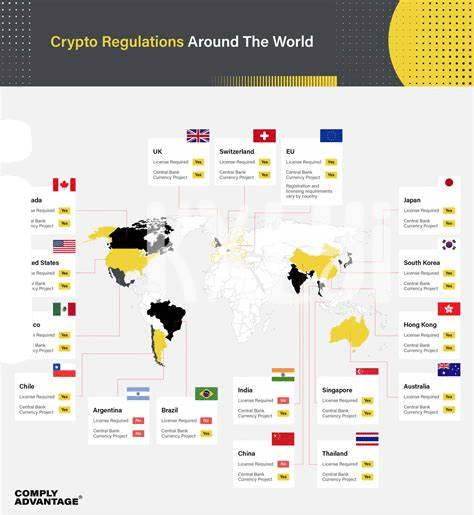

Regulatory Landscape 🌍

Navigating the regulatory landscape in Nigeria can be complex for Bitcoin businesses. With evolving laws and guidelines, staying compliant is crucial to ensure operations run smoothly. Understanding and adhering to the regulatory requirements set forth by the government is essential for the long-term sustainability of Bitcoin businesses. Seeking legal counsel and staying updated on any changes in regulations can help businesses proactively address compliance challenges. Additionally, fostering transparent communication with regulatory bodies and actively engaging in industry discussions can lead to a better understanding of compliance expectations. Operating within the bounds of the law not only mitigates risks but also enhances credibility within the ecosystem. Embracing regulatory compliance as a cornerstone of business operations can pave the way for sustainable growth and opportunities in the dynamic landscape of Bitcoin businesses in Nigeria.

Compliance Tools and Resources 🔧

Compliance Tools and Resources play a crucial role in helping Bitcoin businesses in Nigeria navigate the complex regulatory landscape. These tools serve as a guide, providing insights and assistance in ensuring adherence to the ever-evolving compliance requirements. From KYC (Know Your Customer) procedures to transaction monitoring solutions, these resources offer practical support in implementing robust compliance practices tailored to the specific needs of the business. By leveraging these tools effectively, companies can streamline their compliance processes, mitigate risks, and build trust with regulatory authorities and customers alike.

In addition to the tools available, there are numerous resources such as industry best practices, regulatory guidelines, and professional organizations that can offer valuable information and support to Bitcoin businesses in Nigeria. Staying informed about the latest developments in compliance standards and utilizing the right resources can empower businesses to proactively address compliance challenges and seize opportunities for growth in the dynamic cryptocurrency landscape.

Aml/cft Framework Implementation 💼

The successful implementation of anti-money laundering and combating the financing of terrorism (AML/CFT) frameworks is crucial for Bitcoin businesses in Nigeria to operate within legal boundaries and maintain financial integrity. By adhering to these frameworks, businesses can not only enhance their credibility and trustworthiness but also mitigate risks associated with illicit activities. It is essential for these businesses to stay up to date with evolving regulations and best practices in AML/CFT to ensure compliance and foster a safe and secure environment for both themselves and their customers. The integration of robust AML/CFT measures is not just a regulatory requirement but a strategic investment in building a sustainable business model that is resilient to financial crimes and regulatory scrutiny.

In navigating the complex landscape of AML/CFT compliance, Bitcoin businesses must prioritize the implementation of tailored risk assessment procedures, enhanced due diligence protocols, and robust transaction monitoring systems. Conducting regular audits and assessments can help identify and address vulnerabilities, ensuring that the business is equipped to detect and prevent suspicious activities effectively. Collaborating with regulatory authorities and industry stakeholders can also provide valuable insights and support in developing comprehensive AML/CFT strategies that align with global standards and local requirements, thus positioning Bitcoin businesses in Nigeria for long-term success and growth.

Technological Innovations and Security 🔒

Technological advancements in the Bitcoin industry have revolutionized the way businesses operate in Nigeria. With the integration of blockchain technology, transactions are now more secure and transparent, providing a level of trust previously unseen in traditional financial systems. These innovations not only enhance the efficiency of operations but also ensure a higher level of security for both businesses and consumers.

In terms of security, businesses are now implementing cutting-edge encryption techniques and multi-factor authentication to safeguard their digital assets against cyber threats. These security measures, combined with the decentralized nature of blockchain technology, provide a robust defense against potential breaches. Staying ahead of potential threats, Bitcoin businesses in Nigeria are continuously evolving their security protocols to adapt to the ever-changing landscape of cybersecurity. This proactive approach ensures that customer data and digital assets remain protected in the face of emerging challenges and cyber risks.

Upcoming regulatory changes for Bitcoin in Nigeria

Customer Due Diligence Strategies 🕵️♂️

Customer due diligence strategies are vital for Bitcoin businesses in Nigeria to enhance regulatory compliance and mitigate risks. Implementing robust identity verification processes and ongoing monitoring of customer transactions can help detect and prevent fraudulent activities. Utilizing blockchain analytics tools can provide insights into transaction patterns and identify suspicious behavior, enabling businesses to take necessary precautions. Establishing clear protocols for verifying the source of funds and conducting enhanced due diligence on high-risk customers can further strengthen the due diligence process. Additionally, fostering a culture of compliance within the organization through comprehensive training programs can ensure that employees understand their roles in upholding regulatory requirements. Embracing innovative technologies, such as biometric authentication, can streamline the customer due diligence process while enhancing security measures. By proactively adapting to regulatory changes and leveraging advanced tools, Bitcoin businesses in Nigeria can navigate the evolving compliance landscape effectively.

Future Trends and Challenges 🚀

The future of Bitcoin businesses in Nigeria will be shaped by evolving trends and challenges in the regulatory landscape, technological advancements, and customer due diligence strategies. As the industry continues to mature, businesses must adapt to changing regulatory requirements and leverage compliance tools and resources to stay ahead of the curve. Implementing robust AML/CFT frameworks will be critical to building trust and credibility in the market. Technological innovations will drive efficiencies but also pose security risks that need to be addressed proactively. Customer due diligence strategies will become increasingly sophisticated to combat financial crime and protect against regulatory scrutiny. Looking ahead, future trends such as decentralized finance and digital asset adoption will bring both opportunities and challenges for Bitcoin businesses in Nigeria. Staying abreast of these developments and navigating the dynamic landscape will be key to long-term success in the industry.

Insert upcoming regulatory changes for bitcoin in Namibia with anchor “upcoming regulatory changes for bitcoin in North Macedonia”.