Understanding Bitcoin’s Legal Status 🧐

Bitcoin’s legal status in Guyana presents a nuanced landscape that requires careful examination. Recognizing its potential as a disruptive force in traditional financial systems, lawmakers and regulators are navigating the complexities of incorporating decentralized digital currencies within existing legal frameworks. Understanding the implications of these deliberations is crucial for both industry participants and policymakers to ensure a balanced and conducive environment for Bitcoin’s growth and integration within Guyana’s financial system.

Regulatory Challenges in Guyana 💼

The regulatory landscape in Guyana presents unique challenges for the integration of Bitcoin into the financial system. Navigating these hurdles requires a delicate balance between embracing innovation and ensuring compliance with existing laws. Stakeholders must work together to address issues related to consumer protection, anti-money laundering, and cybersecurity. The evolving nature of digital currencies demands a proactive approach from regulators to create a framework that supports financial innovation while mitigating associated risks. Sustainable solutions will stem from collaboration between industry players, policymakers, and regulators to foster a conducive environment for the adoption of cryptocurrencies.

Impact of Bitcoin on Financial Inclusion 💸

Bitcoin’s potential to enhance financial inclusion in Guyana is underscored by its ability to provide access to banking services for unbanked populations. By offering a digital alternative to traditional financial systems, Bitcoin enables individuals without access to banks to participate in the global economy. This can empower marginalized communities and drive economic growth by facilitating cross-border transactions and reducing the costs associated with transferring money. Embracing Bitcoin could be a catalyst for expanding financial access and inclusivity in Guyana, bridging the gap between the underserved and formal financial services.

Security Concerns and Fraud Prevention 🔒

Bitcoin’s rise in popularity has brought about concerns regarding security and fraud prevention within the financial space. As the decentralized nature of Bitcoin transactions makes them irreversible, users must remain vigilant against potential scams and hacking attempts. It is essential for individuals to safeguard their private keys and employ secure wallets to mitigate the risk of unauthorized access to their digital assets. Moreover, educating oneself on common types of cryptocurrency-related fraud is crucial in avoiding falling victim to malicious activities in the digital realm. By staying informed and adopting stringent security measures, users can enjoy the benefits of Bitcoin while minimizing the associated risks.

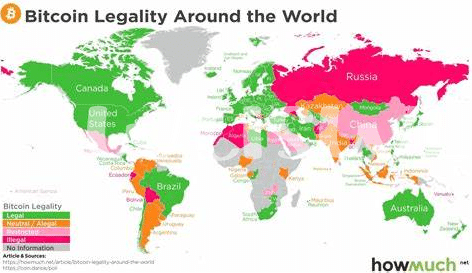

For more information on the legal status of Bitcoin in various countries, including Guatemala, you can visit is bitcoin recognized as legal tender in Guatemala?.

Potential Benefits of Bitcoin Adoption 📈

Bitcoin adoption in Guyana holds the promise of reducing transaction costs, especially for cross-border payments. The decentralized nature of Bitcoin allows for quicker and cheaper transactions compared to traditional banking systems. This could benefit businesses engaged in international trade, as they would no longer have to rely on expensive intermediaries for transactions. Additionally, increased Bitcoin adoption could lead to greater financial inclusion for unbanked populations in Guyana. By providing access to digital financial services, Bitcoin has the potential to empower individuals who previously had limited or no access to traditional banking services. This could pave the way for a more inclusive and accessible financial system in Guyana.

Future Outlook for Bitcoin in Guyana 🌐

In the ever-evolving landscape of Guyana’s financial system, the future outlook for Bitcoin holds promise and potential. As awareness and acceptance of digital currencies grow, Bitcoin is poised to carve out a significant role in the country’s economic framework. With advancements in technology and a shifting global mindset towards cryptocurrency, Guyana may see increased adoption and integration of Bitcoin into everyday financial transactions. This could lead to a more inclusive and technologically-driven financial ecosystem that embraces the benefits of decentralized currencies.