Awareness of Bitcoin 🌍

Bitcoin, a decentralized digital currency, has been making waves globally, sparking curiosity and revolutionizing the way we perceive traditional financial systems. Its rising popularity is driven by the promise of secure and transparent transactions, free from intermediaries. As more individuals and businesses in Gabon become aware of Bitcoin’s potential, questions arise about its implications on the economy and daily transactions. Understanding the fundamentals and possibilities of Bitcoin is crucial as it paves the way for a new era of financial empowerment and innovation.

Growing Adoption in Gabon 💸

In Gabon, Bitcoin has been gradually gaining traction among individuals and businesses, signaling a growing trend towards digital currencies. The ease of use and potential for investment gains have attracted many to explore this alternative form of money. As more people in Gabon become familiar with Bitcoin’s features and benefits, its adoption continues to expand across various sectors of the economy, offering new opportunities for financial engagement and innovation.

With the increasing acceptance of Bitcoin in Gabon, there is a shift towards a more decentralized and accessible financial ecosystem. This trend not only reflects a changing mindset towards traditional banking systems but also presents a potential avenue for financial empowerment and inclusion. As more businesses and consumers embrace Bitcoin, the landscape of financial transactions in Gabon is evolving, paving the way for a more fluid and diverse monetary environment.

Impacts on Traditional Banking 🏦

Traditional banks in Gabon are facing increasing pressure as more individuals turn to Bitcoin for their financial transactions. This shift in consumer behavior is challenging the conventional role of banks in the economy, forcing them to reconsider their services and offerings. With Bitcoin providing a decentralized and borderless option for money management, traditional banks must adapt to remain competitive in the changing financial landscape. This evolution highlights the need for banks to innovate and explore new ways to meet the evolving needs of their customers in the digital age.

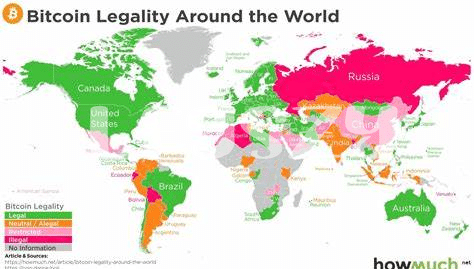

Regulatory Challenges and Opportunities 📜

In Gabon, the use of Bitcoin presents a unique set of regulatory challenges and opportunities. The government is grappling with how to oversee and regulate this emerging form of currency, balancing innovation with the need for consumer protection. While there are concerns about potential risks such as money laundering and tax evasion, there is also recognition of the opportunities that cryptocurrencies can bring to the financial sector. As Gabon navigates this landscape, it is crucial to strike a balance that fosters innovation while safeguarding the interests of its citizens. To learn more about how countries approach Bitcoin regulation, check out this informative article on is Bitcoin recognized as legal tender in Guinea?.

Bitcoin as a Tool for Financial Inclusion 🌱

Bitcoin serves as a gateway to financial inclusion by providing individuals in Gabon access to a decentralized system that transcends traditional banking barriers. This digital currency enables people to participate in the global economy, regardless of their location or financial status. By leveraging Bitcoin, individuals can send and receive funds securely, make transactions more efficiently, and manage their finances independently. As a tool for financial inclusion, Bitcoin empowers the unbanked population in Gabon to have greater control over their economic resources and participate in the digital financial landscape.

Future Outlook and Potential Developments 🔮

The potential developments in Gabon’s Bitcoin landscape hold promise for significant shifts in the financial sector. With increasing awareness and adoption, the traditional banking system faces the challenge of adapting to a new digital currency age. Regulatory frameworks will play a crucial role in shaping how Bitcoin integrates into the country’s economy. As more individuals gain access to Bitcoin, the potential for financial inclusion grows, offering opportunities for those previously excluded from the traditional banking sector. The future outlook for Bitcoin in Gabon is one of transformation and innovation, with the potential for new developments that could reshape the country’s financial landscape.