Current Bitcoin Regulation in Germany 🇩🇪

Germany has taken a proactive approach to regulating Bitcoin, aiming to provide clarity and protection for investors and businesses. The current regulatory framework in Germany offers guidelines on how cryptocurrencies, including Bitcoin, are classified and taxed. This clarity has helped foster greater trust and adoption of Bitcoin within the country, positioning Germany as a key player in the global cryptocurrency market. Authorities in Germany have recognized the potential of blockchain technology and are working to strike a balance between innovation and investor protection within the digital asset space.

Impact on Bitcoin Investors and Businesses 💼

The growth of Bitcoin in Germany has brought both opportunities and challenges for investors and businesses. As more people embrace this cryptocurrency, it has led to a surge in investment activities and innovative business ventures. However, regulatory uncertainties and compliance requirements have also created hurdles for stakeholders in the Bitcoin ecosystem. Despite these challenges, the overall impact on Bitcoin investors and businesses has been significant, shaping the financial landscape and fostering a new wave of digital entrepreneurship. Embracing this evolving regulatory environment is crucial for navigating the complexities and unlocking the full potential of Bitcoin in Germany.

Key Players Shaping Regulation 🕴️♂️

Germany’s approach to Bitcoin regulation is influenced by a variety of key players in the financial and political realms. These individuals and entities hold significant sway in shaping the legal framework surrounding cryptocurrencies. From policymakers and regulatory authorities to industry experts and stakeholder groups, each plays a crucial role in determining the trajectory of Bitcoin regulation in Germany. Collaborative efforts and ongoing dialogue among these stakeholders are essential for fostering a balanced and effective regulatory environment that supports innovation while safeguarding against potential risks.

Future Outlook for Bitcoin in Germany 🔮

As Germany continues to navigate the realm of Bitcoin regulation, the future looks promising for the cryptocurrency within the country. With increasing acceptance and integration of digital currencies, there is a growing sense of optimism among enthusiasts and industry players alike. The evolving landscape of Bitcoin in Germany is set to offer new opportunities and challenges, shaping the way individuals and businesses engage with this innovative form of currency. It is clear that the future of Bitcoin in Germany holds potential for further growth and mainstream adoption, positioning it as a key player in the global cryptocurrency market.

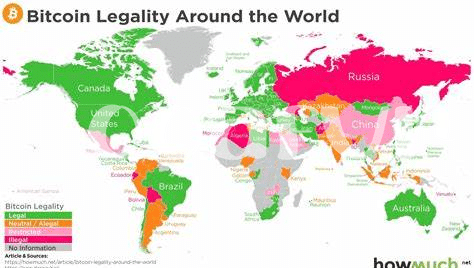

For a deeper dive into the legality of Bitcoin in other regions, you can explore discussions on is Bitcoin recognized as legal tender in Ghana?, and its implications at Wikicrypto News.

Compliance and Legal Challenges 💡

Bitcoin regulation in Germany comes with its fair share of challenges. Navigating the complex web of compliance requirements and legal nuances can be daunting for individuals and businesses alike. From keeping up with changing regulatory frameworks to ensuring adequate safeguards against potential legal risks, staying on the right side of the law is crucial in the evolving landscape of Bitcoin in Germany. Understanding and addressing these compliance and legal challenges are key to maintaining credibility and sustainability in the market.

Recommendations for Navigating Regulations 🚀

Navigating regulations in the Bitcoin landscape can be complex, but there are key strategies to consider. First, staying informed and up to date with the evolving regulatory environment is crucial. Engaging with industry associations and legal experts can provide valuable insights and guidance on compliance requirements. Additionally, implementing robust KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures is fundamental to ensure regulatory adherence while fostering trust with authorities and stakeholders. Embracing a proactive approach to compliance, including conducting regular audits and assessments, can help businesses navigate the regulatory framework effectively.

Moreover, fostering transparent communication with regulators and authorities can enhance cooperation and mitigate legal challenges. Collaborating with industry peers and participating in regulatory discussions can also offer valuable perspectives and insights for navigating the dynamic regulatory landscape. By prioritizing compliance, staying agile in response to regulatory changes, and fostering a culture of transparency and accountability, businesses and investors can navigate the regulatory complexities in the Bitcoin industry successfully.

is bitcoin recognized as legal tender in equatorial guinea?