Advantages of Using Bitcoin for Transfers 🌍

Bitcoin offers a borderless and efficient solution for international money transfers, overcoming the hurdles of traditional banking systems. Transactions can be processed quickly and securely, reducing the need for intermediaries and associated fees. The decentralized nature of Bitcoin also means that users have more control over their funds without reliance on centralized institutions. Additionally, the transparency of the blockchain technology underlying Bitcoin provides a level of accountability and traceability not typically found in traditional financial systems.

Overall, the advantages of using Bitcoin for transfers extend beyond just speed and cost-effectiveness. Its global accessibility opens up new possibilities for individuals and businesses in Zambia to participate in the digital economy seamlessly. As the world becomes increasingly interconnected, Bitcoin stands out as a tool that can empower users to navigate the complexities of international financial transactions with greater ease and autonomy.

Impact on Traditional Banking Systems 💸

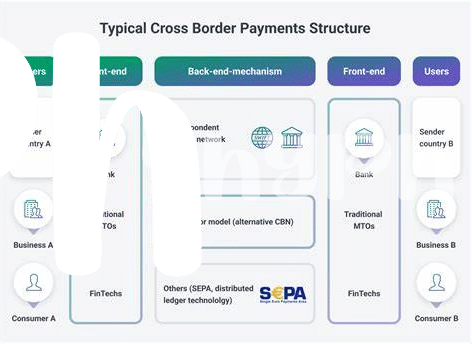

When Bitcoin became a viable option for international money transfers, it stirred waves within traditional banking systems. The decentralized nature of Bitcoin challenged the centralized control that traditional banks had over cross-border transactions. As a result, banks were forced to reconsider their fee structures and processing times to stay competitive in an evolving financial landscape. The direct peer-to-peer nature of Bitcoin transactions also raised questions about the necessity of intermediaries in the banking sector, prompting discussions about the future role of banks in the global remittance industry.

These changes had both positive and negative repercussions for traditional banking systems. On one hand, the adoption of Bitcoin spurred innovation and forced banks to modernize their operations to meet the demands of tech-savvy customers. On the other hand, it highlighted the vulnerabilities of legacy systems and the need for greater transparency and efficiency in cross-border payments. As Bitcoin continues to gain traction as a viable alternative for international money transfers, traditional banks face the challenge of adapting to a changing financial landscape while maintaining trust and reliability among their customers.

Potential Risks and Security Concerns 🔒

Bitcoin transactions for international transfers in Zambia present certain potential risks and security concerns that users need to be mindful of. One key issue revolves around the volatility of Bitcoin prices, which can result in fluctuations in the value of funds during the transfer process. Additionally, the decentralized and pseudonymous nature of Bitcoin transactions can make them susceptible to fraudulent activities and hacking attempts. This lack of centralized regulation and oversight in the world of cryptocurrency poses challenges in terms of recourse and protection for users in case of disputes or security breaches. Moreover, the technical complexity of handling private keys and wallets introduces an element of human error, which could lead to irreversible loss of funds if not managed correctly. To address these risks effectively, users must stay informed about best practices in securing their digital assets and consider utilizing secure wallet services to mitigate potential security threats in the fast-evolving landscape of cryptocurrency transactions.

Regulatory Challenges and Government Response 🛡️

Regulatory challenges pose significant hurdles for the adoption of Bitcoin in international money transfers. Governments grapple with the classification of cryptocurrencies and struggle to keep pace with the rapidly evolving landscape. The lack of a unified global regulatory framework adds complexity, leading to uncertain legal environments in many countries. While some governments embrace blockchain technology, others remain wary, citing concerns about money laundering and tax evasion. This dynamic regulatory environment hampers the widespread acceptance of Bitcoin as a legitimate means of cross-border transactions. To delve deeper into the legal implications of Bitcoin remittances, especially regarding cross-border money transfers, explore the article on bitcoin cross-border money transfer laws in Vanuatu.

Comparison with Other Digital Payment Methods 💳

Bitcoin’s comparative advantage over other digital payment methods lies in its decentralized nature and borderless functionality. Unlike traditional payment systems that rely on intermediaries such as banks or payment processors, Bitcoin transactions are direct peer-to-peer, reducing the time and cost involved in cross-border transfers. Additionally, the transparency of Bitcoin’s blockchain technology enhances security and accountability. However, Bitcoin’s price volatility remains a concern, making it more suitable for speculative purposes rather than everyday transactions. In comparison, established digital payment methods like mobile money offer greater accessibility and stability, catering to a broader user base. While Bitcoin revolutionizes money transfers with its innovative approach, it still faces challenges in mainstream adoption due to regulatory uncertainties and scalability issues.

Future Outlook and Adoption Trends 🚀

In the realm of international money transfers, the future outlook for Bitcoin adoption in Zambia appears promising. As more individuals and businesses seek faster, more cost-effective ways to send funds across borders, the decentralized nature of Bitcoin offers a compelling solution. The adoption trend indicates a gradual shift towards digital currencies for cross-border transactions, reflecting a growing acceptance of alternative payment methods. Despite regulatory challenges and security concerns, the potential benefits of using Bitcoin in Zambia’s financial landscape are undeniable. With evolving technologies and increasing awareness, the path towards mainstream adoption of Bitcoin for international transfers in Zambia seems poised for further growth and integration into the global financial market.