Advantages of Using Bitcoin for Cross-border Transfers ✨

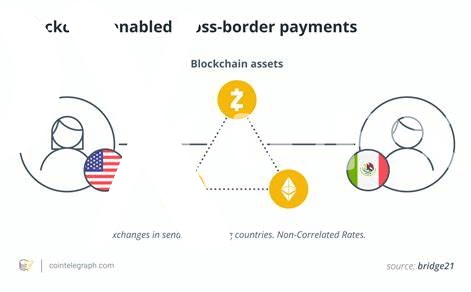

Bitcoin offers a revolutionary solution for cross-border money transfers in Uganda. Its decentralized nature eliminates the need for traditional intermediaries, reducing costs and increasing efficiency. With Bitcoin, transactions can be processed quickly and securely, regardless of geographical boundaries. Users can transfer funds swiftly, bypassing the delays associated with traditional banking systems. Additionally, Bitcoin operates 24/7, enabling transfers at any time, which is particularly beneficial in urgent situations. The transparency of the blockchain technology behind Bitcoin enhances trust and accountability in cross-border transactions, ensuring that funds reach their intended recipients promptly.

Challenges Faced When Using Bitcoin in Uganda 🌍

When it comes to using Bitcoin for cross-border money transfers in Uganda, there are notable challenges that users encounter. One major issue is the lack of widespread acceptance and understanding of Bitcoin within the country. This can make it difficult for individuals to find reliable avenues for exchanging Bitcoin for local currency, hindering the seamless transfer of funds across borders. Additionally, the fluctuating value of Bitcoin poses a risk for users, as the volatility can lead to unexpected gains or losses during the transfer process.

Furthermore, the regulatory environment surrounding Bitcoin in Uganda can also present obstacles. Uncertainty regarding the legality and enforcement of Bitcoin transactions can create hesitancy among users, impacting the ease and security of cross-border money transfers. Overcoming these challenges will be crucial for maximizing the potential benefits that Bitcoin can offer in facilitating efficient and cost-effective international transactions.

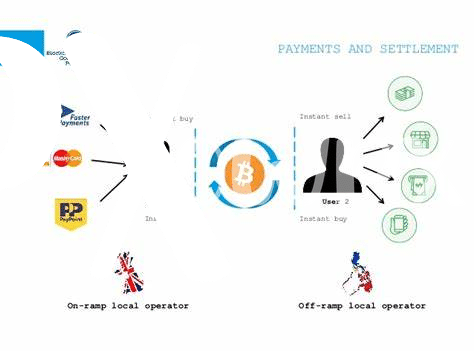

Impact of Bitcoin on Remittance Costs and Speed 💸

Bitcoin has brought revolutionary changes to cross-border money transfers, significantly impacting both the costs and speed of remittances. Through the use of Bitcoin, individuals in Uganda can experience reduced transaction fees compared to traditional methods, enabling more of the sent funds to reach the intended recipient. Moreover, the peer-to-peer nature of Bitcoin transactions bypasses intermediaries, leading to quicker processing times and near-instantaneous transfers across borders. This efficiency in speed not only enhances the overall convenience for senders and recipients but also plays a vital role in addressing urgent financial needs promptly. As a result, the impact of Bitcoin on remittance costs and speed in Uganda is paving the way for a more accessible and streamlined cross-border money transfer system, benefiting individuals seeking efficient and cost-effective solutions for international financial transactions.

Regulations Affecting Bitcoin Transactions in Uganda 📜

When it comes to utilizing Bitcoin for cross-border transactions in Uganda, understanding the regulatory landscape is crucial. Regulations affecting Bitcoin transactions in Uganda play a significant role in shaping the legal framework within which such activities operate. These regulations encompass various aspects, including compliance requirements, taxation policies, and the overall legality of Bitcoin usage in the country. To delve deeper into the specific legal implications and regulations surrounding Bitcoin transactions in Uganda, one can explore valuable insights on the subject through the link provided: bitcoin cross-border money transfer laws in Turkmenistan.

As the cryptocurrency landscape continues to evolve globally, staying informed about the regulatory environment in Uganda is essential for individuals and businesses engaging in Bitcoin transactions. By navigating through the legal implications and regulations associated with Bitcoin, stakeholders can make well-informed decisions that comply with the prevailing laws and contribute to the growth of the digital economy.

Adoption and Awareness of Bitcoin in Uganda 🚀

In Uganda, the adoption and awareness of Bitcoin are steadily increasing. More individuals and businesses are beginning to recognize the benefits of using Bitcoin for cross-border transactions. As awareness grows, so does the acceptance of this digital currency as a viable alternative to traditional payment methods. Additionally, educational initiatives and workshops are helping to inform the public about the potential of Bitcoin in facilitating faster and more cost-effective cross-border transfers. This increased awareness and adoption are contributing to a gradual shift towards utilizing Bitcoin as a preferred method for international money transfers in Uganda.

Future Outlook for Bitcoin in Cross-border Transfers 🌐

As the global financial landscape continues to evolve, the future outlook for Bitcoin in cross-border transfers appears promising. With its decentralized nature and potential for reduced transaction fees, Bitcoin has the capability to streamline international money transfers, especially in regions like Uganda where traditional banking infrastructure may be limited. Embracing this digital currency for cross-border transactions could lead to increased financial inclusion and efficiency, ultimately benefiting individuals and businesses engaged in international trade. However, to fully realize the potential of Bitcoin in cross-border transfers, it is essential to address challenges such as regulatory concerns and market volatility. By fostering greater awareness and understanding of this innovative technology, Uganda is poised to leverage Bitcoin’s advantages while navigating the complexities of the evolving digital financial ecosystem. The future of Bitcoin in facilitating cross-border transactions holds significant promise for reshaping the way funds are transferred on a global scale.

Bitcoin cross-border money transfer laws in Tanzania with anchor bitcoin cross-border money transfer laws in Turkey.