Bitcoin’s Role in Transforming Cross-border Transactions 🌍

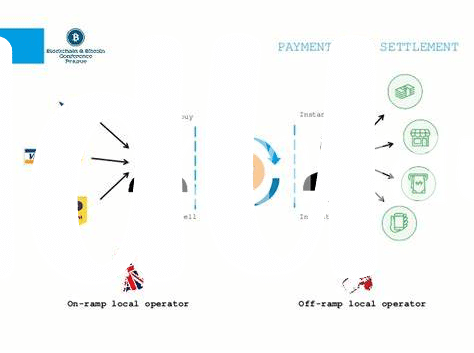

Bitcoin’s innovative technology has revolutionized the landscape of cross-border transactions, offering a seamless and secure method for individuals and businesses to transfer funds internationally. By eliminating the need for intermediaries such as banks or other financial institutions, Bitcoin enables direct peer-to-peer transactions that are faster, more cost-effective, and operate on a decentralized network. This transformation has not only streamlined the process of cross-border transfers but has also opened up new possibilities for individuals in Togo and beyond to participate in the global economy with greater ease and efficiency.

The decentralized nature of Bitcoin provides a level of transparency and autonomy that was previously unattainable in traditional cross-border transactions, giving users more control over their finances and reducing the reliance on centralized entities. As a borderless digital currency, Bitcoin transcends geographical boundaries, allowing for instant transfers across different countries without the limitations imposed by traditional banking systems. This shift towards utilizing Bitcoin for cross-border transactions marks a significant step towards a more interconnected and accessible global financial ecosystem.

Challenges Faced in Traditional Cross-border Transfers 💸

When it comes to traditional cross-border transfers, navigating through a maze of intermediaries and facing high fees are common challenges. The process often involves delays and uncertainties due to varying regulations in different countries. Additionally, the lack of transparency can lead to confusion and potential issues with tracking the progress of the transfer. Currency conversion rates further complicate matters, resulting in recipients receiving less than the sender intended. These challenges underscore the need for a more efficient and cost-effective solution for cross-border transactions.

The reliance on traditional banking systems for cross-border transfers can also expose individuals to security risks, including fraud and identity theft. Moreover, stringent verification procedures and limited operating hours of banks can prolong the transfer process, causing inconvenience and frustration for both senders and receivers. These obstacles highlight the urgent need for alternative payment methods that offer greater speed, security, and accessibility for cross-border transactions.

Benefits of Using Bitcoin for Cross-border Transactions 💡

Bitcoin provides a revolutionary solution for cross-border transactions, offering a multitude of benefits that traditional methods often fail to deliver. One significant advantage is the speed of transactions, with Bitcoin enabling near-instant transfers compared to the lengthy processing times of legacy systems. Additionally, the lower costs associated with Bitcoin transactions make it a more affordable option for individuals and businesses looking to send money internationally. Another key benefit is the transparency of Bitcoin transactions, as the decentralized nature of the cryptocurrency ensures a secure and traceable transfer process. Overall, the efficiency, cost-effectiveness, and transparency offered by Bitcoin make it a compelling choice for cross-border transactions, empowering users with a more streamlined and accessible means of transferring funds globally.

Adoption and Acceptance of Bitcoin in Togo 🚀

Bitcoin’s journey towards adoption and acceptance in Togo has been met with enthusiasm and curiosity from the local community. As more people become aware of the benefits that Bitcoin offers for cross-border transactions, the interest in using this digital currency as a viable payment method continues to grow. With its decentralized nature and ability to facilitate fast and cost-effective transfers, Bitcoin is slowly but steadily making its mark in Togo’s financial landscape. Merchants are beginning to recognize the advantages of accepting Bitcoin as a form of payment, opening up new opportunities for cross-border trade and commerce within the region. The increasing adoption of Bitcoin in Togo showcases a promising future where digital currencies play a significant role in shaping the country’s economic interactions with the rest of the world. This shift towards embracing Bitcoin signals a shift towards a more efficient and accessible financial system for Togolese individuals and businesses alike.

Don’t forget to check out the key compliance considerations for Bitcoin money transfers in Switzerland on bitcoin cross-border money transfer laws in Tajikistan for further insights.

Security Measures When Using Bitcoin for Transfers 🔒

When it comes to utilizing Bitcoin for cross-border transfers, ensuring security measures is paramount. With the decentralized nature of Bitcoin transactions, users are advised to store their digital assets in secure wallets and implement two-factor authentication for added protection. Additionally, conducting thorough research on reputable exchanges and employing encryption tools can further safeguard the transfer process. Educating oneself on commonly known phishing scams and staying informed on the latest security threats in the cryptocurrency space is essential to mitigate potential risks.

Adhering to best practices for secure transactions, such as verifying the recipient’s wallet address and double-checking transaction details before finalizing, can enhance the overall security of using Bitcoin for cross-border transfers. Embracing a proactive approach towards cybersecurity not only safeguards individuals’ funds but also fosters a sense of trust and confidence in the potential of Bitcoin as a secure solution for cross-border transactions in Togo.

Future Prospects and Opportunities for Bitcoin in Togo 🌟

The future of Bitcoin in Togo holds immense promise, with increasing adoption paving the way for enhanced financial inclusivity and efficiency in cross-border transactions. As more individuals and businesses in Togo embrace Bitcoin for international transfers, the cryptocurrency’s potential to streamline payment processes and reduce transaction costs becomes increasingly evident. Additionally, the decentralized nature of Bitcoin provides a level of financial independence and empowerment to individuals in Togo, offering an alternative to traditional banking systems that may be inaccessible or inefficient for cross-border transfers. With the ongoing advancements in blockchain technology and the growing global recognition of Bitcoin as a reliable and secure digital currency, Togo stands poised to leverage the opportunities presented by embracing Bitcoin for cross-border transactions.

To learn more about the legal aspects of Bitcoin cross-border money transfer laws, explore the regulations in Syria by visiting the link on bitcoin cross-border money transfer laws in Syria. For insights into the legal framework in Switzerland, refer to the information provided on bitcoin cross-border money transfer laws in Switzerland.