Understanding the Bitcoin Remittance Landscape in Serbia 🌍

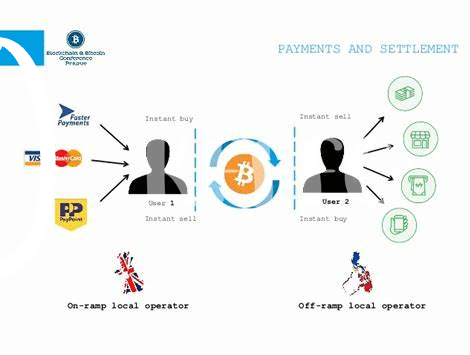

Understanding the Bitcoin remittance landscape in Serbia involves delving into the evolving trends and challenges within the country’s digital currency environment. From the increasing use of Bitcoin as a means of cross-border transactions to the emergence of local startups facilitating remittances, Serbia showcases a dynamic ecosystem. Factors such as regulatory clarity, accessibility to crypto services, and public perception play crucial roles in shaping the landscape. Additionally, the potential for financial inclusion and cost-saving benefits are driving forces behind the adoption of Bitcoin for remittances in Serbia. As the technology continues to evolve, understanding the specific dynamics within the country is essential for both policymakers and industry stakeholders to navigate this innovative financial landscape effectively.

Navigating Regulatory Frameworks Surrounding Bitcoin Transactions 🔒

Navigating the regulatory landscape surrounding Bitcoin transactions can be a complex journey, especially in regions like Serbia where guidelines may still be evolving. Understanding the rules and compliance requirements set forth by regulatory bodies is crucial to ensuring a smooth and legal operation within the Bitcoin remittance space. It involves keeping abreast of changing regulations, identifying potential risks, and implementing robust compliance measures to navigate the evolving landscape. Compliance with anti-money laundering (AML) and know your customer (KYC) regulations is paramount, as regulators are increasingly focusing on ensuring transparency and security in digital transactions. As Serbia grapples with defining its approach to Bitcoin remittances, businesses and individuals involved in these transactions must stay vigilant and adaptable to meet regulatory expectations. By proactively engaging with regulators, seeking clarity on ambiguous guidelines, and collaborating with industry peers, stakeholders can navigate the regulatory challenges and contribute to the growth of Bitcoin remittances in Serbia smoothly.

Impact of Regulatory Challenges on Bitcoin Remittances 💸

Amidst the evolving landscape of Bitcoin remittances in Serbia, regulatory challenges are exerting a significant impact on the efficiency and accessibility of these transactions. The stringent regulatory frameworks surrounding Bitcoin remittances pose obstacles in terms of compliance, security, and operational processes. These challenges can lead to delays in transactions, increased costs, and a level of uncertainty for both senders and recipients. Moreover, the lack of clear guidelines and harmonization of regulations adds to the complexity of navigating the Bitcoin remittance space in Serbia. As a result, individuals and businesses engaging in these transactions may face hurdles in effectively utilizing Bitcoin for remittances. The impact of regulatory challenges not only affects the current state of Bitcoin remittances but also influences the potential growth and adoption of this technology in the country.

Potential Solutions to Overcome Regulatory Hurdles 🛠️

Navigating the complex regulatory landscape surrounding Bitcoin remittances in Serbia can pose significant challenges, but there are potential solutions to overcome these hurdles. One approach involves engaging in constructive dialogue with regulatory authorities to foster a better understanding of how Bitcoin transactions operate within the existing legal framework. Additionally, fostering collaboration between industry stakeholders, policymakers, and regulatory bodies can lead to the development of tailored regulatory guidelines that balance innovation with compliance requirements.

For a comprehensive overview of Bitcoin regulations impacting international money transfers, particularly in San Marino, refer to this resource on bitcoin cross-border money transfer laws in Saudi Arabia. By leveraging insights from such comparative analyses, Serbia can potentially adapt regulatory frameworks to facilitate Bitcoin remittances while addressing key compliance concerns.

Case Studies Highlighting Bitcoin Remittance Roadblocks 📊

Bitcoin remittances in Serbia have faced various challenges, with regulatory roadblocks presenting significant hurdles. These roadblocks have often emerged due to the lack of clear guidelines on how bitcoin transactions should be regulated within the country. Case studies have highlighted instances where remittance services using bitcoin have encountered difficulties in navigating the regulatory landscape. For example, some companies have struggled to obtain the necessary licenses to operate legally, while others have faced uncertainties regarding the taxation of bitcoin transactions. These challenges have not only affected the operations of remittance providers but have also raised concerns among users about the reliability and security of using bitcoin for cross-border transactions in Serbia. Despite these roadblocks, there is a growing recognition of the potential benefits of bitcoin remittances, leading to calls for more streamlined regulatory frameworks to support this innovative form of financial transfer.

Future Outlook for Bitcoin Remittances in Serbia 🚀

In considering the future outlook for Bitcoin remittances in Serbia, it becomes evident that the regulatory landscape will play a crucial role in shaping the trajectory of this mode of financial transfer. As the global economy continues to embrace digital currencies, Serbia stands at a crossroads in determining how to effectively regulate and integrate Bitcoin remittances into its financial framework. The potential for innovative solutions and partnerships between government entities and blockchain enterprises presents a promising path forward. By addressing the regulatory challenges head-on and fostering a conducive environment for Bitcoin remittances to thrive, Serbia could position itself as a frontrunner in the adoption of this transformative technology. As the digital economy evolves, the strategic decisions made today will have a lasting impact on the future landscape of cross-border money transfers.

[a hrefs=”https://www.bitcoinremittances.com/bitcoin-cross-border-money-transfer-laws-senegal”]bitcoin cross-border money transfer laws in San Marino[/a]