Overview of Bitcoin for International Money Transfers 💡

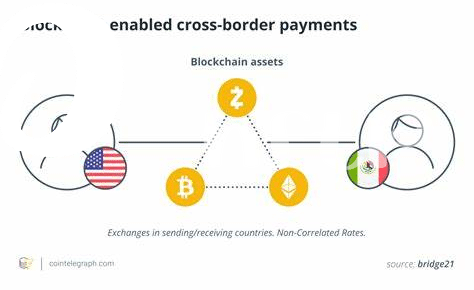

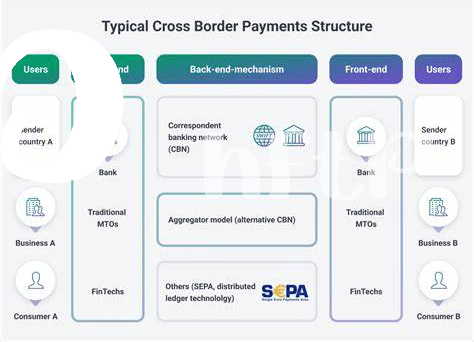

Bitcoin has transformed the landscape of international money transfers by offering a decentralized, borderless, and efficient alternative to traditional banking systems. This digital currency enables individuals and businesses in Pakistan to send and receive funds across borders quickly and securely, without the need for intermediaries. The blockchain technology underlying Bitcoin ensures transparency and immutability of transactions, providing users with a high level of trust and security. Its growing popularity is attributed to lower fees compared to traditional remittance services, faster transaction processing times, and greater accessibility to financial services for underserved populations. Embracing Bitcoin for international money transfers in Pakistan opens up a new realm of possibilities, revolutionizing the way funds are moved globally.

Legal Status of Bitcoin in Pakistan 📜

Bitcoin’s legal status in Pakistan is a complex subject that intertwines regulation, technology, and societal acceptance. The country currently does not recognize Bitcoin as legal tender, and there are no specific laws governing its use. However, the State Bank of Pakistan has issued warnings about the risks associated with cryptocurrencies, urging caution when dealing with them. Despite the lack of clear regulations, Bitcoin continues to be traded and used for various transactions in Pakistan, indicating a growing interest and demand for this digital currency in the country.

As the global landscape of cryptocurrencies evolves, Pakistan faces the challenge of adapting its regulatory framework to accommodate the use of Bitcoin while ensuring consumer protection and financial stability. The potential benefits of embracing Bitcoin, such as facilitating cheaper and faster cross-border transactions, may prompt policymakers to revisit existing laws and develop a comprehensive regulatory framework that addresses the unique characteristics of digital currencies. The legal status of Bitcoin in Pakistan remains a dynamic issue, reflecting the broader debate on how to navigate the intersection of traditional financial systems and emerging technologies.

Regulations Governing International Bitcoin Transfers 🌍

Regulatory frameworks for international Bitcoin transfers vary across countries, with some embracing the decentralized nature of cryptocurrencies, while others maintain tight controls. In Pakistan, the State Bank of Pakistan (SBP) issued a circular in 2018 detailing the prohibition of dealing in virtual currencies and tokens, including Bitcoin. However, in 2021, the country’s Securities and Exchange Commission (SECP) introduced new regulations for digital assets, providing a legal framework for the issuance and trading of digital tokens. These regulations aim to monitor and regulate the use of cryptocurrencies, including Bitcoin, in the country, ensuring compliance with anti-money laundering (AML) and counter-terrorism financing (CFT) standards. The evolving regulatory landscape in Pakistan indicates a cautious approach towards Bitcoin transactions, balancing innovation with the need for oversight and consumer protection.

Tax Implications for Using Bitcoin in Pakistan 💰

Tax implications for using Bitcoin in Pakistan can be complex and require careful consideration. When it comes to taxation, the authorities in Pakistan have yet to provide clear guidelines specifically addressing the use of cryptocurrencies like Bitcoin. However, it’s important for individuals engaging in Bitcoin transactions to keep detailed records of their activities for future reporting purposes. Additionally, any gains realized from Bitcoin transactions may be subject to capital gains tax in Pakistan. It’s advisable to seek advice from a tax professional to ensure compliance with existing laws and regulations. Understanding the tax implications of using Bitcoin can help individuals in Pakistan navigate potential challenges and avoid any legal issues related to their cryptocurrency activities. For further insights into the regulatory landscape of Bitcoin cross-border transfers, especially in the context of Palau, refer to the detailed analysis provided on WikiCrypto News.

Risks and Challenges of Bitcoin Transactions 💥

Bitcoin transactions come with a set of risks and challenges that users need to navigate carefully. One of the primary concerns is the volatility of Bitcoin prices, which can fluctuate rapidly and impact the value of transactions. Additionally, the decentralized nature of Bitcoin means that there is no central authority overseeing transactions, making it essential for users to be vigilant against fraud and security breaches. Ensuring the security of one’s Bitcoin wallet and using reputable exchanges are crucial steps in mitigating these risks. Furthermore, the anonymity associated with Bitcoin transactions can also raise concerns regarding money laundering and other illicit activities, highlighting the importance of regulatory compliance and due diligence when using Bitcoin for international money transfers.

Future Outlook for Bitcoin in Pakistan 🚀

The future outlook for Bitcoin in Pakistan shows promise, with increasing acceptance and adoption of digital currencies in the country. As more individuals and businesses become familiar with the benefits of Bitcoin for international money transfers, the market is set to expand further. While regulatory challenges may exist, the potential for streamlined cross-border transactions and reduced fees is driving interest in using Bitcoin as an alternative to traditional payment methods.

For more information on cross-border money transfer laws related to Bitcoin in other countries, such as Oman and North Korea, you can refer to the relevant regulations on Bitcoin cross-border money transfer laws in Oman and North Korea.