The Rise of Bitcoin in International Payments 💰

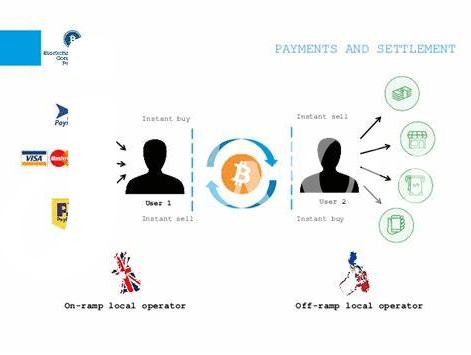

Bitcoin has rapidly gained traction as a popular choice for international payments due to its decentralized nature and potential for lower transaction fees compared to traditional banking systems. Its rise in popularity can be attributed to the increasing global acceptance of digital currencies and the seamless cross-border transactions it offers. As more individuals and businesses recognize the benefits of using Bitcoin for international transfers, its role in the financial landscape continues to expand.

With its borderless nature and ability to facilitate quick and secure transactions, Bitcoin has become a preferred method for those seeking efficient cross-border payment solutions. The growing adoption of Bitcoin for international payments underscores the shifting dynamics in the financial sector, where digital currencies are playing an increasingly significant role in enabling seamless transactions across borders. As Bitcoin continues to evolve and gain wider acceptance, its impact on international payments is poised to shape the future of global financial transactions.

Understanding the Legal Landscape in Niger ⚖️

The legal landscape surrounding cryptocurrency in Niger is complex and constantly evolving. While there are currently no specific regulations governing the use of Bitcoin for international transfers, individuals and businesses should proceed with caution. Due to the decentralized nature of Bitcoin, transactions can be susceptible to fraud and money laundering, posing potential risks for users. It is essential for anyone considering using Bitcoin for international transfers to thoroughly research and understand the laws and guidelines in Niger to ensure compliance. Despite these challenges, the use of Bitcoin presents unique opportunities for faster and more cost-effective cross-border transactions. As the global financial landscape continues to shift, staying informed about the legal implications of using Bitcoin in Niger is crucial for anyone looking to leverage this innovative technology for international transfers.

Benefits and Risks of Using Bitcoin 💸

Bitcoin presents a dual-edged sword when it comes to international transfers. On one hand, its decentralized nature offers swift transactions with relatively low fees, making it an attractive option for individuals in Niger looking to send money across borders. Additionally, the transparency of blockchain technology can enhance security and reduce the risk of fraud. However, there are risks inherent in using Bitcoin for international transfers. Price volatility can lead to significant fluctuations in the value of transferred funds, potentially resulting in unexpected gains or losses. Moreover, the lack of regulatory oversight poses challenges in cases of disputes or fraudulent activities, as there is no centralized authority to appeal to. Understanding and weighing these benefits and risks is crucial for individuals considering using Bitcoin for international transfers in Niger.

Regulation Challenges for Bitcoin Transactions 🚫

When it comes to navigating the realm of Bitcoin transactions, there exist a multitude of challenges in terms of regulations. The evolving nature of cryptocurrency and the lack of unified global oversight mechanisms pose significant hurdles. Ensuring compliance with laws specific to each country adds complexity, especially in jurisdictions like Niger, where the regulatory landscape is still developing. Striking a balance between innovation and adherence to legal frameworks requires a nuanced approach. As highlighted in an insightful resource on best practices for compliance with Bitcoin transfer laws, understanding and proactively addressing regulatory requirements is paramount bitcoin cross-border money transfer laws in Nicaragua. As stakeholders navigate these challenges, the need for clarity and guidance in regulatory frameworks remains a pressing issue for the seamless integration of Bitcoin in international transfers.

Case Studies of Successful Bitcoin Transfers 🌍

Case Studies of Successful Bitcoin Transfers 🌍

In real-world scenarios, individuals and businesses in Niger have successfully leveraged Bitcoin for international transfers, demonstrating the efficacy of this digital currency in facilitating cross-border transactions. One notable case involved a local entrepreneur who needed to pay a supplier overseas. By utilizing Bitcoin, the transfer was executed swiftly and securely, bypassing the traditional banking system’s delays and high fees. Similarly, a freelance designer received payments from international clients via Bitcoin, avoiding the hassle of currency conversion and receiving funds directly into their digital wallet. These case studies illuminate the practical advantages of using Bitcoin for international transfers and highlight its potential to streamline financial transactions across borders. As more success stories emerge, Bitcoin’s role in transforming the landscape of cross-border payments continues to expand.

Future Outlook: Bitcoin’s Impact on International Transfers 🔮

Bitcoin’s influence on international money transfers is set to reshape the traditional financial landscape, offering a glimpse into the future of cross-border transactions. As more individuals and businesses recognize the efficiency and cost-effectiveness of using Bitcoin for global transfers, the potential for widespread adoption continues to expand. This shift towards decentralized currency systems not only streamlines the transfer process but also challenges conventional banking norms. With increased regulatory scrutiny and evolving legal frameworks, the path ahead for Bitcoin in international transfers remains dynamic and uncertain. The ability of Bitcoin to navigate these complexities will determine its lasting impact on reshaping the global financial system. To delve deeper into the legal implications of Bitcoin in cross-border money transfers, explore the current laws governing Bitcoin transactions in New Zealand and the Netherlands. [bitcoin cross-border money transfer laws in new zealand](link to be inserted) and [bitcoin cross-border money transfer laws in the Netherlands](link to be inserted).