Bitcoin as a Disruptive Force ⚡️

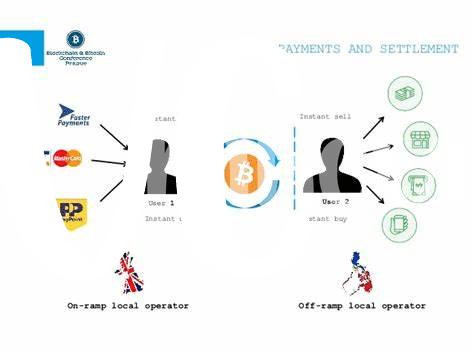

From its inception, Bitcoin has revolutionized traditional financial systems around the world. This digital currency, powered by blockchain technology, has emerged as a disruptive force challenging conventional norms of banking and payment systems. By enabling decentralized transactions, Bitcoin offers a peer-to-peer network that bypasses intermediaries, redefining how individuals conduct financial transactions globally.

As Bitcoin continues to gain traction, its disruptive potential extends beyond finance, sparking discussions on its impact across various industries. The innovative technology behind Bitcoin creates a secure and transparent platform for transactions, paving the way for a more inclusive and efficient financial ecosystem. Embracing this disruptive force opens up new possibilities for businesses and individuals seeking alternative ways to manage their finances in the digital age.

Nauru’s Regulatory Environment 🌴

Nauru’s regulatory landscape surrounding Bitcoin money transfers reflects a balance between fostering financial innovation and safeguarding against potential risks. With a progressive stance on blockchain technology, the government in Nauru is keen on exploring the opportunities presented by cryptocurrencies while ensuring compliance with existing financial laws. The regulatory framework aims to provide clarity for businesses and individuals engaging in Bitcoin transactions, promoting transparency and accountability within the digital currency ecosystem.

As Nauru navigates the evolving landscape of digital finance, collaborations with international entities and adherence to global regulatory standards play a crucial role in shaping the country’s stance on Bitcoin. By fostering an environment that encourages responsible innovation and addresses emerging challenges, Nauru’s regulatory approach sets the stage for a sustainable and secure ecosystem for Bitcoin money transfers within the jurisdiction.

Implications for International Transactions 💸

Bitcoin’s global nature presents unique implications for international transactions. The decentralized nature of Bitcoin enables borderless transactions, allowing users in Nauru to engage in cross-border trade and payments with greater ease. This can potentially streamline international transactions by reducing the reliance on intermediaries and traditional banking systems. However, the fluctuating value of Bitcoin can introduce volatility, impacting the cost and speed of international transfers. Furthermore, navigating the regulatory landscape of different countries can pose challenges in conducting compliant international transactions using Bitcoin. Despite these challenges, the potential cost savings and efficiency gains of utilizing Bitcoin for international transactions make it an attractive option for businesses and individuals looking to expand their global reach and reduce transaction costs.

Challenges and Risks 🛑

Bitcoin money transfers in Nauru present a unique set of challenges and risks for users. The volatility of cryptocurrency prices can lead to sudden fluctuations in the value of transactions, impacting both senders and receivers. Additionally, the decentralized nature of Bitcoin means that there is limited recourse for individuals in case of fraud or theft. Security concerns surrounding digital wallets and exchanges further compound the risks involved in using Bitcoin for money transfers. Despite these obstacles, the potential benefits of using Bitcoin for international transactions are significant. By staying informed about regulatory developments and taking necessary precautions to secure their funds, individuals can navigate the challenges and mitigate the risks associated with Bitcoin transfers in Nauru. To explore more about the impact of Bitcoin on cross-border money transfers, check out this insightful article on bitcoin cross-border money transfer laws in Namibia.

Future Outlook and Opportunities 🚀

Bitcoin’s growing adoption in Nauru signals a promising shift towards decentralized financial systems. As the regulatory landscape evolves to accommodate digital currencies, new avenues for financial inclusion and innovation emerge. The future outlook for Bitcoin money transfers in Nauru is one filled with opportunities for businesses and individuals alike. By leveraging blockchain technology, transactions could become more secure, efficient, and transparent. This potential not only benefits local users but also opens doors for international collaborations and investments, paving the way for a more interconnected global economy. With the right approach and regulatory clarity, Nauru stands at the brink of embracing the transformative power of Bitcoin, unlocking a new era of financial possibilities for its citizens and businesses.

Conclusion: Navigating Legal Waters ⚖️

Navigating the complex legal landscape surrounding Bitcoin money transfers in Nauru requires a delicate balance between innovation and compliance. By understanding the regulatory framework in place and staying abreast of any updates or changes, individuals and businesses can confidently engage in cross-border transactions while mitigating potential risks. Partnering with legal experts well-versed in cryptocurrency laws can offer valuable guidance and ensure adherence to relevant regulations. As the global financial ecosystem continues to evolve, opportunities for utilizing Bitcoin in international transactions are likely to increase, underscoring the importance of maintaining transparency and due diligence. Looking ahead, ongoing dialogue between regulators, industry players, and stakeholders will be essential to fostering a conducive environment for Bitcoin adoption while upholding legal standards and safeguarding against illicit activities.

Insert here the link to bitcoin cross-border money transfer laws in Nepal using the