Regulatory Challenges 🚫

Navigating the intricate web of regulatory obstacles concerning Bitcoin money transfers in Mauritius is akin to charting unexplored territories. The dynamic nature of cryptocurrency legislation presents a significant challenge, making compliance a constant endeavor for both individuals and businesses. From uncertainties in taxation policies to concerns over money laundering and illicit activities, regulators face the daunting task of striking a balance between innovation and risk mitigation. The lack of standardized regulations across borders further compounds the complexity, requiring a comprehensive approach towards international collaboration. As the regulatory landscape continues to evolve, fostering a conducive environment for Bitcoin transactions necessitates proactive dialogue between stakeholders to ensure sustainable growth and financial inclusivity within the Mauritian economy.

Security Concerns 🔐

Security concerns surrounding Bitcoin money transfers in Mauritius are a pivotal aspect that demands rigorous attention from stakeholders across the financial landscape to ensure the integrity of transactions. With the decentralized nature of cryptocurrencies, including the irreversible nature of Bitcoin transactions, the potential vulnerabilities to hacking and cyber threats loom large. The anonymity associated with Bitcoin transactions presents a double-edged sword, offering confidentiality to users but also serving as a potential channel for illicit activities like money laundering and fraud. Moreover, the absence of a central authority overseeing Bitcoin transactions raises questions about recourse and accountability in the event of security breaches or unauthorized access to funds.

Efforts to address these security concerns must be multifaceted, encompassing robust encryption mechanisms, enhanced user authentication protocols, and vigilant monitoring of transaction activities. Collaboration between regulatory bodies, financial institutions, and technology experts is paramount in developing comprehensive security frameworks that mitigate risks and bolster the trust of users in Bitcoin money transfers within the Mauritian context. The evolving nature of cyber threats necessitates a proactive stance towards fortifying security measures, underscoring the importance of continual innovation and adaptation to safeguard the burgeoning ecosystem of digital finance.

Adoption Hurdles 💳

The cryptocurrency market in Mauritius faces challenges when it comes to widespread adoption. Many individuals are still hesitant to fully embrace Bitcoin and other digital currencies as a means of everyday transactions. This hesitation stems from a lack of understanding about how these technologies work, concerns about security, and uncertainties about the future regulatory environment. Additionally, the limited availability of businesses accepting Bitcoin as a form of payment adds to the adoption hurdles. Overcoming these challenges will require education campaigns, improved security measures, and increased merchant acceptance of cryptocurrencies. Despite these obstacles, the potential benefits of using Bitcoin for money transfers in Mauritius, such as faster and cheaper transactions, make it an area with significant growth potential. By addressing the adoption hurdles, the country can position itself as a leader in embracing the future of financial technology.

Technological Advancements 📱

Point 4:

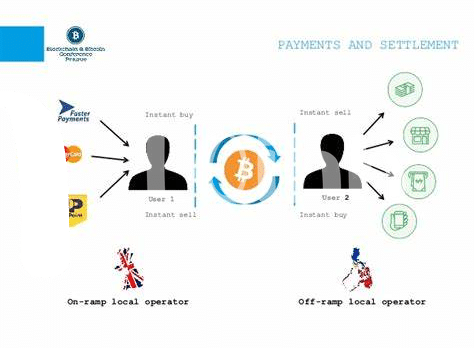

Technological advancements in the realm of Bitcoin money transfers have revolutionized the way cross-border transactions are conducted. With the rise of blockchain technology, the transfer of funds has become more secure, efficient, and transparent. The use of smart contracts and decentralized networks has streamlined the process, reducing the need for intermediaries and lowering transaction costs. Moreover, the integration of mobile applications has made it easier for individuals in Mauritius to send and receive Bitcoin payments with just a few taps on their smartphones. These advancements in technology have paved the way for a more interconnected global economy, allowing for seamless cross-border money transfers. For a detailed insight into the legal framework governing Bitcoin cross-border money transfers, you can refer to the article on bitcoin cross-border money transfer laws in Moldova.

Economic Impacts 💰

Bitcoin money transfers in Mauritius have ushered in a wave of economic impacts, reshaping traditional financial landscapes. Businesses now have access to faster and cheaper cross-border transactions, stimulating international trade and boosting economic growth. Additionally, the transparency and traceability of Bitcoin transactions can enhance accountability and mitigate financial fraud. As more consumers and businesses embrace this digital currency, it opens up new avenues for financial inclusion and access to global markets. However, fluctuating Bitcoin prices can introduce volatility and risk into the economy, requiring stakeholders to develop strategies to manage these uncertainties. Overall, the economic effects of Bitcoin in Mauritius underscore the need for a balanced approach that harnesses its benefits while addressing potential challenges.

Future Outlook 🔮

The future of Bitcoin money transfers in Mauritius is poised for exciting growth and innovation. As technology continues to advance, we can expect to see streamlined processes, enhanced security measures, and increased efficiency in cross-border transactions. This opens up new opportunities for businesses and individuals alike to benefit from the advantages that cryptocurrencies offer in terms of speed, cost-effectiveness, and accessibility.

Moreover, as regulatory frameworks evolve to accommodate the changing financial landscape, there is potential for broader adoption of Bitcoin and other digital currencies in Mauritius. This shift towards embracing innovative payment solutions could pave the way for a more inclusive and digitally-driven economy in the country. With a positive outlook on the horizon, it is crucial for stakeholders to stay informed and proactive in navigating the challenges and seizing the opportunities that lie ahead.

For more information on Bitcoin cross-border money transfer laws in Mauritania, please refer to the Bitcoin cross-border money transfer laws in Mexico.