Understanding Regulatory Environment 📝

In navigating the regulatory landscape surrounding Bitcoin money transfers in Mali, it is essential to grasp the intricate web of rules and guidelines that govern these transactions. Understanding the regulatory environment involves delving into the specific legislative frameworks, licensing requirements, and reporting obligations that shape the operational landscape for utilizing Bitcoin in financial transfers. By familiarizing oneself with the regulatory nuances, stakeholders can ensure compliance with local laws and regulations and mitigate potential risks associated with non-compliance. This foundational knowledge serves as a cornerstone for designing robust compliance strategies and navigating the evolving landscape of digital currency regulations.

Key Compliance Requirements for Bitcoin Transfers 💼

When it comes to conducting money transfers using Bitcoin in Mali, it is crucial to adhere to specific compliance guidelines to ensure smooth and lawful transactions. One of the key compliance requirements is to verify the identity of both the sender and recipient, known as Know Your Customer (KYC) regulations. This helps in preventing money laundering and fraud within the system. Additionally, monitoring transactions for any suspicious activities and adhering to anti-money laundering (AML) regulations are essential. Transparency in reporting and ensuring that transactions are within legal limits also form part of the compliance framework. By following these key requirements diligently, users can navigate the world of Bitcoin transfers securely and contribute to a more robust and reliable financial ecosystem.

Risks Associated with Non-compliance 🛑

Non-compliance with the regulatory guidelines surrounding Bitcoin transfers can lead to significant risks for individuals and businesses alike. Failure to adhere to these compliance requirements may result in legal consequences, fines, and damage to reputation. In addition, non-compliance opens the door to potential fraud, money laundering, and other illicit activities, which can further tarnish the integrity of the financial ecosystem. It is crucial for all parties involved in Bitcoin transactions to prioritize compliance in order to mitigate these risks and ensure the security and legitimacy of their operations. By staying informed about the regulatory landscape and implementing robust compliance measures, individuals and businesses can safeguard themselves against these potential pitfalls and contribute to a safer and more trustworthy environment for Bitcoin transfers in Mali.

Best Practices for Secure Transactions 🔒

One essential aspect of conducting secure Bitcoin transactions is to always double-check the wallet addresses before completing any transfer. Scammers may try to substitute legitimate addresses with their own to divert funds. It’s crucial to verify the first and last few characters of the address to ensure accuracy. Additionally, enabling two-factor authentication adds an extra layer of security by requiring a secondary verification step. Regularly updating your wallet software and using reputable platforms for transactions can further safeguard your funds. Moreover, staying informed about the latest security measures and potential threats in the Bitcoin space can empower users to make informed decisions and protect their assets effectively.

Importance of Record-keeping 📂

Record-keeping plays a vital role in ensuring transparency and accountability in Bitcoin money transfers. By maintaining detailed records of transactions, including sender and receiver information, transaction amounts, and dates, businesses can demonstrate compliance with regulations and detect any suspicious activities. These records not only help in resolving disputes but also serve as a valuable resource during audits or investigations. Furthermore, robust record-keeping practices contribute to building trust with customers and regulatory authorities, showcasing a commitment to operating in a compliant and trustworthy manner. Embracing a systematic approach to record-keeping not only safeguards against potential risks but also sets a strong foundation for the long-term success of Bitcoin transfers in Mali.

Future Outlook and Emerging Trends 🚀

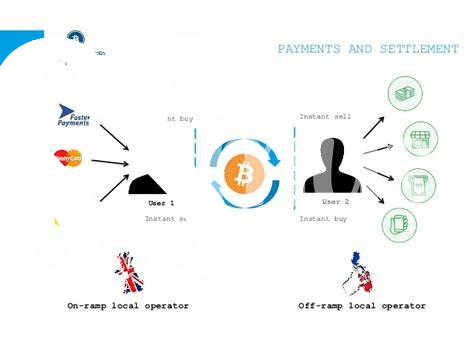

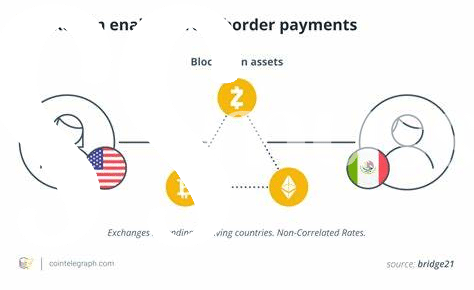

In the rapidly evolving landscape of financial technology, the future outlook for Bitcoin money transfers in Mali is filled with excitement and promise. Emerging trends suggest a gradual yet steady acceptance of cryptocurrencies as a legitimate means of financial transactions. As regulatory frameworks continue to adapt and evolve, there is a growing recognition of the potential benefits that Bitcoin and blockchain technology can bring to the realm of cross-border money transfers. The fusion of innovation and regulation is paving the way for a more inclusive and efficient global financial system, with Bitcoin playing a significant role in shaping the future of remittance services, particularly in regions like Mali.

bitcoin cross-border money transfer laws in Malawi using the anchor bitcoin cross-border money transfer laws in Madagascar indicate that regulatory authorities are recognizing the importance of establishing clear guidelines for cryptocurrency transactions. With a proactive approach to compliance and risk management, the future of Bitcoin money transfers in Mali appears poised for sustained growth and adoption. By staying abreast of the evolving regulatory landscape and embracing best practices, stakeholders can navigate the complexities of cross-border money transfers with confidence and security.