Introduction to Bitcoin in Guatemalan Transactions 💡

Bitcoin has emerged as a transformative force in the landscape of Guatemalan cross-border transactions, offering a decentralized and efficient alternative to traditional payment methods. This digital currency allows individuals and businesses in Guatemala to conduct international transactions swiftly and securely, bypassing intermediaries and reducing associated costs. As Bitcoin gains traction in the region, it presents an opportunity for increased financial inclusion by providing access to global markets and enabling seamless cross-border payments. Embracing this innovative payment solution has the potential to revolutionize the way transactions are conducted in Guatemala, paving the way for a more interconnected and accessible financial ecosystem.

Benefits of Using Bitcoin for Cross-border Payments 🌎

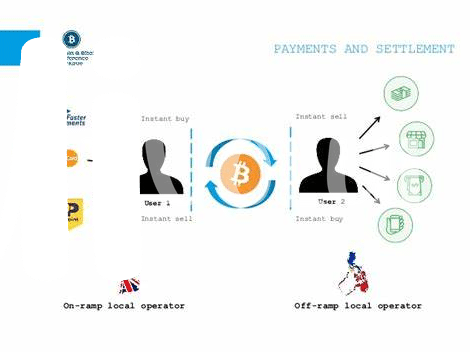

Bitcoin revolutionizes cross-border payments by offering speed, lower costs, and increased transparency. With traditional methods, transactions can take days to clear, incurring hefty fees along the way. Bitcoin, on the other hand, enables near-instantaneous transfers at a fraction of the cost typically associated with international payments. Its decentralized nature ensures that transactions are secure and immutable, safeguarding against potential fraud. Additionally, the use of Bitcoin eliminates the need for intermediaries, cutting out unnecessary layers in the payment process. This direct peer-to-peer approach not only streamlines transactions but also empowers users by giving them more control over their money. Bitcoin’s borderless nature further simplifies global transactions, making it an attractive option for those looking to transfer funds across international boundaries efficiently.

Challenges Faced in Implementing Bitcoin Transactions 🛑

Bitcoin integration into cross-border transactions in Guatemala faces several key challenges that require careful navigation. One significant hurdle is the fluctuating nature of cryptocurrency value, which can introduce uncertainty for both senders and recipients. Ensuring stable and reliable transaction processes amidst this volatility demands strategic planning and risk management strategies. Additionally, the limited awareness and understanding of how Bitcoin operates among the general population pose obstacles to widespread adoption. Overcoming these challenges necessitates initiatives to educate and raise awareness about the benefits and mechanisms of using Bitcoin for cross-border transactions. Furthermore, addressing security concerns related to the digital nature of Bitcoin transactions is crucial to building trust and confidence among users.

Increased collaboration between regulatory bodies, financial institutions, and technology providers can help establish a robust framework for Bitcoin transactions in Guatemala. By actively addressing these challenges, stakeholders can pave the way for a more seamless and efficient cross-border payment ecosystem that leverages the benefits of cryptocurrencies like Bitcoin.

Impact of Bitcoin on Financial Inclusion in Guatemala 🏦

Bitcoin has played a significant role in enhancing financial inclusion in Guatemala by providing individuals with access to cross-border transactions and banking services. Through the decentralized nature of Bitcoin, individuals in Guatemala who were previously excluded from traditional banking systems now have the opportunity to participate in the global economy. This has not only empowered the unbanked population but has also facilitated easier and more cost-effective cross-border payments. Moreover, the transparency and security features of Bitcoin help in building trust among users and reducing the risks associated with conventional financial transactions. As a result, the impact of Bitcoin on financial inclusion in Guatemala is paving the way for a more inclusive and accessible financial system for all individuals, regardless of their economic background or geographical location.

Government Regulations and Bitcoin in Cross-border Transactions 📝

Government regulations play a crucial role in shaping the landscape of cross-border transactions involving Bitcoin in Guatemala. As the government continues to navigate the evolving digital currency space, regulatory frameworks are being crafted to mitigate risks and ensure compliance with legal requirements. Striking a balance between fostering innovation and safeguarding against illicit activities is a key focus for policymakers. Clear guidelines on taxation, anti-money laundering measures, and consumer protection are essential to promote transparency and trust in cross-border Bitcoin transactions. Collaborative efforts between regulatory bodies, financial institutions, and industry stakeholders are vital to establish a secure and robust foundation for the integration of Bitcoin in the Guatemalan economy. By addressing regulatory challenges proactively, Guatemala can harness the potential benefits of Bitcoin while safeguarding against associated risks, paving the way for a more inclusive and efficient cross-border payment ecosystem.

Future Outlook for Bitcoin’s Role in Guatemalan Economy 🔮

Bitcoin’s increasing influence in the Guatemalan economy presents exciting prospects for the future. As more businesses and individuals adopt Bitcoin for cross-border transactions, the financial landscape in Guatemala is poised for significant transformation. This shift could lead to greater financial inclusion, particularly for underbanked populations who previously faced barriers in accessing traditional financial services. Moreover, the potential growth of Bitcoin’s role in Guatemala’s economy may prompt policymakers to reevaluate existing regulations to ensure a conducive environment for innovation and economic development. By embracing the possibilities that Bitcoin offers, Guatemala has the opportunity to position itself at the forefront of the digital economy, paving the way for a more interconnected and efficient financial ecosystem.

To learn more about Bitcoin cross-border money transfer laws in Georgia, visit bitcoin cross-border money transfer laws in Germany.