Overview 🌎

Ecuador’s geographical location in South America offers a strategic advantage for implementing Bitcoin in international transactions. With its diverse economy and growing digital infrastructure, the country is poised to leverage the benefits of cryptocurrency on a global scale. The overview of Ecuador’s legal framework for Bitcoin reflects a progressive approach towards embracing the potential of decentralized finance. As the world increasingly shifts towards digital forms of payment, Ecuador stands at the forefront of exploring innovative solutions that can streamline cross-border transactions. This overview sets the stage for a deeper dive into the legal status, regulations, benefits, challenges, and future outlook of using Bitcoin in Ecuador’s international transactions.

Legal Status 📜

In Ecuador, the legal status of Bitcoin in international transactions is evolving, reflecting the government’s stance on the use of cryptocurrencies. The country has not declared Bitcoin as legal tender, but it is not prohibited either, creating a gray area for its utilization. This ambiguity has led to a cautious approach by businesses and individuals in incorporating Bitcoin into their international transactions. While there is no specific regulation outlining the legality of Bitcoin in cross-border payments, the government has shown interest in exploring the potential benefits and risks associated with this digital currency.

As Ecuador navigates the changing landscape of digital currencies, stakeholders are closely monitoring the developments to adapt their practices accordingly. The absence of clear guidelines on the legal status of Bitcoin has both advantages and challenges for users, highlighting the need for comprehensive regulatory frameworks to provide clarity and security in international transactions involving cryptocurrencies. The evolving legal landscape in Ecuador underscores the importance of staying informed and proactive in navigating the complexities of using Bitcoin for cross-border payments.

Regulations 📝

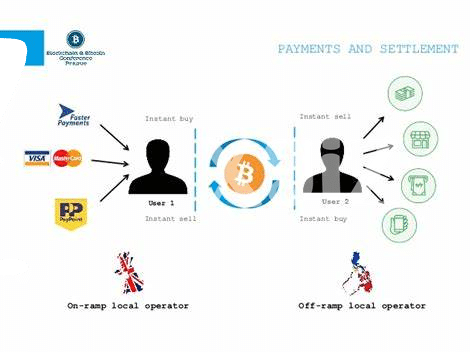

Ecuador has established clear regulations to govern the use of Bitcoin in international transactions. These rules provide a framework for individuals and businesses to engage in cross-border transactions using the digital currency. Compliance with these regulations is crucial to ensure transparency and security in the growing Bitcoin market. By outlining the procedures and requirements for conducting international transactions with Bitcoin, Ecuador aims to streamline processes and reduce potential risks associated with this innovative form of payment. These regulations serve as a guide for both users and service providers, fostering trust and confidence in the use of Bitcoin within the country’s borders. Furthermore, the clear regulatory framework helps to pave the way for further adoption and integration of Bitcoin into the traditional financial system, potentially opening up new opportunities for economic growth and innovation in Ecuador.

Benefits 💰

Ecuador’s legal framework presents several advantages for cryptocurrency users. One of the key benefits is the clarity it offers, providing a defined structure for using Bitcoin in international transactions. This clear legal status helps to reduce uncertainty and potential risks, making it easier for individuals and businesses to engage in cross-border dealings with confidence. Additionally, the regulations in place aim to promote security and transparency, ensuring that transactions are conducted in a safe and reliable manner. These legal foundations not only facilitate the use of Bitcoin but also contribute to the overall growth and development of the digital economy in Ecuador.

For further insights into navigating legal aspects of Bitcoin transfers, especially in international contexts, check out this comprehensive guide on bitcoin cross-border money transfer laws in Egypt: bitcoin cross-border money transfer laws in Egypt.

Challenges ⚠️

Ecuador’s legal framework for Bitcoin in international transactions poses certain challenges that need to be addressed. One of the primary concerns revolves around ensuring adequate consumer protection measures, especially considering the decentralized and pseudonymous nature of Bitcoin transactions. Additionally, regulatory clarity is crucial to avoid potential misuse of cryptocurrencies for illicit activities such as money laundering or terrorist financing. Another significant challenge lies in balancing innovation and risk management, as the dynamic nature of the cryptocurrency market requires constant monitoring and adaptation of regulatory frameworks. Moreover, the integration of blockchain technology into existing financial systems may require significant investments in infrastructure and workforce training. Overcoming these challenges will be key to harnessing the full potential of Bitcoin in facilitating international transactions and promoting financial inclusion in Ecuador.

Future Outlook 🔮

Ecuador’s legal framework for Bitcoin in international transactions is poised for a promising future. As the country continues to evolve its regulatory landscape, there’s a sense of anticipation surrounding the potential growth and impact of incorporating cryptocurrencies into cross-border transactions. With a forward-looking approach, Ecuador aims to harness the benefits of Bitcoin while addressing any challenges that may arise, paving the way for a more inclusive and efficient global financial ecosystem.

For a comprehensive understanding of cross-border money transfer laws related to Bitcoin, explore the regulations in place in Djibouti and Dominica bitcoin cross-border money transfer laws in Dominica. By examining the legal frameworks across different countries, one can gain valuable insights into the evolving landscape of cryptocurrency regulations and their implications on international transactions.