The Rise of Bitcoin in Congo 💰

Bitcoin is gaining traction in the Democratic Republic of the Congo, signaling a shift towards digital finance in the region. As more individuals and businesses discover the benefits of using Bitcoin for transactions, its popularity continues to rise. This digital currency offers a decentralized and secure way to conduct financial transactions, overcoming barriers often encountered with traditional banking systems. With its potential to streamline cross-border payments and reduce fees associated with remittances, Bitcoin presents a promising avenue for financial empowerment in the country. The increasing acceptance of Bitcoin in the Congo reflects a growing interest in alternative financial solutions and the potential for technological innovation to drive economic progress.

Challenges of Cross-border Transactions 🌍

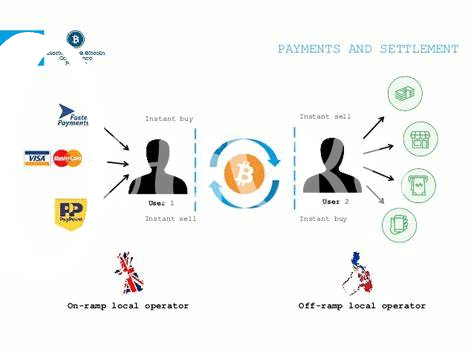

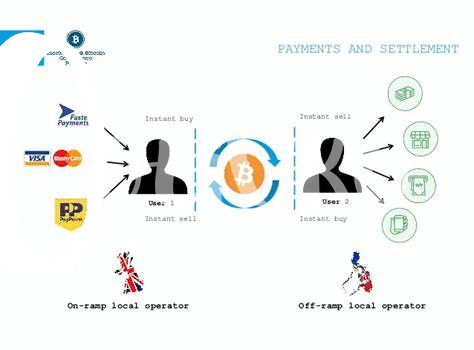

When it comes to conducting transactions across borders, one of the key challenges lies in navigating the complexities of different financial systems and regulations. This can often result in delays, higher costs, and limited transparency, making it difficult for individuals and businesses to seamlessly transfer funds internationally. The need for intermediaries further complicates the process, adding additional layers of complexity and potential points of failure. These challenges not only hinder the efficiency of cross-border transactions but also pose risks in terms of security and privacy. As the world becomes increasingly interconnected, finding solutions to these obstacles is essential for fostering smoother and more efficient global financial transactions. Embracing innovative technologies like blockchain and cryptocurrencies such as Bitcoin holds the potential to address these challenges by offering a more streamlined and secure way to conduct cross-border transactions. By reducing reliance on traditional intermediaries and central authorities, cryptocurrencies have the power to revolutionize the way money moves across borders, creating a more inclusive and efficient global financial landscape.

Impact of Remittances on Local Economy 💼

Remittances flowing into the local economy have the power to uplift communities and drive economic growth. With the use of Bitcoin, remittances can now be sent faster and at lower costs, ensuring that more funds reach the intended recipients. This influx of funds not only supports individual households but also fuels local businesses and stimulates overall economic activity. As more people in the Democratic Republic of the Congo rely on remittances for their daily needs, the impact on the local economy becomes increasingly significant, creating a ripple effect that can lead to greater financial stability and prosperity for the community.

Potential for Financial Inclusion 🌱

Financial inclusion remains a key focal point when considering the potential impact of Bitcoin on the economy of the Democratic Republic of the Congo. By leveraging the decentralized nature of cryptocurrencies, individuals who have historically been marginalized from traditional banking systems can now access financial services with greater ease. This opens up avenues for participation in the broader economy, enabling them to send and receive funds securely, even across borders. Furthermore, the lower cost associated with Bitcoin transactions compared to traditional banking methods can help reduce financial barriers and empower individuals with more control over their financial assets. As the landscape continues to evolve, the potential for enhanced financial inclusion through Bitcoin in the Democratic Republic of the Congo is promising, offering new opportunities for individuals to actively engage in economic activities and drive financial independence.

Please make sure to properly insert the link provided in the text as requested.

Regulatory Hurdles and Government Response 🛑

Navigating the complexities of regulatory hurdles in the realm of Bitcoin remittances presents a crucial challenge for the Democratic Republic of the Congo. As the government grapples with understanding and regulating this new form of currency exchange, it must strike a delicate balance between fostering innovation and mitigating potential risks. The response from the authorities will play a pivotal role in shaping the future landscape of Bitcoin remittances in the country. Clarity and transparency in regulatory frameworks will be key to ensuring a stable and secure environment for both users and businesses alike. Collaborative efforts between the government, financial institutions, and industry stakeholders will be essential in establishing a sustainable framework that addresses both regulatory concerns and promotes the benefits of Bitcoin remittances. The ability to adapt and evolve regulations in response to changing dynamics in the cryptocurrency space will be crucial for fostering trust and confidence among users and investors.

Future Prospects and Adoption Trends 🚀

The future of Bitcoin remittances in the Democratic Republic of the Congo looks promising, with increasing interest and adoption of digital currencies. As technology advances, more people are recognizing the benefits of using Bitcoin for cross-border transactions, which can be faster and more cost-effective compared to traditional methods. The potential for financial inclusion is vast, as Bitcoin allows individuals who are unbanked or underbanked to participate in the global economy. However, regulatory challenges remain a key consideration, as governments grapple with how to oversee this emerging form of financial exchange. Looking ahead, the trend towards utilizing Bitcoin for remittances is expected to continue growing, providing a valuable alternative for individuals seeking efficient and secure ways to send money across borders. To stay informed about Bitcoin cross-border money transfer laws in the Czech Republic, check out the regulations outlined in the Bitcoin cross-border money transfer laws in Croatia.