Impact of Regulations on Bitcoin 🌍

Regulations play a pivotal role in shaping the landscape of Bitcoin transactions globally. They act as a double-edged sword influencing both the adoption and challenges faced by users engaging in cross-border transfers. While regulations aim to provide a sense of security and legitimacy to the cryptocurrency market, they also introduce complexities that impact the seamless flow of Bitcoin transactions. Striking a balance between regulatory oversight and the decentralized nature of Bitcoin remains a continual challenge for both authorities and users alike. This intersection of regulation and innovation creates a dynamic environment where the future trajectory of Bitcoin cross-border transfers is intricately tied to the evolving regulatory landscape.

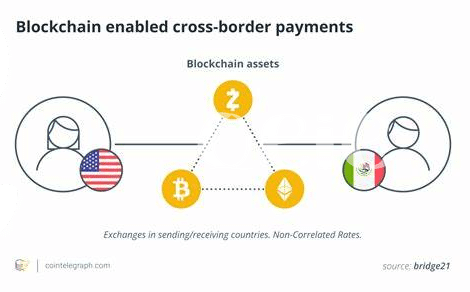

Challenges in Cross-border Bitcoin Transfers 💸

As businesses and individuals increasingly turn to Bitcoin for cross-border transfers, they encounter a variety of challenges along the way. One significant hurdle is the lack of clarity and consistency in regulatory frameworks across different countries. This can lead to uncertainty and confusion among users, as they try to navigate the legal requirements and compliance standards necessary for cross-border Bitcoin transactions. Additionally, the complex nature of international regulations can result in delays, higher transaction fees, and potential risks for both senders and recipients.

In the evolving landscape of cross-border Bitcoin transfers, staying compliant with regulations poses a significant burden on users. The ever-changing regulatory environment requires constant monitoring and adjustment, adding to the overall costs and complexities of utilizing Bitcoin for international transactions. Despite these challenges, innovative solutions and technologies are emerging to address regulatory hurdles and streamline cross-border transfers, offering hope for a more efficient and seamless experience in the future.

Compliance Costs for Bitcoin Users 💼

Navigating the world of Bitcoin transfers entails not only understanding the technology behind it but also being well-versed in the regulatory landscape. For Bitcoin users, compliance costs can often pose a significant financial burden, as staying compliant with varying regulations across different jurisdictions requires dedicated resources and expertise. From conducting KYC (Know Your Customer) procedures to constantly monitoring for regulatory updates, the cost of adherence adds up. These compliance costs can range from hiring specialized personnel to investing in compliance software solutions, placing additional strain on businesses and individuals utilizing Bitcoin for cross-border transactions. As the regulatory environment continues to evolve, finding cost-effective ways to meet compliance requirements while ensuring the seamless transfer of Bitcoin becomes crucial for sustained growth and adoption.

Innovation to Address Regulatory Hurdles 🚀

Innovative solutions are emerging to tackle the regulatory challenges faced by Bitcoin users engaging in cross-border transfers. From advanced encryption techniques to decentralized platforms, the focus is on creating tools that comply with regulations while ensuring privacy and security. These innovations not only streamline the process but also enhance transparency, an essential element in regulatory environments. By embracing cutting-edge technologies and novel approaches, the Bitcoin community is actively working towards bridging the gap between regulations and the borderless nature of cryptocurrencies. As these solutions continue to evolve, they pave the way for a more seamless and efficient cross-border transfer experience, setting the stage for a future where regulatory hurdles are not barriers but opportunities for growth and advancement in the digital finance space. Bitcoin cross-border money transfer laws in Cameroon can widely benefit from these innovative developments.

Global Perspectives on Bitcoin Regulations 🌐

Bitcoin regulations vary widely across the globe, reflecting the diverse perspectives and approaches of different countries towards this digital currency. In some regions, authorities have embraced Bitcoin, seeing it as a potential driver of innovation and economic growth. These jurisdictions have adopted a more permissive stance, allowing for greater flexibility in how Bitcoin can be used and transferred across borders. On the other hand, some countries have taken a more cautious approach, imposing strict regulations and limitations on Bitcoin usage. These divergent regulatory frameworks have created a complex landscape for global Bitcoin transactions, with users navigating through a patchwork of rules and requirements.

As Bitcoin continues to gain prominence as a tool for cross-border transfers, the global community is increasingly recognizing the need for harmonized regulations to facilitate seamless transactions and ensure compliance. Efforts are being made to bridge the regulatory gap between different jurisdictions, fostering greater collaboration and mutual understanding. The evolving landscape of Bitcoin regulations underscores the importance of continual dialogue and cooperation on an international level to shape a more cohesive regulatory environment for the future of cross-border Bitcoin transfers.

Future of Bitcoin Transfers in Regulated Environment 🚪

The future of Bitcoin transfers in a regulated environment holds promises of increased stability and trust for users worldwide. As governments continue to define and implement regulations around cryptocurrencies, the compliance standards for cross-border transactions are expected to become more streamlined. These regulations, while initially met with skepticism by some in the crypto community, are likely to pave the way for broader adoption of Bitcoin as a legitimate form of transferring value across borders. As users and businesses adapt to the changing regulatory landscape, innovation in compliance technology is anticipated to flourish, offering efficient solutions that balance the need for security and privacy in Bitcoin transactions. The future of Bitcoin transfers in a regulated environment is poised to bring about a new era of legitimacy and acceptance for digital currencies on the global stage.

For more information on Bitcoin cross-border money transfer laws in Burundi, visit the Bitcoin cross-border money transfer laws in Bulgaria.