Introduction to Bitcoin and Compliance in Burundi 🌍

Bitcoin has been gaining popularity in Burundi, offering a potential solution for facilitating cross-border transactions. However, navigating the compliance landscape when it comes to utilizing Bitcoin in the country can be complex. Understanding the regulatory environment and ensuring adherence to compliance standards are essential for businesses operating in this space. This introduction will delve into the intersection of Bitcoin and compliance in Burundi, shedding light on the opportunities and challenges that come with embracing digital currencies in the region. By exploring the current framework and discussing key considerations, this section aims to provide a comprehensive overview of the evolving landscape where technology meets regulatory requirements.

Cross-border Transfer Regulations and Challenges 🌐

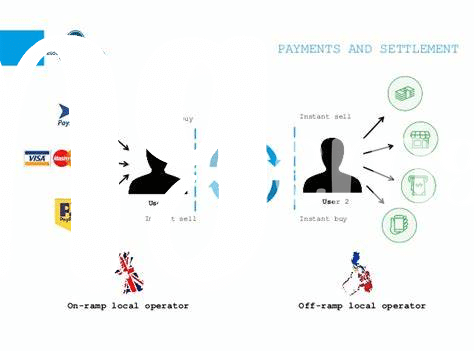

Cross-border transfers pose unique challenges and regulatory hurdles in the financial landscape of Burundi. Navigating the intricate web of compliance requirements, varying from one jurisdiction to another, can be a daunting task for businesses engaging in cross-border transactions. The regulatory landscape plays a pivotal role in shaping the efficiency and transparency of such transfers, impacting the speed and cost of cross-border transactions. Ensuring compliance with these regulations is crucial to mitigate risks, maintain trust, and avoid potential penalties. These challenges underscore the importance of staying informed and proactive in adapting to the evolving regulatory environment governing cross-border transfers.

The complexity of cross-border transfer regulations highlights the need for businesses to prioritize compliance and implement robust mechanisms to address regulatory requirements effectively. By proactively addressing these challenges, businesses can streamline their cross-border operations, enhance transparency, and build credibility with stakeholders. Adopting a proactive approach to compliance not only ensures adherence to legal frameworks but also fosters a culture of trust and reliability in cross-border transactions.

Impact of Bitcoin on Financial Inclusion 📈

The adoption of Bitcoin in Burundi is expected to have a significant impact on financial inclusion. By leveraging the decentralized nature of cryptocurrencies, individuals who may have been excluded from traditional banking systems can now access and participate in the financial ecosystem. This increased accessibility to financial services can empower unbanked populations, providing them with avenues for savings, payments, and investments, ultimately contributing to their economic well-being and overall financial stability.

Additionally, the use of Bitcoin for cross-border transfers can streamline the process, making it faster and more cost-effective compared to traditional methods. This capability not only benefits individuals sending money across borders but also opens up new opportunities for businesses and entrepreneurs to engage in global commerce, fostering economic growth and prosperity in Burundi and beyond.

Compliance Best Practices for Businesses 💼

Businesses operating in Burundi need to adhere to stringent compliance measures when dealing with Bitcoin transactions. Staying up to date with the latest regulations and guidelines is crucial to ensure smooth and legal cross-border transfers. Implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures is essential for mitigating risks and maintaining trust with customers and regulatory authorities. Additionally, utilizing secure and reputable payment processors and wallets can help safeguard sensitive transaction data. Regular audits and compliance checks should be conducted to identify and address any potential issues proactively. By prioritizing compliance best practices, businesses can navigate the complex regulatory landscape effectively while demonstrating their commitment to ethical and lawful operations. For further detailed information on compliance guidelines for Bitcoin transactions across borders in Burundi, you can refer to the resource here: [bitcoin cross-border money transfer laws in bulgaria](https://wikicrypto.news/compliance-guidelines-for-bitcoin-transactions-across-borders-in-brunei).

Risks and Security Measures in Cross-border Transactions 🔒

Risks associated with cross-border transactions can pose significant challenges for businesses operating in an evolving financial landscape. From potential fraud to regulatory compliance issues, navigating the complexities of international transactions requires a vigilant approach. Implementing robust security measures is paramount to safeguarding against potential risks and ensuring the integrity of cross-border transfers. Utilizing encryption technologies and multi-factor authentication can enhance the security framework, protecting sensitive information during the transfer process. By staying abreast of emerging threats and continuously updating security protocols, businesses can mitigate risks and foster trust in cross-border transactions.

Future Outlook: Bitcoin’s Role in Burundi’s Economy 🚀

In the dynamic landscape of Burundi’s economy, Bitcoin is poised to play a pivotal role in shaping the future of financial transactions and economic development. As the country explores avenues for growth and innovation, the adoption of cryptocurrencies like Bitcoin presents an opportunity to revolutionize cross-border transactions, enabling faster and more efficient transfer of funds across international borders. With its decentralized nature and borderless functionality, Bitcoin has the potential to streamline cross-border payments in Burundi, reducing reliance on traditional banking systems and opening up new possibilities for businesses and individuals alike.

Additionally, the regulatory framework surrounding Bitcoin and cross-border money transfers in Burundi will play a crucial role in shaping the adoption and integration of cryptocurrencies into the country’s economy. Understanding and complying with the evolving laws and regulations governing Bitcoin transactions will be essential for businesses seeking to leverage the benefits of digital currencies while mitigating risks associated with cross-border transactions. For further insights on cross-border money transfer laws related to Bitcoin in other countries, you can refer to the regulations in Burkina Faso by visiting the link: Bitcoin Cross-Border Money Transfer Laws in Burkina Faso.