Impact of Us Regulations on Bitcoin Trading 💡

The impact of US regulations on Bitcoin trading is a topic of significant relevance in the cryptocurrency sphere. The regulatory environment set forth by the US government plays a pivotal role in shaping the dynamics of Bitcoin markets. Changes in regulations can lead to fluctuations in trading volumes, price volatility, and overall investor confidence. Understanding how these regulations influence the behavior of market participants is crucial for navigating the complexities of the cryptocurrency landscape.

As US policies continue to evolve, their impact on Bitcoin trading cannot be understated. Traders and investors alike must stay informed about regulatory updates and adapt their strategies accordingly. By observing the interplay between US regulations and Bitcoin trading, one can better position themselves to capitalize on opportunities while mitigating risks associated with changing governmental policies.

Relationship between Government Policies and Market Trends 📊

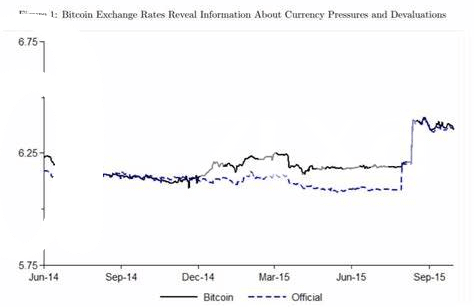

The interplay between government policies and market trends in the realm of Bitcoin trading is a captivating tale of influence and adaptation. As regulators maneuver to define their stance on cryptocurrency, the market responds with fluctuations that mirror the shifts in policy. Investors keenly watch the decisions made by authorities, drawing insights from the resulting market trends. The relationship between government actions and market reactions embodies a dynamic dance, where each move by policymakers can sway the value of Bitcoin and shape trading behaviors.

Looking ahead, the evolving landscape of regulatory frameworks promises a continued narrative of intrigue and adjustment for Bitcoin traders. Navigating the ebb and flow of government policies demands astute observation and strategic planning to capitalize on market trends within this intricate ecosystem. The fusion of government policies and market dynamics sets the stage for a compelling saga of adaptation and opportunity in the world of Bitcoin trading.

Historical Context of Us Involvement in Cryptocurrency 🕰️

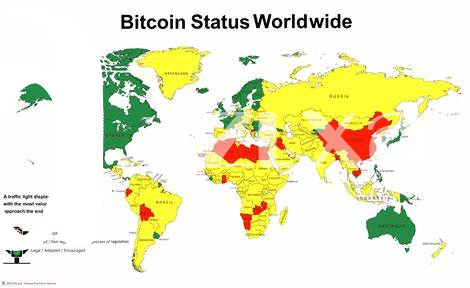

Throughout the years, the evolution of cryptocurrency in the United States has been a multifaceted journey, marked by a series of pivotal moments and shifting perspectives. From the early days of skepticism and uncertainty to the gradual acceptance and integration of digital assets into the mainstream financial landscape, the historical context of U.S. involvement in cryptocurrency reveals a complex tapestry of regulatory challenges, technological advancements, and market dynamics. The interplay between government agencies, financial institutions, and industry stakeholders has shaped the trajectory of digital currencies, highlighting both the opportunities and the risks associated with this emerging asset class. As policymakers continue to grapple with the implications of decentralized finance and blockchain technology, the historical narrative of U.S. involvement in cryptocurrency serves as a roadmap for understanding the past, present, and future of this rapidly evolving ecosystem.

Influence of Political Decisions on Investor Sentiment 💰

When political decisions impact investor sentiment in the realm of Bitcoin trading, the effects ripple through the market with palpable force. Investor confidence, easily swayed by governmental actions and policies, can fluctuate dramatically based on the perceived stability or uncertainty introduced by regulatory changes. The mere hint of new legislation or a shift in political stance can trigger waves of buying or selling, showcasing the close link between policy decisions and market reactions. This intricate dance between government decisions and investor sentiment shapes the landscape of Bitcoin trading, underlining the need for stakeholders to stay informed and adaptable amidst the dynamic interplay of politics and finance. For more insights on how foreign exchange controls affecting Bitcoin have unfolded in Turkey, check out this article: foreign exchange controls affecting Bitcoin in Turkey.

Future Implications of Policy Changes on Bitcoin 🌐

As government policies continue to evolve, the future implications of these regulatory changes on the Bitcoin market are becoming increasingly significant. These policy shifts have the potential to drive market behavior and shape the trajectory of Bitcoin trading in the coming years. Investors and stakeholders are closely monitoring how political decisions and regulatory frameworks will impact the overall landscape of Bitcoin trading. The interplay between policy changes and market dynamics will undoubtedly influence investor sentiment, market volatility, and the overall growth potential of Bitcoin as a digital asset.

In this dynamic environment, adapting to regulatory changes and understanding their implications will be crucial for navigating the evolving landscape of Bitcoin trading. Developing a proactive approach to staying informed about policy developments and implementing sound strategies to mitigate risk will be key for investors looking to capitalize on opportunities while managing potential challenges in the ever-changing regulatory environment.

Strategies for Navigating the Regulatory Landscape 🗺️

Navigating the regulatory landscape in the realm of Bitcoin trading requires a nuanced approach that balances compliance with innovation. Understanding the evolving regulatory frameworks and staying informed about the latest guidelines are essential strategies for market participants. Engaging with industry experts, monitoring legislative developments, and actively participating in regulatory discussions can provide valuable insights and help anticipate potential changes. Implementing robust compliance measures, such as KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures, can not only ensure adherence to regulations but also build trust with stakeholders. Additionally, diversifying investments across different jurisdictions and asset classes can mitigate the impact of regulatory uncertainties. Embracing transparency, maintaining open communication channels with regulators, and advocating for industry-friendly policies are key components of successfully navigating the complex regulatory landscape in the Bitcoin trading ecosystem.

Insert link to foreign exchange controls affecting bitcoin in Uganda with anchor foreign exchange controls affecting bitcoin in United Arab Emirates using the