The Rise of Bitcoin: a Digital Revolution 🚀

Bitcoin’s journey from its inception to becoming a household name has been nothing short of remarkable. It has challenged traditional financial systems, introducing a new era of decentralized currency that transcends borders and regulations. The allure of Bitcoin lies in its innovative blockchain technology, which offers a secure and transparent way to conduct transactions. As more people embrace this digital currency, the potential for its widespread adoption continues to grow. Bitcoin’s rise signifies a shift towards a more inclusive and accessible global financial landscape, where individuals have greater control over their assets. Its digital revolution paves the way for a future where financial empowerment is within reach for everyone, regardless of their background or location.

Impact of Uae Exchange Controls on Bitcoin 💸

UAE’s stringent exchange controls wield a profound influence on Bitcoin activities within the region. The restrictions imposed by the UAE government exert notable pressure on the flow and exchange of cryptocurrencies, including Bitcoin. These constraints often lead to increased scrutiny and regulatory hurdles for individuals and businesses engaged in Bitcoin transactions within the UAE. Despite the challenges posed by the stringent exchange controls, Bitcoin continues to capture the interest of investors seeking alternative financial avenues in the face of such regulations. The impact of the UAE’s exchange controls on Bitcoin showcases the intricate relationship between traditional financial systems and the burgeoning digital currency landscape.

The Role of Regulations in Shaping Bitcoin’s Future 📜

Regulations play a pivotal role in shaping the future trajectory of Bitcoin. As governments globally grapple with the concept of regulating this decentralized digital currency, a delicate balance must be struck. Stricter regulations could potentially stifle innovation and adoption of Bitcoin, while looser regulations may expose users to risks such as fraud and security breaches. Finding the middle ground between regulatory oversight and the open nature of cryptocurrencies is crucial for Bitcoin’s continued growth and integration into the traditional financial landscape. It is a complex dance between embracing the innovative potential of Bitcoin while safeguarding against illicit activities, with each regulatory decision influencing the path Bitcoin takes in the years to come.

Global Perspectives on Bitcoin Adoption 🌍

Bitcoin adoption is gaining traction worldwide, with countries like Japan, Switzerland, and the United States embracing its potential. Japan, for instance, has recognized Bitcoin as a legal form of payment, leading to a surge in usage across various industries. In Switzerland, a thriving crypto valley has emerged, fostering innovation and investment in blockchain technology. The United States remains a key player in the global Bitcoin market, with increasing acceptance from mainstream financial institutions and consumers. These diverse perspectives highlight the growing significance of Bitcoin on an international scale, paving the way for continued growth and evolution in the digital currency space. To delve deeper into how foreign exchange controls are impacting Bitcoin in Turkmenistan, check out this insightful article on foreign exchange controls affecting bitcoin in Turkmenistan.

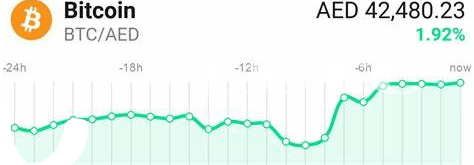

Navigating Volatility: Bitcoin’s Price Fluctuations ⚖️

Navigating the ever-changing landscape of Bitcoin’s price fluctuations requires a keen understanding of market dynamics and trends. Investors often find themselves on a rollercoaster ride, as prices can soar to unprecedented heights one day and plummet the next. While volatility comes with the territory in the world of cryptocurrencies, seasoned traders see it as an opportunity rather than a hindrance. Strategies such as dollar-cost averaging and setting stop-loss orders can help mitigate risks during turbulent times. By staying informed, adopting a long-term perspective, and diversifying their portfolios, individuals can better navigate the fluctuations in Bitcoin’s price and potentially capitalize on the market’s ups and downs.

Looking Ahead: Innovations in the Bitcoin Ecosystem 🔮

Looking ahead in the dynamic realm of the Bitcoin ecosystem, we witness a wave of innovation sweeping across the digital landscape. From advancements in blockchain technology to the emergence of new decentralized finance (DeFi) platforms, the future holds a promise of unprecedented growth and transformation. As developers and visionaries collaborate to push the boundaries of what is possible, we can anticipate enhanced security protocols, streamlined user experiences, and innovative applications that redefine the way we interact with cryptocurrencies. The evolution of the Bitcoin ecosystem is not just about technological progress; it embodies a shift towards a more inclusive and accessible financial system that empowers individuals worldwide to take control of their assets and financial future.

Foreign exchange controls affecting Bitcoin in United Kingdom