Bitcoin’s Impact on South Korea’s Remittance Landscape 🌏

In South Korea, the increasing popularity of Bitcoin is reshaping the remittance landscape. With its borderless, efficient nature, Bitcoin is opening up new avenues for cross-border transactions that traditional methods struggle to match. The ease and speed of sending funds through Bitcoin are gaining traction among individuals looking for cost-effective and swift remittance options. This shift towards digital currencies like Bitcoin signifies a changing tide in how money is being moved globally.

The embrace of Bitcoin in South Korea is not just a trend but a fundamental shift in how remittances are carried out, offering a glimpse into a future where traditional barriers are overcome by technology. As more people recognize the advantages of using Bitcoin for remittance, the landscape is evolving, paving the way for innovative solutions and greater financial inclusion. The influence of Bitcoin on South Korea’s remittance scene extends beyond borders, setting a precedent for other nations to explore the potential of digital currencies in revolutionizing financial transactions.

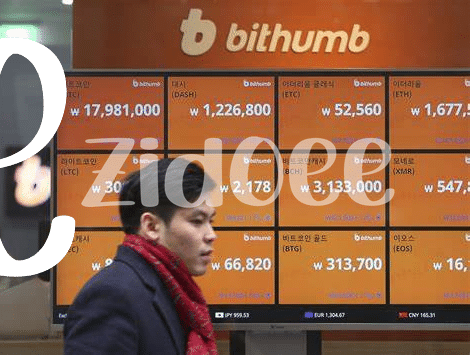

Evolution of Policies Towards Cryptocurrency Exchanges 💡

The journey of South Korea’s policies towards cryptocurrency exchanges has been a dynamic and transformative one. Initially met with skepticism and caution, the regulatory landscape gradually evolved to embrace the potential of digital assets. This shift was fueled by a growing recognition of the technological innovations that cryptocurrencies bring, alongside the need to adapt to the changing financial ecosystem. As policies were refined and updated, a delicate balance between oversight and innovation was sought, aiming to foster a thriving digital currency market while safeguarding against potential risks. This evolution not only shaped the local exchange sector but also sent ripples across global markets, signaling a new era in the intersection of traditional financial systems and emerging digital currencies.

Inserted link with anchor text: https://wikicrypto.news/legal-perspectives-sri-lankas-forex-laws-and-bitcoin-exchanges

Challenges and Opportunities in Regulatory Shifts 🔄

Navigating the shifting regulatory landscape surrounding cryptocurrency exchanges brings forth both challenges and opportunities. As South Korea reevaluates its policies in response to the increasing influence of Bitcoin, stakeholders are faced with the task of balancing innovation with security. Adapting to new regulations requires exchanges to enhance transparency, compliance, and risk management measures, while also fostering industry growth. This transition period offers opportunities for market players to differentiate themselves through responsible practices and technological advancements, thereby setting higher standards for the digital currency ecosystem. Embracing regulatory changes can lead to increased credibility and trust among users and regulators, paving the way for a more robust and sustainable industry landscape in South Korea and beyond.

Public Response and Adoption of Digital Currency 💳

In South Korea, the public response and adoption of digital currency have been met with varying degrees of enthusiasm. While some individuals have wholeheartedly embraced the convenience and potential financial benefits of using cryptocurrencies for transactions, others remain cautious due to concerns about security and volatility. This diverse response highlights the ongoing shift towards digital forms of currency in everyday transactions, reflecting the evolving financial landscape globally. As more people become familiar with the concept and practical applications of digital currencies, their adoption is expected to continue growing, influencing not only individual consumers but also businesses and financial institutions looking to adapt to this changing reality.

To delve deeper into the legal considerations surrounding bitcoin exchange in different contexts, such as foreign exchange controls affecting bitcoin in South Sudan, visit foreign exchange controls affecting bitcoin in South Sudan.

Influence on Traditional Banking Systems and Services 🏦

The integration of Bitcoin into South Korea’s financial landscape has not only transformed the remittance sector but also sparked significant changes in traditional banking systems and services. As digital currencies gain momentum, banks are beginning to explore ways to adapt their operations to accommodate this new financial paradigm. This shift is reshaping how banks handle transactions, offer services, and interact with their customers. Moreover, the influence of Bitcoin is compelling traditional banks to reevaluate their strategies to remain competitive in the evolving financial ecosystem. The challenge lies in striking a balance between embracing innovation and maintaining regulatory compliance, as banks navigate this uncharted territory to meet the changing needs of their clients.

Future Implications for Global Remittance Market 🚀

Bitcoin’s influence on South Korea’s exchange policies is expected to have significant repercussions on the global remittance market. As the landscape shifts towards digital currencies, the future implications for remittance services worldwide are profound. The integration of blockchain technology and cryptocurrencies not only streamlines cross-border transactions but also reduces costs and enhances security for users. This shift towards decentralized payment systems may redefine how remittances are conducted on a global scale, potentially disrupting traditional banking models.

To learn more about foreign exchange controls affecting Bitcoin in Sri Lanka, visit foreign exchange controls affecting Bitcoin in Sweden.