Legal Framework 📚

In Sweden, the legal landscape surrounding Bitcoin exchange operates within a carefully crafted framework that seeks to balance innovation with regulatory oversight. This framework outlines the rights and responsibilities of both cryptocurrency exchanges and users, providing a structured approach to ensure compliance and protect stakeholders’ interests. It encompasses laws related to financial transactions, data protection, and consumer rights, offering a robust structure within which Bitcoin exchanges can operate securely and transparently.

Moreover, this legal framework undergoes regular reviews and updates to adapt to the evolving nature of the cryptocurrency market and address emerging challenges effectively. By understanding and adhering to these regulations, Bitcoin exchanges in Sweden can navigate the complex legal terrain with confidence, fostering trust and sustainability in the digital asset ecosystem.

Licensing Requirements 📃

Navigating the world of cryptocurrency exchanges can be complex, especially when it comes to meeting the licensing requirements. By obtaining the necessary permits and approvals from regulatory bodies, businesses can operate legally within Sweden’s strict framework. Ensuring compliance with these licensing requirements is crucial for maintaining a trustworthy and transparent exchange platform for users.

Implementing robust security measures, conducting thorough background checks, and demonstrating financial stability are just some of the critical components that play into obtaining and maintaining the necessary licenses for operating a Bitcoin exchange in Sweden. As the regulatory landscape continues to evolve, staying informed and adaptable is key to successfully navigating the licensing requirements set forth by the authorities.

Compliance Obligations 🛡️

Ensuring compliance with regulations is crucial in the operation of a Bitcoin exchange. It involves adhering to strict guidelines set forth by the authorities to prevent potential illegal activities and safeguard the interests of users. Compliance obligations cover a wide range of aspects, including anti-money laundering measures, customer verification procedures, and transaction monitoring. By fulfilling these obligations diligently, exchanges demonstrate their commitment to operating lawfully and ethically within the financial ecosystem.

Incorporating compliance into the core operations of a Bitcoin exchange is not just a legal requirement; it also builds trust with customers and establishes credibility within the industry. Demonstrating a proactive approach to compliance not only mitigates regulatory risks but also fosters a secure and transparent trading environment for all parties involved. By staying ahead of evolving compliance standards, exchanges can navigate the regulatory landscape effectively and contribute to the legitimacy and sustainability of the cryptocurrency market.

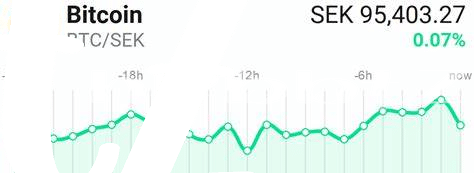

Reporting and Record-keeping 📊

One of the critical aspects of operating a Bitcoin exchange in Sweden is ensuring proper reporting and record-keeping practices. These requirements are essential for transparency and accountability within the financial system. By maintaining accurate records of transactions and user information, exchanges can demonstrate compliance with regulatory standards and facilitate investigations when necessary.

Effective reporting and record-keeping not only contribute to regulatory compliance but also enhance security and trust in the cryptocurrency ecosystem. By documenting and reporting all relevant activities, exchanges can help prevent fraud, money laundering, and other illicit activities. This proactive approach aligns with the evolving landscape of cryptocurrency regulations worldwide, as demonstrated by the foreign exchange controls affecting Bitcoin in Suriname. For more insights on the impact of regulatory measures on digital currencies, you can visit the article on Wikicrypto News about foreign exchange controls affecting Bitcoin in Suriname.

Customer Protection Measures 🛡️

Customer protection measures play a vital role in safeguarding users’ interests within the Bitcoin exchange arena. These measures are designed to enhance transparency and trust, ensuring that customers’ assets are protected from potential risks such as fraud or misuse. One key aspect of customer protection involves robust security protocols to prevent unauthorized access to funds and personal information. Additionally, clear communication channels and responsive customer support services enable users to address any concerns promptly. Implementing effective dispute resolution mechanisms further enhances customer confidence and satisfaction. By prioritizing these protective measures, Bitcoin exchanges in Sweden can cultivate a secure and reliable trading environment for their users.

Enforcement Actions ⚖️

Enforcement actions in the realm of Bitcoin exchanges under Swedish regulations can have significant implications for non-compliant entities. Authorities in Sweden are vigilant in monitoring and enforcing adherence to established guidelines, with penalties ranging from fines to potential shutdowns for violators. In cases of severe non-compliance, legal action can be pursued, leading to detrimental repercussions for those operating outside the legal framework.

Foreign exchange controls affecting bitcoin in Sudan can significantly impact the flow and utilization of digital assets in the region. On the other hand, regulatory measures in Spain play a crucial role in shaping the landscape for cryptocurrency exchanges. Understanding these differing dynamics is essential for both investors and operators navigating the global cryptocurrency market.

Foreign exchange controls affecting bitcoin in Spain