Understanding the Dynamics of Bitcoin 🌟

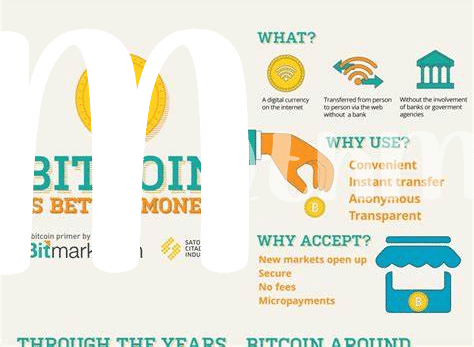

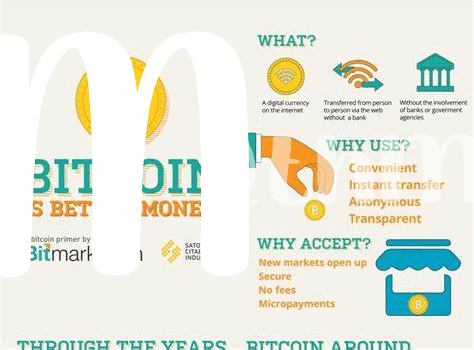

Bitcoin, often referred to as the pioneer of cryptocurrencies, operates on a decentralized network, free from governmental control. Its value is dictated by market demand and supply, leading to often volatile price fluctuations. Understanding the dynamics of Bitcoin involves grasping its underlying technology, blockchain, which ensures secure and transparent transactions. Learning how Bitcoin is mined and how its supply is capped at 21 million coins adds depth to comprehending its value proposition. Exploring the history of Bitcoin, from its creation in 2009 by the pseudonymous figure Satoshi Nakamoto, to its mainstream adoption, provides insights into its significance in the digital age. Delving into the intricacies of Bitcoin’s peer-to-peer network and how transactions are verified through a consensus mechanism elevates one’s knowledge of this evolving digital asset.

Navigating through Foreign Exchange Controls 🌍

In navigating foreign exchange controls, individuals and businesses face a complex landscape filled with regulations and restrictions. This environment requires a strategic approach to ensure seamless transactions and compliance with varying rules across different jurisdictions. Understanding the nuances of these controls is crucial in avoiding potential pitfalls and maximizing opportunities in cross-border transactions. By staying informed about the evolving regulatory frameworks and seeking expert advice when needed, one can proactively navigate through the challenges presented by foreign exchange controls. Adaptability and a thorough understanding of the legal requirements can empower individuals and entities to engage in global commerce with confidence and efficiency. Embracing transparency and staying abreast of regulatory updates are essential components of successfully managing foreign exchange controls, paving the way for smoother cross-border transactions.

Strategies for Thriving in Uncertain Times 💡

In today’s unpredictable economic landscape, having the right strategies in place is crucial for individuals and businesses to thrive amidst uncertainty. Embracing flexibility and diversification can be key components in weathering turbulent times, allowing for quick pivots when faced with unexpected challenges. Adapting a proactive mindset that focuses on innovation and creativity enables one to turn obstacles into opportunities, fostering growth and sustainability in the face of uncertainty. By fostering a culture of adaptability and resilience, individuals and businesses can position themselves to not only survive but thrive, no matter the circumstances.

Harnessing the Potential of Digital Currencies 💰

Digital currencies have opened up a world of possibilities for individuals and businesses alike. The decentralized nature of these digital assets bypasses traditional financial systems, offering greater accessibility and financial autonomy. Embracing digital currencies allows users to transact across borders with ease, reducing the barriers imposed by conventional banking systems. Moreover, the potential for growth and innovation within the realm of digital currencies is immense, presenting opportunities for individuals to diversify their portfolios and explore alternative investment avenues. Understanding the intricacies of this evolving landscape is crucial for harnessing the full potential of digital currencies and staying ahead in the rapidly changing financial sphere.

For further insights on navigating the complexities of foreign exchange controls affecting bitcoin in Peru, check out this detailed guide on foreign exchange controls affecting bitcoin in Peru.

Adapting to Changing Regulatory Environments 🔍

Strategies in response to evolving rules & regulations aim to enhance flexibility and align with compliance demands. Embracing agility in operations and fostering a culture of adaptability can help navigate the shifting landscape of regulatory measures. Working proactively toward compliance readiness can mitigate risks posed by regulatory changes and foster resilience in the face of regulatory uncertainty. Recognizing the significance of regulatory compliance and promptly adjusting strategies can contribute to sustained success amid changing regulatory environments. Adoption of proactive monitoring mechanisms and continuous assessment can aid in adapting swiftly to new regulatory requirements, ensuring organizational readiness for future shifts in compliance standards. Adaptability is key to not just surviving but thriving in a constantly evolving regulatory environment, enabling businesses to stay ahead of the curve and maintain credibility with stakeholders.

Ensuring Financial Security and Stability 🛡️

Navigating through the complex landscape of financial systems, safeguarding one’s assets is paramount in ensuring stability during uncertain times. Implementing a diversified portfolio strategy can offer a layer of protection, with a mix of traditional holdings and digital assets like Bitcoin. This approach spreads risk and minimizes exposure to volatility in any one market, enhancing overall financial security. Additionally, staying informed about regulatory changes and compliance requirements is essential to adapt swiftly and protect investments.

To delve deeper into how foreign exchange controls impact Bitcoin specifically in Panama, consider the regulatory framework in place. Conversely, explore the implications of foreign exchange controls affecting Bitcoin in Pakistan to understand the varying approaches taken by different nations in regulating digital currencies. By grasping these dynamics, individuals can make informed decisions to fortify their financial positions and navigate through evolving global financial landscapes effectively.