Bitcoin as a Solution for Cross-border Payments ✨

When it comes to facilitating cross-border payments, Bitcoin has emerged as a promising solution. Its decentralized nature and borderless transactions offer a convenient and efficient way to transfer funds internationally. By leveraging blockchain technology, Bitcoin provides a secure and transparent platform for individuals looking to send or receive money across different countries. With traditional remittance services often plagued by high fees and slow processing times, Bitcoin offers a faster and cost-effective alternative for cross-border transactions.

In the realm of financial innovation, Bitcoin stands out as a versatile tool for navigating the challenges of cross-border payments. Its ability to transcend geographical boundaries and streamline the remittance process makes it a valuable asset in the realm of international transactions. Embracing the potential of Bitcoin as a solution for cross-border payments can pave the way for a more seamless and accessible remittance experience for individuals around the globe.

Turkmenistan’s Regulatory Environment and Challenges 🌍

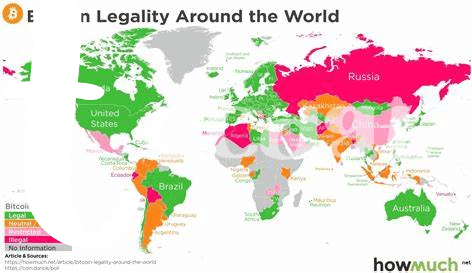

Turkmenistan faces regulatory hurdles in the realm of Bitcoin remittances, posing challenges for both residents and travelers. The government’s stance on cryptocurrency remains ambiguous, with limited guidance on its legal status and usage within the country. This uncertainty creates barriers for individuals looking to send or receive Bitcoin as a means of remittance, complicating cross-border transactions. Compliance with existing financial regulations proves to be a significant concern, as the lack of specific laws governing digital currencies leaves users in a grey area of legality and exposes them to potential risks. Navigating Turkmenistan’s regulatory landscape requires a delicate balance between technological advancements and adherence to traditional financial norms, highlighting the need for more comprehensive guidelines to streamline Bitcoin remittance processes effectively.

The Role of Technology in Facilitating Remittances 📲

Technology plays a crucial role in streamlining the process of remittances, especially in countries like Turkmenistan where traditional banking systems face limitations. The use of mobile apps, online platforms, and blockchain technology has revolutionized the way funds are transferred across borders. These technological advancements not only enhance the speed and efficiency of remittance transactions but also reduce the associated costs, making it more accessible to individuals seeking to send money back home. Additionally, the transparency and security provided by these technological solutions instill trust among users, ensuring that their funds reach the intended recipients securely.

Benefits and Limitations of Bitcoin in Turkmenistan 💸

Bitcoin presents a unique opportunity for individuals in Turkmenistan to navigate the challenges of remittances. Its decentralized nature allows for faster and more cost-effective cross-border transactions compared to traditional methods. However, the use of Bitcoin in Turkmenistan also comes with its own set of limitations. While it offers increased financial inclusion and security, the lack of regulatory clarity and infrastructure in the country can pose hurdles for widespread adoption. Despite these challenges, the potential benefits of utilizing Bitcoin for remittances in Turkmenistan cannot be overlooked, highlighting the need for further exploration and strategic planning in this evolving landscape.

For more insights on navigating the world of Bitcoin remittances, check out this informative article on traveling with Bitcoin: regulations in Uganda on WikiCrypto News.

Case Studies of Bitcoin Remittance Success Stories 🌟

In Turkmenistan, there are inspiring stories of individuals who have successfully used Bitcoin for remittances, overcoming traditional barriers and delays. One such story involves a young student who was able to receive financial support from family abroad quickly and securely through Bitcoin. This method not only saved time but also minimized fees compared to traditional channels. The transparency and efficiency of Bitcoin played a crucial role in ensuring that the funds reached the recipient without unnecessary complications. Such success stories highlight the potential of Bitcoin to revolutionize remittance processes in Turkmenistan.

Recommendations for Future Bitcoin Remittance Strategies 🔮

For future bitcoin remittance strategies, it is crucial to focus on education and awareness initiatives to increase adoption among the population. Additionally, establishing partnerships with local financial institutions and payment service providers can help bridge the gap between traditional banking systems and digital currencies. Implementing user-friendly mobile applications tailored to the specific needs of Turkmenistan’s remittance market can also enhance the overall user experience and accessibility. Keeping abreast of regulatory developments and actively engaging with policymakers to advocate for a conducive environment for bitcoin remittance services will be key in driving long-term sustainability and growth in the region.

In exploring different approaches and considering the unique challenges faced in Turkmenistan, it is essential to collaborate with industry experts and leverage innovative technologies to optimize the efficiency and security of bitcoin remittance transactions. By nurturing a supportive ecosystem that fosters trust and transparency, the potential for transformative impact in facilitating cross-border payments through bitcoin can be realized. For further insights on navigating regulatory landscapes while traveling with bitcoin, regulations in Ukraine offer valuable insights into the evolving landscape of digital currencies and their implications for global remittance strategies.