Current State of Bitcoin in Brazil 🇧🇷

In recent years, Brazil has seen a notable surge in the adoption of Bitcoin, with a growing number of individuals and businesses embracing the digital currency as a means of transferring value and conducting transactions. This uptick in Bitcoin usage in the country has been met with a mixture of excitement and caution, as regulators work to establish a clear legal framework for its use. Despite some regulatory uncertainties, the Brazilian cryptocurrency community continues to thrive, showcasing the potential for Bitcoin to revolutionize the financial landscape in the region.

Regulatory Challenges and Concerns 🚧

The regulatory landscape surrounding Bitcoin in Brazil presents a complex web of challenges and concerns for users and authorities alike. As the adoption of cryptocurrencies grows, government agencies face the task of balancing innovation with the need to protect consumers and maintain financial stability. Questions around money laundering, tax evasion, and investor protection loom large, prompting policymakers to tread carefully in crafting regulations that address these issues without stifling the potential benefits of blockchain technology. The evolving nature of the digital asset space adds another layer of complexity, requiring proactive measures to stay ahead of emerging trends and safeguard against risks.

Impact on Traditional Financial Institutions 💸

The integration of Bitcoin in Brazil has brought about a notable shift in the landscape of traditional financial institutions. With the rise of decentralized currencies, these institutions are facing a challenge to adapt to a new era of financial transactions. The impact is palpable as traditional banks are compelled to reevaluate their services and embrace digital innovation to stay relevant in an evolving market environment. While some may see this as a threat, it also presents an opportunity for financial institutions to explore new ways of delivering services and engaging with a more tech-savvy customer base.

Opportunities for Businesses and Consumers 🤝

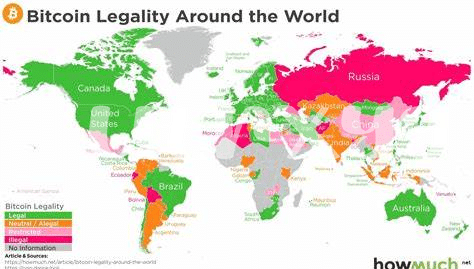

Opportunities are abundant for businesses and consumers alike as Bitcoin gains traction in Brazil. Businesses can expand their customer base by accepting Bitcoin as payment, tapping into a growing market of tech-savvy consumers. Additionally, the use of Bitcoin enables seamless cross-border transactions, unlocking new opportunities for international trade. Consumers benefit from lower transaction fees and increased financial autonomy. As the cryptocurrency ecosystem continues to evolve, embracing Bitcoin presents a pathway to innovation and economic growth. To learn more about the legal aspects of Bitcoin adoption, read this insightful article on is Bitcoin recognized as legal tender in Benin?.

Tax Implications for Bitcoin Transactions 💰

– Bitcoin transactions in Brazil come with a unique set of tax implications that both businesses and individual users need to navigate. With the evolving landscape of cryptocurrency regulations, understanding the tax requirements is crucial to ensure compliance and avoid potential penalties. From capital gains to income tax considerations, staying informed and seeking professional advice can help streamline the process of incorporating Bitcoin transactions into financial planning. As the authorities continue to evaluate and adjust tax policies related to cryptocurrencies, keeping abreast of these developments will be essential for all stakeholders involved in the digital asset ecosystem.

Future Outlook and Potential Growth 🌱

In the rapidly evolving landscape of Brazil’s Bitcoin adoption, the future outlook and potential growth hold promising prospects. As awareness and understanding of cryptocurrencies continue to expand among both businesses and consumers in the country, this upward trajectory is anticipated to fuel further integration of Bitcoin into everyday transactions. With regulatory frameworks gradually taking shape to provide more clarity and stability, the path seems clearer for sustained growth and innovation in the cryptocurrency space.

Moreover, the potential for partnerships between traditional financial institutions and emerging cryptocurrency platforms could offer unique opportunities for collaboration and technological advancement. As Brazil embraces the digital currency revolution, the stage is set for a dynamic shift in the financial landscape, paving the way for a new era of economic possibilities.

is bitcoin recognized as legal tender in belize?