Potential Impact 💡

Bitcoin’s entry into Saudi Arabia’s remittance market could potentially revolutionize the way money is transferred across borders. The decentralized nature of Bitcoin offers a secure and cost-effective alternative to traditional remittance methods, reducing transaction fees and processing times. By leveraging blockchain technology, individuals in Saudi Arabia can now send and receive money with greater speed and transparency, opening up new avenues for financial inclusion and economic empowerment. As more people in the region embrace the benefits of Bitcoin for remittance purposes, the potential impact on the overall financial landscape could be significant, paving the way for a more efficient and accessible cross-border payment ecosystem.

Current Remittance Challenges 💸

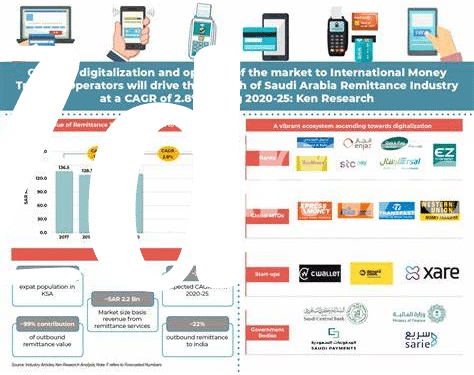

In the realm of international money transfers, navigating through the intricacies of high fees, cumbersome processes, and fluctuating exchange rates presents a significant challenge for individuals seeking to send funds across borders. Remittance services often entail delays and financial uncertainties, impacting both the sender and the recipient. The need for more efficient and cost-effective solutions in the remittance market underscores a pressing issue that many face today. Moreover, the lack of transparency in traditional remittance channels further compounds the challenges encountered by individuals looking to send money abroad. The current landscape calls for innovative approaches that can streamline the remittance process and provide greater financial inclusivity for all parties involved.

Bitcoin’s Solution 🚀

Bitcoin’s innovative technology offers a decentralized solution to the challenges faced in the remittance market, revolutionizing the way people send money across borders. By eliminating intermediaries and reducing transaction costs, Bitcoin provides a faster and more cost-effective alternative for cross-border payments. Its secure and transparent blockchain network ensures the reliability of transactions, making it an attractive option for remittance services. Additionally, Bitcoin’s borderless nature allows for seamless cross-border transactions, providing newfound opportunities for individuals in Saudi Arabia to maximize their remittance potential.

Regulatory Landscape 📜

In the realm of digital currencies, navigating through the regulatory landscape can be a complex endeavor. Governments and financial institutions worldwide are still in the process of formulating clear guidelines regarding the use and exchange of cryptocurrencies. This uncertainty often leads to hesitance among potential users and businesses, impeding the widespread adoption of Bitcoin for remittance purposes. However, as more countries like Somalia are recognizing the benefits of using Bitcoin for international transfers, there is a growing momentum towards embracing this innovative technology as a viable solution for cross-border transactions.

For further insights on how Bitcoin is revolutionizing international remittances, be sure to check out this informative article on the benefits of using Bitcoin for international transfers in Somalia: using bitcoin for international remittances in Slovenia.

Adoption Strategies 🌍

Adoption Strategies in the realm of Bitcoin in Saudi Arabia’s remittance market hold immense potential to revolutionize how transactions are conducted. By focusing on education and awareness campaigns, the general populace can gain a better understanding of the benefits and processes involved in utilizing Bitcoin for remittance purposes. Furthermore, fostering partnerships with local financial institutions and tech-savvy startups can help create a seamless integration of Bitcoin into existing remittance infrastructures, ultimately paving the way for widespread adoption and convenience in cross-border transactions.

Future Possibilities 🔮

The landscape of remittances in Saudi Arabia could undergo a significant transformation with the integration of Bitcoin. As digital currencies continue to evolve, the future possibilities of utilizing Bitcoin for international remittances are promising. The decentralization and security features of Bitcoin offer a cost-effective and efficient alternative to traditional transfer methods, potentially revolutionizing the remittance market in the country. With the potential for faster transactions and lower fees, the adoption of Bitcoin in remittance services could open up new avenues for individuals looking to send money across borders. Discover how Bitcoin is already being used for international remittances in Singapore and explore the potential for its application in enhancing cross-border money transfers in places like Somalia.