Current Challenges in Traditional Remittance Methods ⚠️

Traditional remittance methods face a myriad of challenges in Pakistan, from high fees and lengthy processing times to limited accessibility for remote populations. The reliance on intermediaries adds layers of complexity, leading to potential security risks and issues with transparency. Moreover, fluctuating exchange rates can significantly impact the value received by beneficiaries. These obstacles highlight the need for innovative solutions that can streamline the remittance process and provide a more efficient and cost-effective way to transfer funds.

How Bitcoin Is Reshaping the Remittance Landscape 🌍

In the dynamic realm of remittances, Bitcoin emerges as a transformative force, charting a new course for cross-border financial transactions. As digital currencies continue to gain traction, Bitcoin stands out for its borderless nature, allowing for seamless and efficient remittance transfers. The decentralized nature of Bitcoin circumvents traditional banking systems, offering a more cost-effective and quicker alternative for sending money globally. By leveraging blockchain technology, Bitcoin is reshaping the remittance landscape, introducing a paradigm shift in how individuals transfer funds across borders. The decentralized and transparent nature of Bitcoin not only revolutionizes remittance processes but also opens up new avenues for financial inclusion and accessibility.

Benefits of Using Bitcoin for Remittances 💸

Bitcoin is revolutionizing remittances in Pakistan, offering instant transactions at lower costs compared to traditional methods. The peer-to-peer nature of Bitcoin enables direct transfers without the need for intermediaries, reducing fees and increasing the speed of transactions. Additionally, the decentralized nature of Bitcoin provides greater financial autonomy to users, empowering them with control over their funds and enabling cross-border transfers seamlessly. With Bitcoin, recipients can access funds quickly and securely, transforming the remittance experience for both senders and receivers alike.

Potential Obstacles and Regulatory Concerns 🚫

Bitcoin presents a promising avenue for remittances in Pakistan, offering potential solutions to various hurdles posed by traditional methods. However, as with any emerging technology, there are valid concerns surrounding the adoption and regulation of Bitcoin for remittance purposes. One of the key obstacles lies in the volatility of Bitcoin’s value, which can impact the overall stability and predictability of remittance transactions. Additionally, regulatory uncertainty regarding the legal status of Bitcoin in Pakistan raises legitimate questions about compliance, consumer protection, and the prevention of illicit activities. These factors collectively contribute to a complex landscape that necessitates thoughtful consideration and strategic planning for the integration of Bitcoin into the remittance sector.

To delve deeper into the benefits of using Bitcoin for international remittances, especially in regions facing unique challenges like North Korea, explore the insights provided in this comprehensive analysis from Wikicrypto.News: using bitcoin for international remittances in netherlands.

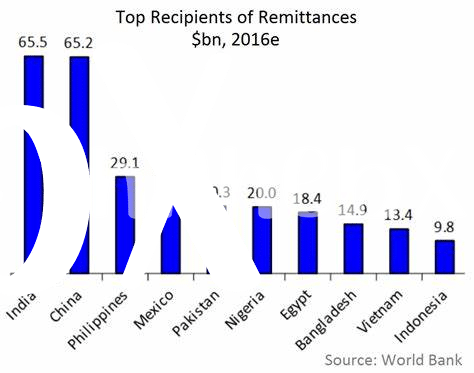

Adoption of Bitcoin Remittances in Pakistan 📈

The trend of Bitcoin remittances is gradually gaining traction in Pakistan, demonstrating a promising shift in how cross-border transactions are conducted. As more individuals become aware of the benefits associated with using Bitcoin for remittance purposes, there has been a noticeable increase in adoption rates. This uptake is fueled by factors such as faster transaction speeds, lower fees, and increased financial inclusion for those who may have been underserved by traditional banking systems. The growing popularity of Bitcoin remittances in Pakistan signifies a changing landscape in the remittance industry, hinting at a future where digital currencies play a more significant role in facilitating cross-border financial transactions.

Future Outlook and Possibilities for Remittance Industry 🚀

As technology continues to advance, the remittance industry is poised for significant transformation. Innovations such as Bitcoin are revolutionizing the way cross-border transactions are conducted, offering faster and more cost-effective solutions compared to traditional methods. The future outlook for the remittance industry points towards increased integration of digital currencies like Bitcoin, leading to greater financial inclusion and accessibility for individuals worldwide. With evolving regulations and growing adoption rates, the possibilities for leveraging Bitcoin in remittances are expanding, opening up new opportunities for secure and efficient money transfers on a global scale. To see how Bitcoin is being utilized for international remittances in North Korea, check out using Bitcoin for international remittances in Niger.