Rising 📈 Interest in Bitcoin Remittances in Iran

The digital landscape in Iran is experiencing a notable shift towards utilizing Bitcoin for remittances, gaining momentum as a preferred method of cross-border transactions. Citizens are increasingly drawn to the accessibility and efficiency that Bitcoin offers, looking beyond traditional means of sending and receiving funds. This rising interest signifies a growing trust and adoption of cryptocurrency within the remittance sector, indicating a shifting paradigm towards embracing decentralized financial solutions with potential to revolutionize the way money is transferred across borders.

Regulatory 📝 Challenges and Uncertainties

Rising interest in Bitcoin remittances in Iran has brought forth a wave of possibilities for efficient cross-border transactions. However, navigating the regulatory landscape poses significant challenges and uncertainties for both users and service providers. The evolving nature of regulations in the cryptocurrency space in Iran presents a dynamic environment where compliance and adaptability are crucial for sustainable operations. As stakeholders continue to grapple with the shifting regulatory framework, clarity and consistency are essential to foster trust and confidence in utilizing Bitcoin for remittance purposes. Despite the hurdles, overcoming regulatory challenges stands as a vital stepping stone towards unlocking the full potential of digital currencies in the remittance sector.

Technological 💻 Advancements Facilitating Transactions

Technological advancements in the realm of Bitcoin remittances are streamlining transactions, making them faster and more efficient. From improved wallet interfaces to innovative payment processing solutions, these advancements are simplifying the process of sending and receiving funds. With the integration of smart contracts and blockchain technology, the need for intermediaries is minimized, reducing associated costs and enabling near-instantaneous transfers. These developments are not only enhancing the user experience but also fostering greater trust in the security and reliability of Bitcoin transactions for remittances. As these technologies continue to evolve, the future of Bitcoin remittances in Iran appears increasingly promising and accessible.

Economic 💰 Implications for Senders and Receivers

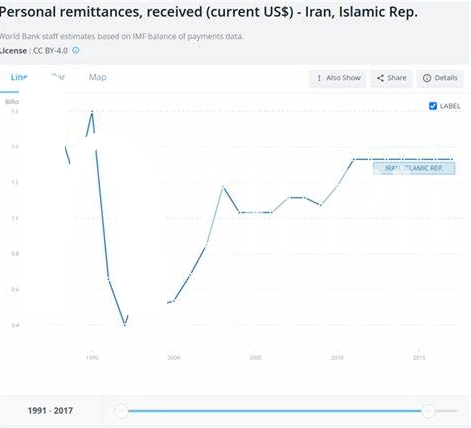

Economic implications of utilizing Bitcoin for remittances can significantly benefit both senders and receivers. With traditional money transfer methods often burdened by high fees and slow transaction times, Bitcoin presents a cost-effective and swift alternative, especially for cross-border remittances in Iran. Senders can experience reduced transaction costs and quicker transfers, enabling them to send funds more efficiently to their recipients. On the receiving end, beneficiaries can access funds faster, contributing to improved financial inclusion and supporting economic empowerment. As the adoption of Bitcoin for international remittances continues to grow worldwide, including countries like Indonesia, the economic landscape for senders and receivers in Iran stands to witness a transformation towards more streamlined and accessible financial transactions. More insights can be found using bitcoin for international remittances in Indonesia.

Security 🔒 Concerns and Potential Risks

– Security concerns and potential risks related to using Bitcoin for remittances in Iran are crucial aspects to consider. With the decentralized nature of cryptocurrencies, there is a higher vulnerability to hacking and fraud, putting funds at risk. Additionally, the lack of regulatory oversight in the cryptocurrency space poses challenges in resolving disputes or recovering lost funds in case of unauthorized transactions. It is essential for users to be cautious and proactive in safeguarding their digital assets through secure wallets and strong authentication methods. Understanding the evolving landscape of cybersecurity threats is key to mitigating risks and ensuring the safe transfer of funds through Bitcoin remittances.

Future 🌟 Outlook and Growth Potential

As the landscape of financial transactions evolves, the future of utilizing Bitcoin for remittances in Iran holds promising potential for both senders and receivers. The increasing interest in digital currencies signals a shift towards innovative solutions in cross-border payments, paving the way for greater accessibility and efficiency. Technological advancements are not only enhancing the ease of transactions but also fostering a more interconnected global financial environment.

Amid regulatory challenges and security concerns, the growth potential of Bitcoin remittances in Iran lies in addressing these obstacles through robust solutions and continued education on the benefits of decentralized finance. The economic implications for individuals engaging in Bitcoin transactions extend beyond traditional banking systems, offering a glimpse into a future where financial inclusion and empowerment are at the forefront. Looking ahead, the ongoing developments in this space present an exciting opportunity to revolutionize the remittance industry and drive financial empowerment worldwide.

For further insights on utilizing Bitcoin for international remittances in Iran, explore how using Bitcoin for international remittances in Iraq can offer valuable lessons and guidance in navigating the evolving landscape of digital financial transactions.