The Rise of Bitcoin Usage in Central Africa 🌍

In recent years, the adoption of Bitcoin in Central Africa has seen a steady increase, reflecting a growing trend towards digital currency usage in the region. From urban centers to rural areas, more individuals are embracing Bitcoin as a means of transacting, investing, and storing value. This surge in Bitcoin usage is not only driven by technological advancements but also by a desire for financial inclusion and alternative means of conducting financial transactions. As more people become familiar with and trust Bitcoin, its potential to revolutionize the traditional financial landscape in Central Africa becomes increasingly apparent.

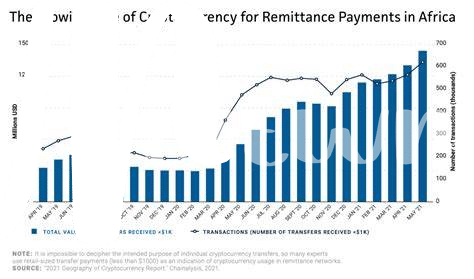

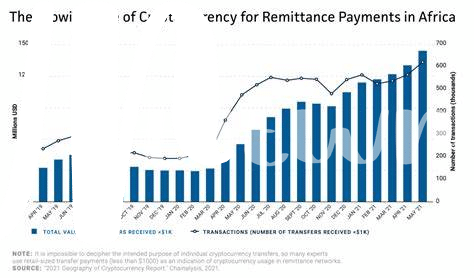

How Bitcoin Is Transforming Remittance Processes 💸

Bitcoin, with its decentralized nature and fast transactions, is revolutionizing the way remittances are handled in Central Africa. By cutting out the middlemen and reducing fees, individuals can now send and receive money more efficiently. This shift towards using Bitcoin for remittances is streamlining the process and providing a more cost-effective solution for many in the region, ultimately empowering communities to have more control over their finances and contributing to financial inclusion.

Challenges and Opportunities for Bitcoin Adoption 🤔

The landscape of Bitcoin adoption in Central Africa presents a mix of challenges and opportunities. Access to reliable internet connectivity can be limited in some regions, hindering widespread usage. Additionally, regulatory uncertainty and lack of awareness pose barriers to mainstream acceptance. On the flip side, the decentralized nature of Bitcoin offers an alternative financial system for those underserved by traditional banking. The potential for lower transaction fees compared to traditional remittance methods also presents a compelling case for adoption, especially for individuals looking to send money across borders efficiently.

Real-life Stories of Bitcoin’s Impact on Communities 🌟

The impact of Bitcoin on communities in Central Africa is nothing short of transformative. Through real-life stories, we witness individuals bypassing traditional remittance barriers, empowering themselves with financial independence, and fostering economic growth within their localities. One such compelling narrative unfolds in Cabo Verde, where Bitcoin’s utilization for international remittances has revolutionized the way individuals send and receive funds. Families separated by borders can now seamlessly transfer money, cutting through bureaucratic hurdles and high fees. This newfound freedom is not just about financial transactions; it’s about empowering communities to thrive and prosper in a more connected world.Witness firsthand the stories of resilience and empowerment through utilizing Bitcoin for remittances in Cabo Verde. Discover how this innovative approach is reshaping the future of financial inclusivity and economic empowerment for individuals across Central Africa.

The Future Outlook of Bitcoin in Central Africa 🔮

As Central Africa navigates the realm of digital currencies, Bitcoin is positioned to play a pivotal role in shaping the region’s financial landscape. The future outlook of Bitcoin in Central Africa holds promise and possibility, offering a potential solution to longstanding economic challenges. As more individuals and businesses explore the benefits of cryptocurrencies, there is a growing sense of optimism regarding the transformative power of Bitcoin in driving financial inclusion and innovation within the region. Looking ahead, the continued adoption and integration of Bitcoin could pave the way for a more inclusive and accessible financial ecosystem in Central Africa, empowering individuals and communities alike with newfound opportunities for economic empowerment and growth.

Empowering Communities through Decentralized Finance 🚀

In the realm of decentralized finance, the potential for empowering communities in Central Africa is immense. Through the utilization of blockchain technology, individuals are granted access to financial services without the need for traditional intermediaries. This innovative approach not only enhances financial inclusion but also fosters economic independence within communities. By embracing decentralized finance solutions, individuals can transact securely, access loans, and participate in various investment opportunities, thus paving the way for broader financial empowerment. The transformative impact of decentralized finance extends beyond borders, bridging gaps and unlocking new possibilities for individuals seeking to enhance their financial well-being.

using bitcoin for international remittances in cameroon