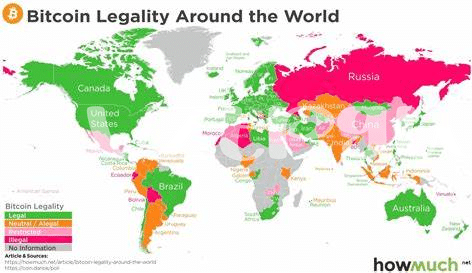

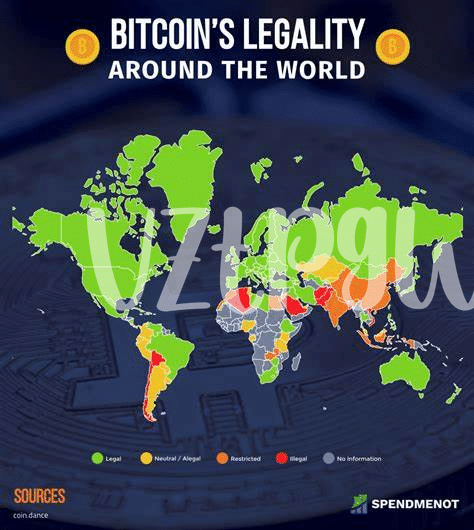

Legal Status of Bitcoin Mining in Uganda 🇺🇬

Bitcoin mining in Uganda operates within a dynamic legal landscape, where the regulatory status continues to evolve. As cryptocurrency gains traction globally, Uganda is also working to define the legality of Bitcoin mining activities within its borders. This evolving regulatory environment presents challenges and opportunities for miners looking to navigate the legal framework and operate compliantly in the country. Understanding the legal status of Bitcoin mining in Uganda is crucial for miners to ensure they are operating within the bounds of the law and are aware of any potential changes or developments in regulations.

Tax Implications for Bitcoin Miners 💰

Bitcoin mining in Uganda presents unique tax considerations for miners. Understanding the tax implications is crucial for ensuring compliance with the law and maximizing profits. Miners are subject to taxation on their mining income, with the specific rates and rules varying based on factors such as the amount of income generated and the mining activities undertaken. Additionally, miners may be eligible for certain deductions and exemptions that can help reduce their overall tax liability. It is essential for miners to keep detailed records of their mining activities and income to accurately report to the authorities and fulfill their tax obligations in Uganda.

Reporting Requirements to the Authorities 📝

In order to ensure compliance with tax regulations in Uganda, Bitcoin miners are required to fulfill specific reporting requirements to the authorities. This involves submitting detailed records of their mining activities, including income generated from mining rewards and any associated expenses. Additionally, miners may be required to disclose information about their mining equipment and the energy consumption involved in the mining process. By providing accurate and timely reports to the authorities, miners can demonstrate transparency and accountability in their Bitcoin mining operations, ultimately contributing to a more regulated and sustainable cryptocurrency environment in Uganda.

Potential Deductions and Exemptions 💸

When it comes to potential deductions and exemptions for Bitcoin miners in Uganda, navigating the tax landscape can offer some relief amidst the complexities. Understanding the various allowances and exceptions available can significantly impact the overall tax liabilities for individuals engaged in Bitcoin mining activities. By exploring and leveraging these potential deductions and exemptions, miners can optimize their tax positions and potentially reduce their financial obligations to the authorities. It’s essential to stay informed about the specific tax regulations and opportunities for deductions and exemptions to maximize benefits while remaining compliant.”

Link to the article: is mining of bitcoin legal in tonga?

Impact of Bitcoin Price Fluctuations on Taxes 📉

Bitcoin price fluctuations can have a significant impact on the taxes paid by miners in Uganda. When the price of Bitcoin rises, miners may end up owing more in taxes due to the increased value of the coins they have mined. Conversely, if the price drops, they may face a lower tax bill. This dynamic nature of Bitcoin prices adds a layer of complexity to the tax implications for miners in Uganda, requiring them to stay informed and adapt their tax planning strategies accordingly. Partnering with tax professionals who understand the nuances of cryptocurrency taxation can help miners navigate these fluctuations effectively and optimize their tax obligations.

Future Outlook for Bitcoin Mining in Uganda 🚀

In Uganda, the future outlook for Bitcoin mining shows promising growth with increasing interest and investment in the industry. The government’s evolving approach towards digital currencies and blockchain technology paves the way for potential opportunities for miners in the country. As regulations and infrastructure continue to develop, the environment for Bitcoin mining in Uganda is expected to become more conducive and supportive. With a proactive stance on embracing innovation and technology, Uganda stands to benefit from the expanding global presence of Bitcoin mining activities.

To explore more about the legality of Bitcoin mining in other countries such as Timor-Leste and Iceland, click here: is mining of bitcoin legal in Iceland?