Rise of Bitcoin in Mali 🚀

The introduction of Bitcoin in Mali has sparked a financial revolution, offering individuals an alternative currency outside traditional banking systems. This digital currency allows people to transact securely and efficiently, breaking boundaries previously faced in financial transactions. As more Malians embrace Bitcoin for its decentralized nature and ease of use, the traditional financial landscape in the country is witnessing a significant shift. The rise of Bitcoin in Mali signifies a new era of financial inclusion, empowering individuals and businesses to participate in the global economy with greater ease and control.

Impact on Unbanked Population 💰

As Bitcoin gains traction in Mali, it is reshaping the financial landscape for many unbanked individuals. By providing a decentralized and accessible means of conducting financial transactions, Bitcoin is empowering those who previously lacked access to traditional banking services. This digital currency is bridging the gap for the unbanked population, offering them opportunities for financial inclusion and economic participation like never before. As a result, more people in Mali are now able to engage in a wide range of economic activities, contributing to the overall growth and development of the country’s financial ecosystem.

The impact of Bitcoin on the unbanked population in Mali is profound and transformative. By leveraging this innovative technology, individuals who were once excluded from the formal financial system are now able to participate fully in the economy, accumulate savings, and access various financial services without the need for a traditional bank account. This shift towards greater financial inclusion is fostering a more inclusive and resilient financial environment in Mali, ultimately driving socio-economic progress and empowerment for previously marginalized communities.

Overcoming Financial Barriers 🤝

Amidst the digital revolution, Bitcoin is emerging as a transformative force in Mali, offering a pathway for individuals to sidestep traditional financial barriers. By tapping into the decentralized nature of cryptocurrency, individuals can now access financial services with greater ease and efficiency. This newfound accessibility has the potential to empower the unbanked population, enabling them to participate more fully in the economy and unlock opportunities for financial growth. With innovative solutions like Bitcoin, Mali is poised to overcome longstanding financial hurdles and embrace a future where inclusion knows no bounds.

Government Regulations and Challenges 📜

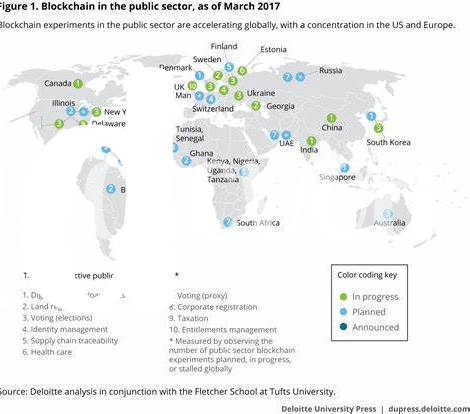

In navigating the realm of Bitcoin in Mali, the government faces a dual challenge of establishing regulatory frameworks that balance innovation and security. Striking a delicate equilibrium between fostering financial inclusion and safeguarding against risks poses intricate hurdles. The evolving landscape necessitates agile responses to emerging trends in the digital currency space. A case in point is the proactive stance taken by governments like Lithuania in exploring digital currency policies, as seen in their initiatives on bitcoin and blockchain. Embracing such forward-thinking strategies can be instrumental in shaping the trajectory of financial technologies and regulatory environments globally.

Potential for Economic Growth 📈

Bitcoin’s integration into Mali’s financial landscape holds significant promise for driving economic growth. By providing access to financial services for the unbanked population, Bitcoin can stimulate investment, foster entrepreneurship, and facilitate cross-border transactions. This digital currency has the potential to increase financial inclusion and promote economic development in Mali, paving the way for a more inclusive and prosperous future for its citizens.

Future of Financial Inclusion 🌍

In a rapidly evolving financial landscape, the future of financial inclusion holds promise for bridging gaps and empowering communities worldwide. The integration of innovative technologies such as blockchain and Bitcoin presents opportunities for greater accessibility and security in financial services. As governments and organizations continue to explore and implement these solutions, there is potential for a more inclusive and resilient global economy. Embracing the principles of transparency and accessibility, the future of financial inclusion strives towards a more interconnected and sustainable financial ecosystem. For further insights into government initiatives on bitcoin and blockchain, explore government initiatives on bitcoin and blockchain in Madagascar and government initiatives on bitcoin and blockchain in Lithuania.