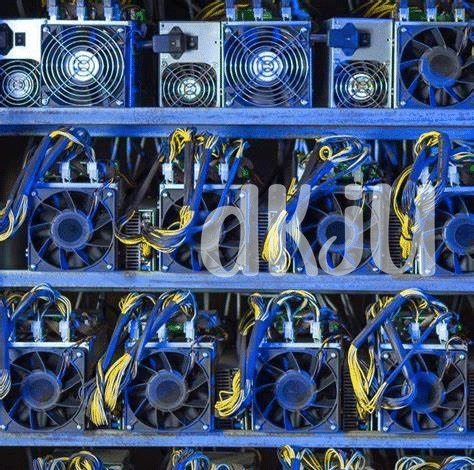

Overview of Bitcoin Mining 🌐

Bitcoin mining, a process essential to the creation of new bitcoins, involves computers solving complex mathematical problems. Miners are rewarded for their efforts with bitcoins, which are then added to the digital currency ecosystem. This decentralized system relies on miners to verify transactions and secure the network. Mining operations can vary in scale, from individuals using their personal computers to large facilities equipped with specialized hardware. As the backbone of the cryptocurrency world, mining plays a crucial role in sustaining blockchain networks worldwide.

Tax Regulations in Slovenia 💰

When it comes to navigating the tax landscape in Slovenia with respect to Bitcoin mining, it’s essential to familiarize oneself with the local tax regulations. Understanding how cryptocurrency transactions are treated, whether as assets or income, can significantly impact the tax obligations for miners in the country. Furthermore, considering any specific tax incentives or exemptions available for Bitcoin mining activities can help optimize compliance while minimizing tax liabilities. Staying abreast of the evolving regulatory environment and seeking professional guidance can ensure miners stay on the right side of the law while maximizing their financial outcomes.

In addition to the general tax framework, it’s important for Bitcoin miners to be aware of any unique considerations or recent updates in Slovenia that specifically apply to cryptocurrency transactions. Engaging with local tax authorities, attending relevant workshops or seminars, and leveraging resources from reputable sources can aid miners in effectively navigating the tax implications associated with Bitcoin mining activities. By proactively staying informed and seeking expert advice when necessary, miners can streamline their tax processes and make informed decisions that align with their financial objectives.

Reporting and Compliance Requirements 📋

Understanding the rules and regulations surrounding reporting and compliance is crucial for individuals engaged in Bitcoin mining in Slovenia. Proper documentation and adherence to the requirements set forth by the authorities can help miners avoid potential penalties and ensure a smooth operation. Key aspects to consider include keeping detailed records of mining activities, accurately reporting income generated from mining rewards, and staying up to date with any changes in tax laws. By proactively meeting these compliance requirements, miners can navigate the tax landscape more effectively and minimize the risk of facing legal issues in the future.

Impact of Cryptocurrency Market Volatility 📉

The fluctuations in cryptocurrency market values can have significant impacts on Bitcoin mining operations in Slovenia. The volatility in prices can directly affect the profitability of mining activities, as miners may experience fluctuating revenues based on the market conditions. This uncertainty requires miners to adapt quickly to changing prices and assess the potential risks of market volatility on their operations.

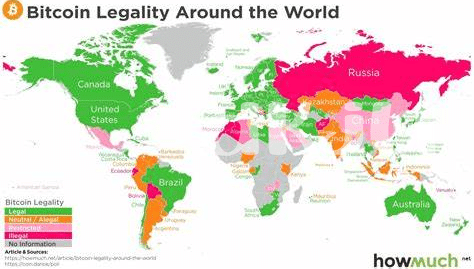

For further insights into the legal aspects of Bitcoin mining in different regions, including Slovenia, you can explore more on is mining of bitcoin legal in Slovakia?.

Potential Tax Planning Strategies 💡

The fluctuating nature of the cryptocurrency market in Slovenia poses unique challenges for Bitcoin miners when it comes to tax implications. To navigate this landscape successfully, consider diversifying your cryptocurrency portfolio, optimizing mining operations for efficiency, and staying informed about regulatory updates. Implementing a systematic record-keeping process and consultation with tax professionals can also help in effectively managing tax liabilities. Additionally, exploring tax-deferral strategies and utilizing available deductions can potentially minimize tax burdens and optimize overall financial outcomes in the long run.

Future Outlook for Bitcoin Mining in Slovenia 🔮

When looking ahead at the future of Bitcoin mining in Slovenia, there are several key factors to consider. The evolving regulatory landscape, technological advancements, and shifting market trends will all play crucial roles in shaping the landscape for miners. Additionally, the level of governmental support and infrastructure development will be pivotal in determining the sustainability and growth potential of mining operations in the region.

As miners navigate these dynamic elements, staying informed about local regulations and market conditions will be essential for making informed decisions and adapting strategies. Collaborative efforts within the industry and proactive engagement with policymakers may also influence the direction of Bitcoin mining activities in Slovenia in the years to come.