History 📜

Equatorial Guinea’s journey towards implementing a national digital currency traces back to a pivotal moment in the country’s economic history. This initiative was born out of a need for modernization and a desire to stay abreast of global financial trends. The evolution of Equatorial Guinea’s digital currency project reflects a forward-thinking approach aimed at enhancing financial accessibility and efficiency for its citizens.

Over the years, the development of this digital currency has been met with various milestones, challenges, and triumphs. Each step in its history has contributed to shaping the project into what it is today. Through a combination of strategic planning and innovative thinking, Equatorial Guinea has positioned itself as a trailblazer in the realm of digital financial solutions.

Purpose 💡

The national digital currency project in Equatorial Guinea aims to revolutionize the country’s financial landscape, offering a seamless and inclusive way for citizens to engage in transactions. This initiative seeks to enhance financial accessibility, promote economic growth, and foster innovation in the digital realm. By leveraging blockchain technology, the envisioned digital currency will provide a secure and transparent platform for conducting financial operations, ultimately advancing financial inclusion and economic development. Additionally, this digital currency project aligns with the government’s broader vision of modernizing the financial sector and promoting digital transformation across various industries. Through the implementation of this innovative digital currency, Equatorial Guinea aims to position itself at the forefront of technological advancements in the global financial landscape.

Technology 🔧

Equatorial Guinea’s National Digital Currency Project incorporates cutting-edge innovations that facilitate secure and efficient transactions. By harnessing blockchain technology, the system ensures transparent and immutable record-keeping, enhancing trust in the digital currency ecosystem. The implementation of smart contracts automates processes and reduces the need for intermediaries, streamlining financial operations and boosting overall accessibility. As the technology evolves, there is a strong emphasis on cybersecurity measures to safeguard user data and prevent potential breaches. Additionally, the platform is designed to be user-friendly, catering to both tech-savvy individuals and those new to digital currencies.

The National Digital Currency Project in Equatorial Guinea leverages advanced technologies to advance financial inclusion and foster economic growth. Through the integration of digital wallets, users can seamlessly manage their funds and engage in transactions with ease. The incorporation of biometric authentication enhances security measures, protecting users from fraudulent activities and ensuring the integrity of the system. Moreover, the scalability of the technology allows for future expansion and the incorporation of additional features to meet the evolving needs of the market. By embracing innovation, Equatorial Guinea is poised to lead the way in digital currency adoption and drive progress in the financial sector.

Benefits 🌟

Incorporating a national digital currency in Equatorial Guinea could bring a myriad of benefits to the economy and its citizens. One key advantage is the potential for increased financial inclusion, as even those without access to traditional banking services can participate in the digital economy. This can empower individuals with tools to manage their finances more effectively and securely, ultimately leading to greater economic stability and growth. Additionally, the use of a digital currency can streamline transactions, reducing costs and processing times, benefiting both businesses and consumers. Furthermore, it has the potential to enhance transparency and traceability in financial transactions, which can help combat issues like corruption and money laundering.

To delve deeper into government initiatives in promoting digital currencies, explore the legal framework surrounding bitcoin and blockchain in El Salvador in this detailed analysis available at government initiatives on bitcoin and blockchain in El Salvador.

Challenges 🛑

In integrating a national digital currency, Equatorial Guinea faces the challenge of ensuring widespread adoption and acceptance within its population. Overcoming any initial resistance and skepticism towards this new form of currency will be crucial for its success. Additionally, the country must address issues related to cybersecurity and data privacy to safeguard the integrity and security of its digital financial ecosystem. Building trust and confidence among users will be a continuous challenge, requiring ongoing education and communication about the benefits and safeguards of the digital currency system. Adaptation to rapid technological advancements and potential regulatory hurdles are also key challenges that Equatorial Guinea will need to navigate to ensure the smooth implementation and sustainability of its national digital currency project.

Future 🚀

In the landscape of digital currencies, Equatorial Guinea’s National Digital Currency Project holds promise for a seamless transition to a more interconnected and efficient financial ecosystem. With a forward-thinking approach, this initiative aims to revolutionize the way transactions are conducted, paving the way for a more inclusive and streamlined economy. Through embracing cutting-edge technology and fostering innovation, Equatorial Guinea is poised to set new standards in the realm of digital finance.

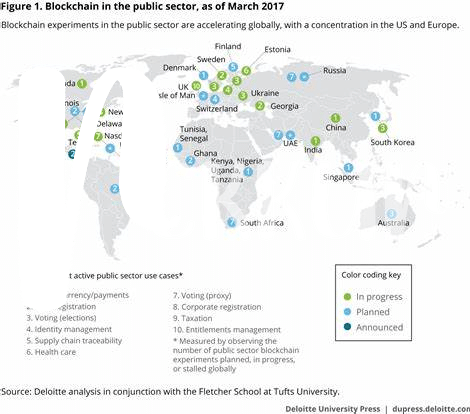

As governments around the world explore the potential of blockchain and digital currencies, countries like Estonia and Eswatini have taken notable steps to integrate these technologies into their financial systems. Estonia, known for its progressive digital initiatives, has made significant strides in leveraging blockchain for governmental operations. On the other hand, Eswatini has shown a growing interest in adopting blockchain and cryptocurrency technologies to enhance financial transparency and efficiency. These government initiatives underscore a global shift towards embracing the future of finance. [government initiatives on bitcoin and blockchain in Eswatini]