Tax Implications of Buying Bitcoin in Germany 🇩🇪

Germany’s tax laws regarding Bitcoin purchases are crucial for individuals to grasp. When you acquire Bitcoin in Germany, it’s essential to recognize the tax implications. Understanding the tax treatment associated with buying Bitcoin can save you from potential pitfalls and ensure compliance with regulations. By delving into the tax ramifications of purchasing Bitcoin in Germany, you gain insights into how your investments may be taxed and what reporting obligations you need to fulfill. Embracing this knowledge empowers you to navigate the cryptocurrency landscape confidently.

Taxes on Selling Bitcoin: What You Need to Know 💸

When it comes to selling Bitcoin in Germany, understanding the tax implications is crucial for every investor. Capital gains from selling Bitcoin are subject to taxation, with rates varying based on the holding period. Additionally, it’s essential to keep detailed records of transactions to accurately report profits and losses to the tax authorities. Staying compliant with tax regulations not only ensures legal compliance but also helps in maximizing returns from your Bitcoin investments.

Mining Cryptocurrency and Taxation in Germany ⛏️

Mining cryptocurrency in Germany can be a profitable endeavor, but it’s essential to be aware of the tax implications. The German tax authorities consider mined cryptocurrencies as an immediate taxable event, meaning that miners are required to pay taxes on the value of the coins mined at the time they are received. Additionally, expenses related to mining, such as electricity costs and equipment depreciation, can often be deducted to lower the taxable amount. It’s crucial for cryptocurrency miners in Germany to keep detailed records of their mining activities and expenses to accurately report and comply with tax regulations. By understanding and properly managing the taxation of mining activities, miners can ensure compliance with German tax laws and optimize their tax liabilities.

Handling Bitcoin Payments as a Business Owner 💼

Handling Bitcoin Payments as a Business Owner can be a complex yet rewarding aspect of integrating cryptocurrencies into your operations. By accepting Bitcoin payments, you open up your business to a broader customer base and potentially new markets. It is crucial to stay informed about the tax implications and regulations surrounding Bitcoin transactions to ensure compliance with the law. Additionally, implementing secure payment gateways and staying updated on industry trends can help mitigate risks and streamline the payment process for both you and your customers. As cryptocurrency adoption continues to grow, embracing Bitcoin payments can position your business for future success in the evolving digital economy.

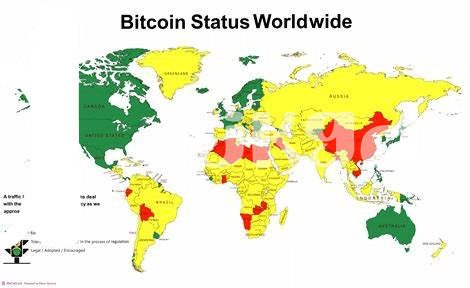

government initiatives on bitcoin and blockchain in Gabon

Tax Reporting Requirements for Bitcoin Transactions 📝

Understanding the tax reporting requirements for Bitcoin transactions in Germany is essential for individuals and businesses involved in cryptocurrency activities. From keeping detailed records of transactions to accurately reporting gains and losses, complying with tax regulations is crucial in avoiding potential penalties. Transparency and accuracy in reporting your Bitcoin transactions will not only ensure compliance with the law but also provide a clear financial picture for future planning. With the evolving nature of cryptocurrency taxation, staying informed and proactive in meeting reporting requirements is key to navigating the complex landscape of Bitcoin taxes in Germany.

Future Outlook on Bitcoin Taxes in Germany 🚀

Concerning the future outlook on Bitcoin taxes in Germany, the landscape is poised for continued evolution. As digital currencies gain further mainstream acceptance, regulatory bodies are increasingly focusing on ensuring proper taxation. Germany, known for its proactive approach to cryptocurrency taxation, is likely to introduce more refined guidelines to address the complexities of Bitcoin transactions. This could involve clearer directives on reporting requirements, as well as potential amendments to tax rates for cryptocurrency activities.

For further information on government initiatives related to Bitcoin and blockchain in Finland, visit the government initiatives on bitcoin and blockchain in fiji. This signals promising advancements in how cryptocurrencies are viewed and regulated on a governmental level, aiming to provide a conducive environment for innovation in the digital asset space.