Rising Bitcoin Ponzi Schemes 📈

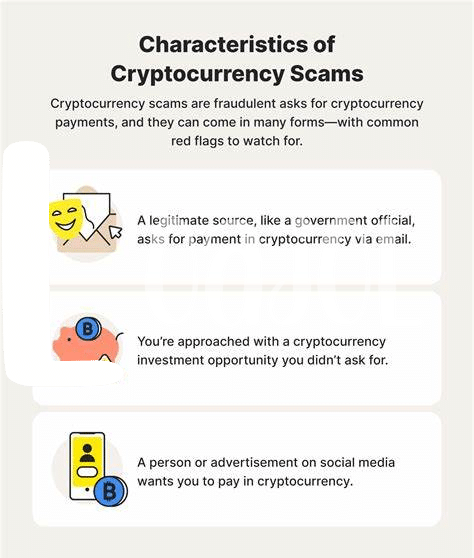

Bitcoin Ponzi schemes have been on the rise, creating a wave of deception in the cryptocurrency world. These schemes promise high returns with little to no risk, often attracting unsuspecting investors looking to capitalize on the growing popularity of Bitcoin. As the allure of quick profits overshadows caution, individuals may fall prey to these fraudulent schemes, ultimately losing their hard-earned money. It is crucial for investors to be vigilant and conduct thorough research before participating in any investment opportunity, especially those that seem too good to be true.

| Common Signs of a Ponzi Scheme: | Protective Measures: |

|---|---|

| Guarantees of High Returns | Research and Verify Investment Opportunities |

| Payouts to Existing Investors from New Investors’ Funds | Avoid Investment Schemes with Unrealistic Promises |

| Lack of Transparency in Operations | Seek Advice from Financial Experts |

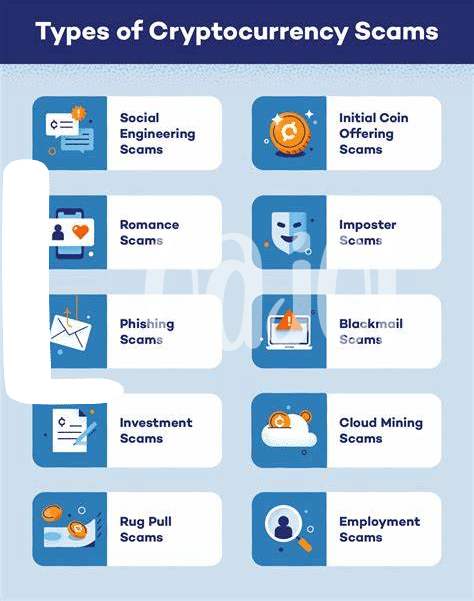

Social Engineering Scams in Crypto 🕵️♂️

Cybercriminals have been devising sophisticated social engineering scams within the realm of cryptocurrency, manipulating investors into divulging sensitive information. These deceptive tactics often involve impersonating trusted entities or creating fake websites and emails to trick individuals into providing their private keys or login credentials. By exploiting psychological triggers and leveraging trust, these scammers aim to gain unauthorized access to digital wallets and drain funds. It’s crucial for crypto enthusiasts to remain vigilant and verify the authenticity of any communication or platform before sharing personal details. Educating oneself about common social engineering techniques and implementing robust security measures can help mitigate the risks associated with these malicious activities. Stay informed and stay safe in the ever-evolving landscape of crypto scams.

Phishing Tactics Targeting Bitcoin Investors 🎣

Phishing Tactics Targeting Bitcoin Investors have become increasingly sophisticated and prevalent in the cryptocurrency world. Scammers often use deceptive emails or fake websites to trick unsuspecting investors into providing their private keys or personal information. These tactics rely on exploiting trust and creating a sense of urgency, making it crucial for investors to stay vigilant and verify the legitimacy of any communication related to their Bitcoin holdings. By educating themselves on common phishing red flags and employing strong security measures such as two-factor authentication, investors can better protect themselves from falling victim to these malicious schemes.

As the value of Bitcoin and other cryptocurrencies continues to attract interest from both legitimate investors and scammers, it is essential for individuals to be aware of the risks posed by phishing tactics. By staying informed and adopting best practices for online security, investors can minimize the chances of falling prey to fraudulent schemes and safeguard their hard-earned digital assets.

Pump and Dump Schemes Exploiting Cryptocurrency 🔄

Pump and dump schemes are a prevalent issue in the cryptocurrency world, attracting unsuspecting investors with promises of quick profits. These schemes involve artificially inflating the price of a certain cryptocurrency through misleading information and hype, only to sell off quickly, leaving investors with substantial losses. The perpetrators behind these schemes often use social media and online forums to spread false rumors and artificially boost the demand for the coin before swiftly selling their holdings. It’s crucial for cryptocurrency enthusiasts to be vigilant and skeptical of any sudden surges in prices that seem too good to be true. To protect yourself from falling victim to pump and dump schemes, always conduct thorough research before investing, and avoid making impulsive decisions based on speculative information. Stay informed and cautious to safeguard your investments in the volatile crypto market.

Ico Frauds and Initial Coin Offering Pitfalls 💸

Ico Frauds and Initial Coin Offering Pitfalls 💸

Investors in the cryptocurrency space need to exercise caution when participating in Initial Coin Offerings (ICOs). While ICOs can offer exciting opportunities to invest in new digital assets, they also present risks of fraud and deception. One common pitfall is falling victim to ICO scams, where fraudulent projects lure investors with promises of high returns, only to disappear with the funds raised. It’s essential for investors to conduct thorough research, scrutinize the credibility of the project team, and beware of red flags such as unrealistically high return promises or lack of a viable product.

| ICO Fraud Warning Signs | Unrealistic Promises | Lack of Transparent Information | Anonymous Teams | Pressure Tactics |

|---|

Strategies to Safeguard Against Crypto Scams 🔒

When it comes to safeguarding against crypto scams, vigilance and caution are key. Always verify the legitimacy of the investment opportunity or platform before committing funds. Utilize secure and reputable cryptocurrency exchanges, and be wary of promises of high returns with little to no risk. Keep your private keys secure and never share them with anyone. Stay informed about common scam tactics and continuously educate yourself about the latest trends in cryptocurrency scams. If you encounter any suspicious activity or believe you have fallen victim to a scam, report it immediately to relevant authorities. Being proactive and staying alert is crucial in protecting your investments in the crypto space. Remember, prevention is always better than dealing with the aftermath of a scam.

Don’t forget, reporting any suspicious activity is essential in combating cryptocurrency fraud. For Bitcoin fraud and scam reporting in Latvia, click here and for Madagascar, click here.