Legal Status 📜

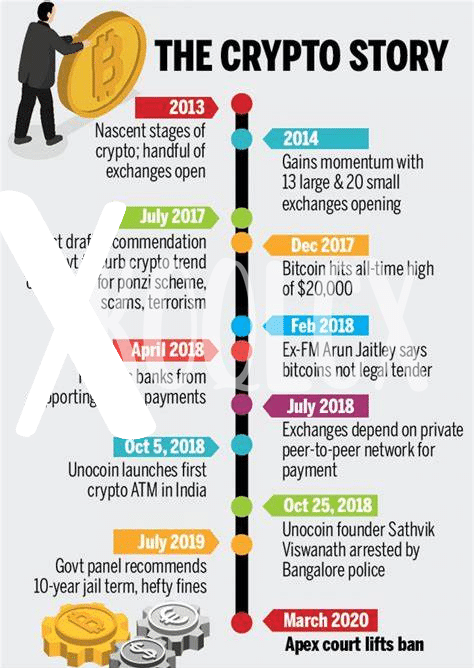

In the realm of Bitcoin P2P trading in India, the legal status remains a pivotal point of focus. Understanding the nuances and implications of existing laws is crucial for both traders and platforms operating within the space. Navigating the regulatory landscape effectively is key to ensuring compliance and fostering a secure environment for all stakeholders involved in this burgeoning sector.

Regulatory Challenges 💼

Regulatory Challenges in the realm of Bitcoin peer-to-peer trading can present significant hurdles for participants and platforms. As the regulatory landscape continues to evolve, compliance requirements and uncertainties may deter potential traders and hinder the growth of P2P trading ecosystems. Identifying and addressing these challenges proactively is essential to fostering a transparent and sustainable trading environment. Embracing regulatory developments with adaptability and a forward-thinking approach is key to navigating the ever-changing landscape of P2P Bitcoin trading in India.

Tax Implications 💸

Navigating the realm of cryptocurrency trading in India entails a crucial consideration of tax implications. The evolving regulatory landscape has compelled traders to diligently assess and adhere to relevant tax laws. Understanding the tax implications of Bitcoin peer-to-peer transactions is paramount for maintaining compliance and ensuring financial prudence. By unraveling the intricate web of tax obligations associated with P2P trading, individuals can make informed decisions and minimize potential liabilities.

As the digital asset space continues to garner immense interest, proactive engagement with tax authorities is imperative for traders. The dynamic nature of tax policies necessitates a proactive approach to compliance, enabling traders to mitigate risks and optimize their financial strategies. Embracing a transparent approach to tax obligations not only fosters regulatory trust but also fortifies the foundation of the burgeoning cryptocurrency ecosystem.

Kyc Requirements 🕵️♂️

When it comes to engaging in peer-to-peer Bitcoin trading in India, understanding the Know Your Customer (KYC) requirements is crucial. These guidelines exist to ensure transparency, security, and compliance within the cryptocurrency space. By adhering to these regulations, both traders and platforms can operate within the legal framework while mitigating risks associated with financial transactions. To dive deeper into the specific compliance requirements for peer-to-peer Bitcoin trading, check out this insightful article on peer-to-peer bitcoin trading laws in Ireland.

Impact on P2p Platforms 🌐

Peer-to-peer platforms have become pivotal in the cryptocurrency realm, revolutionizing how individuals trade Bitcoin. These platforms offer direct interactions between buyers and sellers, promoting decentralized transactions. However, they face challenges in complying with evolving regulations, risking disruptions to their operations. The emergence of stricter laws could potentially reshape the landscape for these P2P platforms, urging them to adapt swiftly to ensure continued functionality and compliance.

Future Outlook 🔮

As the landscape of Bitcoin P2P trading in India evolves, the future outlook is poised for dynamic shifts. Innovations in blockchain technology, coupled with potential regulatory updates, could significantly impact the ecosystem. This could pave the way for increased mainstream adoption and the emergence of new opportunities within the sector. Keeping an eye on these developments will be crucial for participants in the space.peer-to-peer bitcoin trading laws in iran with anchor peer-to-peer bitcoin trading laws in israel