Risks 🚫 in Tonga’s Bitcoin Investment Funds

Navigating the landscape of Bitcoin investment funds in Tonga presents its own set of challenges that investors need to be aware of. Understanding the risks involved is crucial in making informed decisions regarding their investments. Factors such as market volatility, regulatory uncertainties, and security threats pose potential obstacles that can impact the performance of these funds. Being mindful of these risks and developing risk management strategies can help mitigate potential drawbacks and safeguard investments in this rapidly evolving market. Balancing the allure of potential gains with the need to navigate these risks effectively is key to successful investment outcomes in Tonga’s Bitcoin funds.

Opportunities 💰 for Investors in Tonga

When it comes to investing in Tonga’s Bitcoin opportunities, investors are presented with a unique landscape where potential for growth meets the challenge of navigating market volatility. The decentralized nature of Bitcoin offers a level playing field for investors of all backgrounds, allowing for greater accessibility and inclusivity in Tonga’s investment landscape. Moreover, the potential for significant returns on investment in the Bitcoin market presents a compelling opportunity for investors looking to diversify their portfolios and explore alternative assets. Concurrently, investors must exercise caution and stay informed about the risks and regulatory challenges inherent in the market to make informed decisions and protect their investments effectively.

Regulatory 📝 Challenges in the Bitcoin Market

Navigating the ever-evolving landscape of the Bitcoin market presents a myriad of regulatory challenges. From varying approaches to digital currency oversight among global jurisdictions to the absence of standardized frameworks, investors in Tonga’s Bitcoin investment funds must adeptly maneuver through regulatory ambiguities. Ensuring compliance with stringent anti-money laundering (AML) and know your customer (KYC) requirements, while staying abreast of shifting regulatory guidelines, is paramount. Strategic partnerships with industry regulators and proactive engagement in shaping regulatory discourse can bolster investor confidence and mitigate regulatory risks.

Security 🔒 Measures for Fund Protection

Bitcoin investment funds in Tonga require robust security measures to protect investors’ funds from cyber threats. Implementing multi-factor authentication, encryption protocols, and regular security audits are crucial steps in safeguarding the integrity of the funds. Additionally, employing cold storage solutions and utilizing reputable custodians can mitigate the risk of hacking and unauthorized access to digital assets. By prioritizing security measures, investment funds in Tonga can instill confidence in investors and demonstrate a commitment to maintaining a protected environment for their assets.

As the cryptocurrency market evolves, staying ahead of potential security threats is imperative for Bitcoin investment funds in Tonga. Embracing innovative technologies like blockchain-based security frameworks and real-time monitoring systems can enhance the resilience of fund protection mechanisms. By continuously adapting and enhancing security practices, investment funds can fortify their defenses against malicious actors and ensure the long-term viability of their operations. For further insights on regulatory requirements for Bitcoin investment funds, check out this informative article on bitcoin investment funds regulation in Tonga.

Market Volatility 📈: Navigating the Ups and Downs

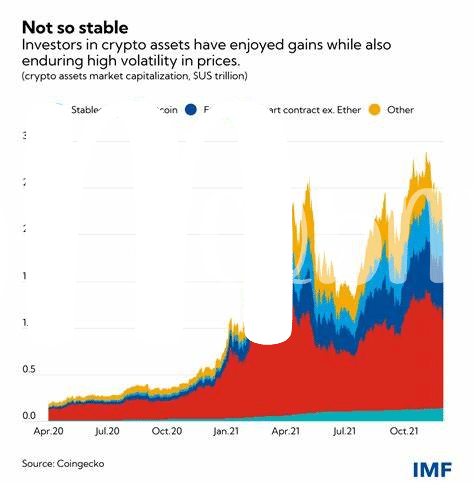

Market volatility in Tonga’s Bitcoin investment funds can be a rollercoaster ride, with prices soaring one moment and plummeting the next. Navigating these ups and downs requires a keen understanding of cryptocurrency markets and the ability to make informed decisions in the face of uncertainty. Investors need to stay vigilant, diversify their portfolios, and be prepared for sudden shifts in value. By staying informed and proactive, investors can better weather the storms of market volatility and capitalize on opportunities as they arise.

Future Trends 🔮 in Tonga’s Bitcoin Investments

In Tonga’s evolving landscape of Bitcoin investments, future trends point towards growing mainstream acceptance and integration of digital assets into the traditional financial system. As global awareness and adoption of cryptocurrencies increase, Tonga’s Bitcoin Investment Funds are likely to see a surge in demand from both local and international investors. The emergence of innovative financial products and services tailored to the needs of cryptocurrency users is expected to shape the direction of the market, offering new opportunities for diversification and wealth creation. The dynamic nature of the cryptocurrency space necessitates a proactive approach to adapt to changing trends and regulations, ensuring sustainable growth and investor protection.